- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Is Lyft’s Recent 42% Rally Justified Amid Market Volatility in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Lyft could be a great value or if the stock’s price still has room to run? You’re not alone. Plenty of investors are eyeing its potential right now.

- Lyft’s stock is up a robust 42.3% year-to-date, but it took a recent breather with a 3.0% drop over the last week and an 11.7% decline this past month.

- Much of this volatility has been driven by ongoing headlines about the evolving ride-sharing market and speculation around strategic moves in the sector. News that major players are navigating both regulatory shifts and renewed competition has added fuel to Lyft’s story.

- When we step back and look at its valuation, Lyft stands at a value score of 2 out of 6. This suggests it’s undervalued in just a couple of key metrics. Let’s dive into how that score is calculated through a few common valuation methods, but keep in mind there’s a smarter way to assess a stock’s true value at the end of this article.

Lyft scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lyft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by estimating a company's future cash flows and then discounting them back to today's value. This helps investors determine what the stock should be worth based on its ability to generate cash in the coming years.

For Lyft, the latest reported Free Cash Flow is $923.5 million. Analysts forecast FCF to grow modestly in the near term, projecting $892.6 million in 2026 and $718 million by the end of 2029. Beyond the next five years, these projections are less certain and are extrapolated using trusted models from Simply Wall St rather than direct analyst estimates.

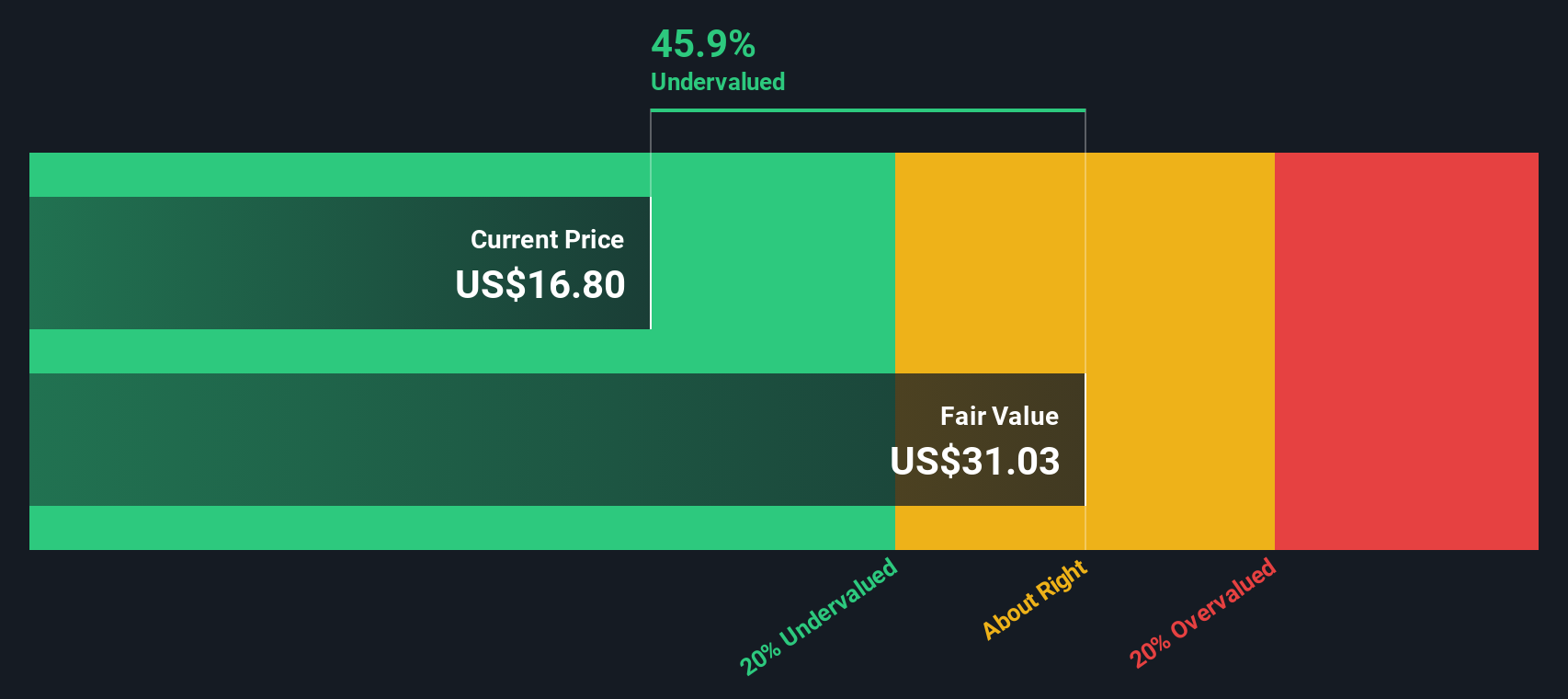

By bringing all these future cash flows together with a suitable discount rate, the estimated intrinsic value for Lyft is $29.54 per share. This implies the stock is trading at a 34.3% discount compared to its calculated fair value, suggesting that the market price may not fully reflect the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lyft is undervalued by 34.3%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Lyft Price vs Earnings (PE)

For profitable companies like Lyft, the price-to-earnings (PE) ratio is one of the most widely used and practical ways to gauge a stock's valuation. The PE ratio tells us how much investors are willing to pay today for a dollar of earnings, making it particularly relevant for businesses that are generating consistent profits.

