- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PANL

There May Be Some Bright Spots In Pangaea Logistics Solutions' (NASDAQ:PANL) Earnings

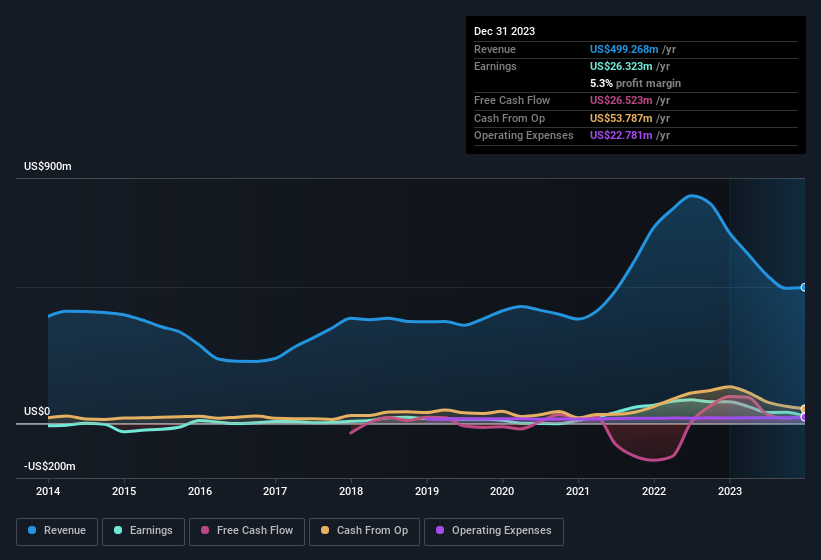

Last week's earnings announcement from Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) was disappointing to investors, with a sluggish profit figure. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

See our latest analysis for Pangaea Logistics Solutions

Our Take On Pangaea Logistics Solutions' Profit Performance

Therefore, it seems possible to us that Pangaea Logistics Solutions' true underlying earnings power is actually less than its statutory profit. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 2 warning signs with Pangaea Logistics Solutions, and understanding these bad boys should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PANL

Pangaea Logistics Solutions

Provides seaborne dry bulk logistics and transportation services to industrial customers worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives