- United States

- /

- Airlines

- /

- NasdaqGS:SKYW

Why SkyWest (SKYW) Is Up 5.5% After a Strong Earnings Beat and Fleet Expansion News

Reviewed by Sasha Jovanovic

- Earlier this quarter, SkyWest reported quarterly sales and earnings per share that surpassed consensus expectations, driven by strong demand for regional air travel, improved operational performance, and growth in prorate and charter revenues.

- Analyst projections highlight the company's operational flexibility and new E175 aircraft deliveries as key contributors to anticipated EPS growth and resilient earnings in the coming years.

- We'll now explore how SkyWest's strong earnings and outlook might influence its investment narrative, with a focus on fleet modernization.

Find companies with promising cash flow potential yet trading below their fair value.

SkyWest Investment Narrative Recap

To be confident in owning SkyWest, an investor needs to believe in the durability of regional air travel demand and the company’s ability to modernize its fleet efficiently. The latest earnings beat highlights operational gains and strong demand, but the acute pilot shortage remains a near-term risk that could pressure costs and limit the benefits of new aircraft deliveries; this risk has not materially changed with the recent announcement.

Among recent developments, SkyWest’s expanded buyback program stands out as highly relevant. The continued repurchase of shares, now totaling over 12% of the authorized plan, underlines the company’s focus on returning value to shareholders and serves as a sign of confidence amid ongoing delivery of new E175s, a key short-term catalyst linked to margin expansion and operational efficiency.

By contrast, investors should be aware that labor constraints, especially pilot hiring challenges, remain a risk that could unexpectedly impact forecasted margins and...

Read the full narrative on SkyWest (it's free!)

SkyWest's outlook anticipates $4.5 billion in revenue and $456.5 million in earnings by 2028. This scenario assumes a 5.7% annual revenue growth rate and a $48.6 million increase in earnings from the current $407.9 million.

Uncover how SkyWest's forecasts yield a $131.80 fair value, a 30% upside to its current price.

Exploring Other Perspectives

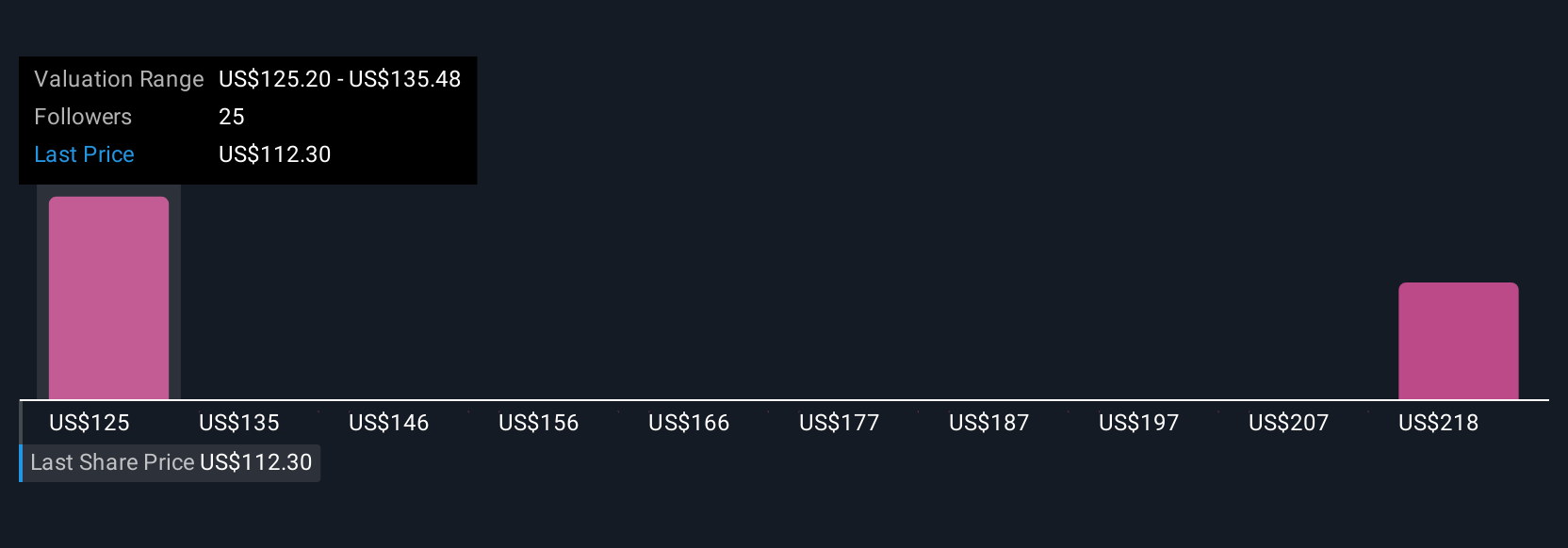

Three fair value estimates from the Simply Wall St Community range from US$131.80 to US$217.61, signaling a wide span of individual outlooks. While some focus on SkyWest’s ability to grow through fleet upgrades, continued exposure to rising labor costs may shape performance in ways not reflected in all market opinions.

Explore 3 other fair value estimates on SkyWest - why the stock might be worth over 2x more than the current price!

Build Your Own SkyWest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWest research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SkyWest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWest's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKYW

SkyWest

Through its subsidiaries, engages in the operation of a regional airline in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026