Interpreting what counts as a "fair" PE ratio depends on factors like growth expectations and the level of business risk. Companies expected to grow quickly or with more reliable earnings often justify a higher PE, while slow growers or riskier businesses generally trade at lower multiples.

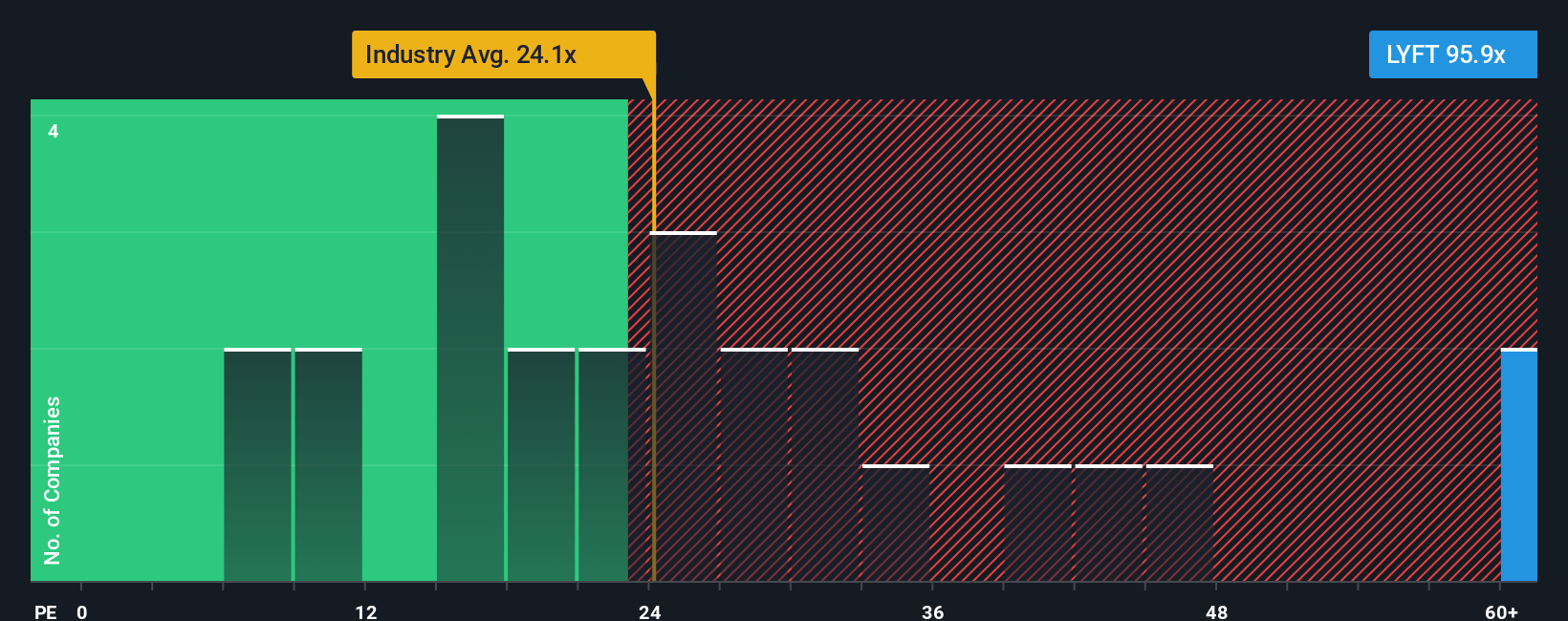

Lyft currently trades at a lofty 85.6x PE, significantly above the Transportation industry average of 27.6x and its peer average of 25.9x. These comparisons might make Lyft’s valuation seem rich at a glance, but surface-level benchmarks can be misleading.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This metric evaluates what PE multiple is appropriate for a company like Lyft by factoring in not just industry groupings but also the company's growth outlook, profit margins, market size, and specific risks. It essentially personalizes the benchmark, providing a more nuanced view than broad industry or peer averages.

Lyft’s Fair Ratio is calculated to be 21.2x. Since Lyft’s actual PE is substantially above this, it suggests the market is pricing the stock above what its fundamentals support, even after accounting for its prospects and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lyft Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized investment story, a way to link your outlook on Lyft’s business to a specific financial forecast and fair value, all in one place. Instead of just crunching numbers, Narratives help you describe what you believe will drive Lyft’s future, from expansion plans to competitive risks, and translate those beliefs into revenue and earnings estimates.

On Simply Wall St’s Community page, used by millions of investors, anyone can create and refine a Narrative. It is as easy as entering what you expect for future growth, margins, and risks, and the platform dynamically compares your calculated Fair Value to Lyft’s current price, showing whether it looks like a buy or sell to you. Narratives update automatically as new information arrives, like earnings or industry news, so your decision keeps pace with reality.

For Lyft, Narratives vary widely: some investors project strong global partnerships and urban growth, leading to high earnings estimates and target prices as optimistic as $28 per share, while others focus on regulatory and competitive headwinds, arriving at much less bullish targets as low as $10. Narratives put you, the investor, in the driver’s seat, empowering you to make smarter, story-driven decisions in real time.

Do you think there's more to the story for Lyft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives