- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

Does JetBlue's (JBLU) Fort Lauderdale Mint Expansion Signal a Shift in Its Competitive Strategy?

Reviewed by Sasha Jovanovic

- JetBlue Airways recently announced plans to launch 17 new routes, increase frequencies on 12 existing routes, and establish a dedicated Mint base for inflight crewmembers in South Florida by early 2026, along with updated 2025 operating guidance signaling year-over-year declines in certain capacity and revenue metrics.

- The company's move to expand its premium Mint service and offer its largest-ever schedule from Fort Lauderdale highlights an intensified competitive push in the South Florida market.

- We'll examine how JetBlue's deployment of more premium Mint service in Fort Lauderdale may shape its investment narrative and long-term prospects.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

JetBlue Airways Investment Narrative Recap

Owning JetBlue shares often hinges on conviction in the company's ability to capture resilient leisure and premium travel demand, especially as it builds out high-margin services such as Mint. The latest expansion in South Florida, paired with an update projecting short-term declines in capacity and revenue per seat, may not meaningfully change the core near-term catalyst: better load factors from operational improvements, while the biggest risk remains ongoing pressure from rising labor and fuel costs that could weigh on profitability.

Among JetBlue’s many recent updates, the large-scale Mint base and premium service ramp-up in Fort Lauderdale directly connects to the current push for higher-yield revenue. As JetBlue launches its largest-ever schedule from this market, the success of these efforts could influence its ability to offset industry-wide cost inflation and generate sustained margin gains as competition for premium travelers increases.

But while management focuses on premium expansion, investors should also be aware of the ongoing risk from labor cost escalation and...

Read the full narrative on JetBlue Airways (it's free!)

JetBlue Airways' narrative projects $10.6 billion revenue and $728.0 million earnings by 2028. This requires 5.1% yearly revenue growth and a $1,114 million earnings increase from -$386.0 million today.

Uncover how JetBlue Airways' forecasts yield a $4.65 fair value, in line with its current price.

Exploring Other Perspectives

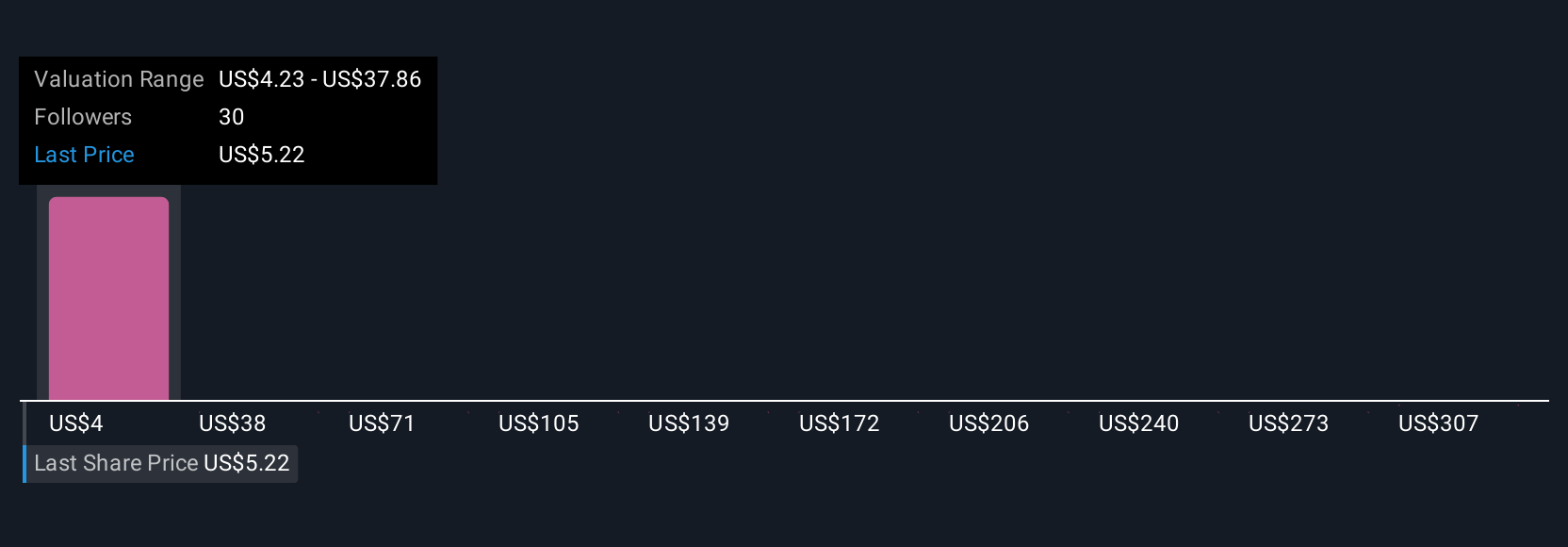

Simply Wall St Community members contributed seven separate fair value estimates for JetBlue, ranging from US$3 up to US$340.49 per share. Despite this wide divergence, analyst consensus continues to highlight challenges to sustained profitability, suggesting the road ahead may hold both opportunities and headwinds for future returns.

Explore 7 other fair value estimates on JetBlue Airways - why the stock might be a potential multi-bagger!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JetBlue Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JetBlue Airways' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Undervalued with minimal risk.

Market Insights

Community Narratives