- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

How Investors May Respond To JetBlue Airways (JBLU) Expanding TrueBlue Points to Condor Flights

Reviewed by Simply Wall St

- JetBlue and Condor recently expanded their partnership, allowing TrueBlue loyalty members to earn and redeem points on Condor-operated flights to over 70 destinations across Europe and the U.S.

- This enhanced loyalty integration not only provides JetBlue customers with greater travel flexibility but also extends the airline’s reach within key transatlantic markets through Condor’s network.

- We'll examine how broadening JetBlue’s loyalty program through Condor may influence its appeal among transatlantic travelers and shape its investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

JetBlue Airways Investment Narrative Recap

To invest in JetBlue Airways, you have to believe that the airline can convert operational improvements, network expansion, and enhanced loyalty offerings into sustained profitability, even as industry-wide pressures on unit revenues and persistent cost challenges remain immediate hurdles. The expanded partnership with Condor and broader access for TrueBlue members is a positive development, providing another potential lever for loyalty growth, but it is unlikely to materially move the needle on near-term demand uncertainty or margin risks, which remain the most significant short-term catalysts and risks for JetBlue shareholders right now.

Of JetBlue’s recent moves, the July 29 completion of the Blue Sky collaboration with United Airlines is the most relevant for context here. This expanded network connectivity, alongside the Condor partnership, continues JetBlue’s push to grow customer loyalty and tap new travel corridors, a potential catalyst the company is leveraging to offset ongoing pressures on load factors and unit revenues.

Yet, in contrast to these membership gains, investors should also know that unit revenues have continued to fall and...

Read the full narrative on JetBlue Airways (it's free!)

JetBlue Airways' narrative projects $10.6 billion revenue and $728.0 million earnings by 2028. This requires 5.1% yearly revenue growth and a $1,114 million increase in earnings from the current -$386.0 million.

Uncover how JetBlue Airways' forecasts yield a $4.23 fair value, a 21% downside to its current price.

Exploring Other Perspectives

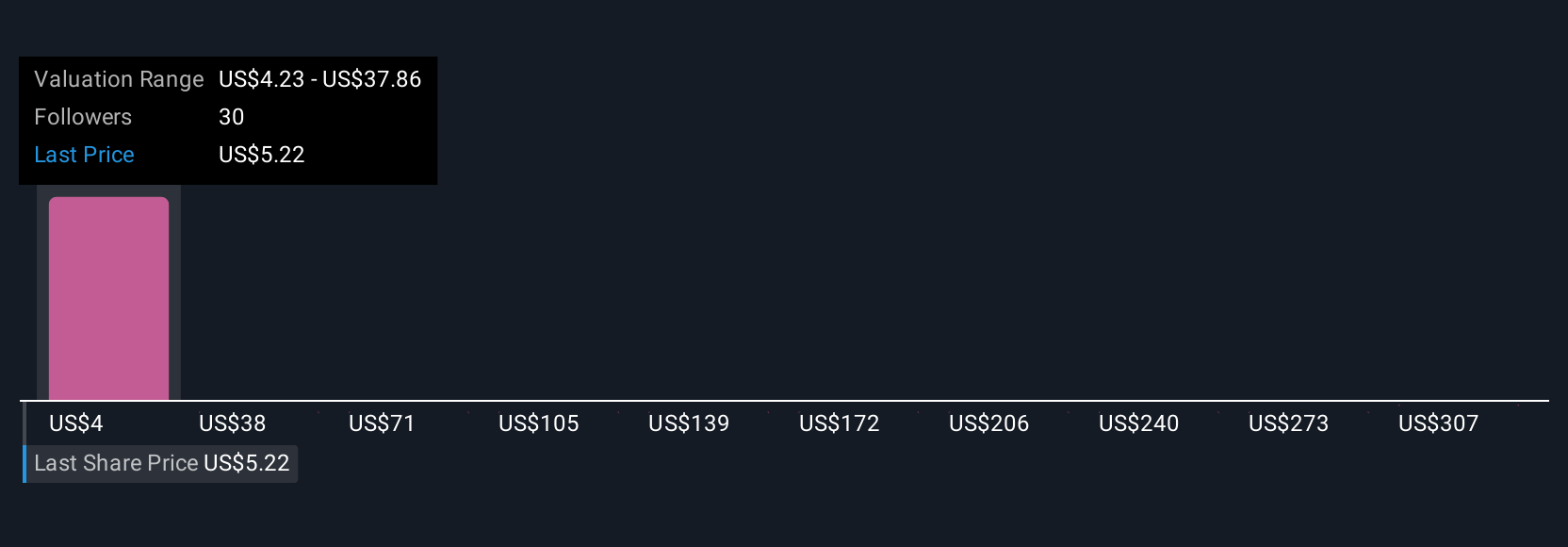

Simply Wall St Community members offered six fair value estimates for JetBlue ranging from US$4.23 to US$340.49. You can see this variety comes as many still cite falling unit revenues and margin compression as key concerns influencing wider performance views.

Explore 6 other fair value estimates on JetBlue Airways - why the stock might be a potential multi-bagger!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JetBlue Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JetBlue Airways' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Undervalued with minimal risk.

Market Insights

Community Narratives