- United States

- /

- Logistics

- /

- NasdaqCM:JYD

Market Cool On Jayud Global Logistics Limited's (NASDAQ:JYD) Revenues Pushing Shares 27% Lower

Unfortunately for some shareholders, the Jayud Global Logistics Limited (NASDAQ:JYD) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 82% loss during that time.

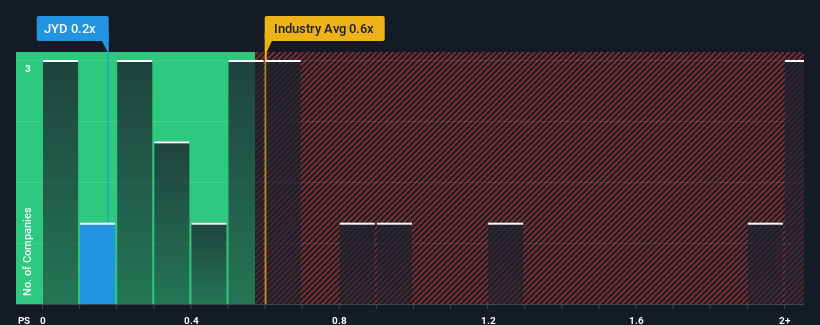

Although its price has dipped substantially, it's still not a stretch to say that Jayud Global Logistics' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Logistics industry in the United States, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Jayud Global Logistics

What Does Jayud Global Logistics' P/S Mean For Shareholders?

For instance, Jayud Global Logistics' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Jayud Global Logistics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Jayud Global Logistics?

The only time you'd be comfortable seeing a P/S like Jayud Global Logistics' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 71% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

This is in contrast to the rest of the industry, which is expected to grow by 5.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Jayud Global Logistics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Jayud Global Logistics' P/S

Jayud Global Logistics' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jayud Global Logistics currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Jayud Global Logistics (2 are a bit concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:JYD

Jayud Global Logistics

Through its subsidiaries, provides a range of cross-border supply chain solution services worldwide.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives