- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Will Hertz (HTZ)'s New Legal Chief Shape Its Sustainability Agenda or Signal a Shift in Priorities?

Reviewed by Sasha Jovanovic

- Hertz Global Holdings recently announced that Piero Bussani has joined the company as Executive Vice President and Chief Legal Officer to lead global legal, government affairs, and sustainability initiatives, effective October 27, 2025.

- Bussani’s extensive background in legal and business leadership across multiple sectors, including real estate and technology, could provide valuable expertise at a critical time for Hertz's transformation.

- We'll examine how Bussani's appointment to oversee legal affairs and sustainability could impact Hertz's investment narrative and strategic priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hertz Global Holdings Investment Narrative Recap

To be a Hertz Global Holdings shareholder right now, you’d need to be convinced the company’s ongoing transformation, modernizing its fleet, accelerating digital initiatives, and reimagining customer experience, will eventually translate into a path back to profitability and debt stability. The appointment of Piero Bussani as Chief Legal Officer may strengthen legal and sustainability oversight, but is not likely to materially shift Hertz’s most urgent catalyst: restoring earnings momentum and managing heavy debt. Conversely, the immediate risk remains persistent unprofitability and high leverage, which could threaten financial flexibility if not addressed.

Among recent announcements, Mike Moore's promotion to Chief Operating Officer in early October stands out in the context of Hertz’s fleet strategy, as operational leadership is central to improving margins and maximizing asset efficiency, key near-term drivers for the stock. Leadership depth across operations and legal could help the company execute on these critical priorities, but does not eliminate concerns around ongoing losses and debt obligations.

In contrast, investors should be aware that unprofitability combined with growing fleet costs could...

Read the full narrative on Hertz Global Holdings (it's free!)

Hertz Global Holdings' narrative projects $8.8 billion in revenue and $424.8 million in earnings by 2028. This requires a -0.8% annual revenue decline and a $2.93 billion earnings increase from current earnings of -$2.5 billion.

Uncover how Hertz Global Holdings' forecasts yield a $4.01 fair value, a 23% downside to its current price.

Exploring Other Perspectives

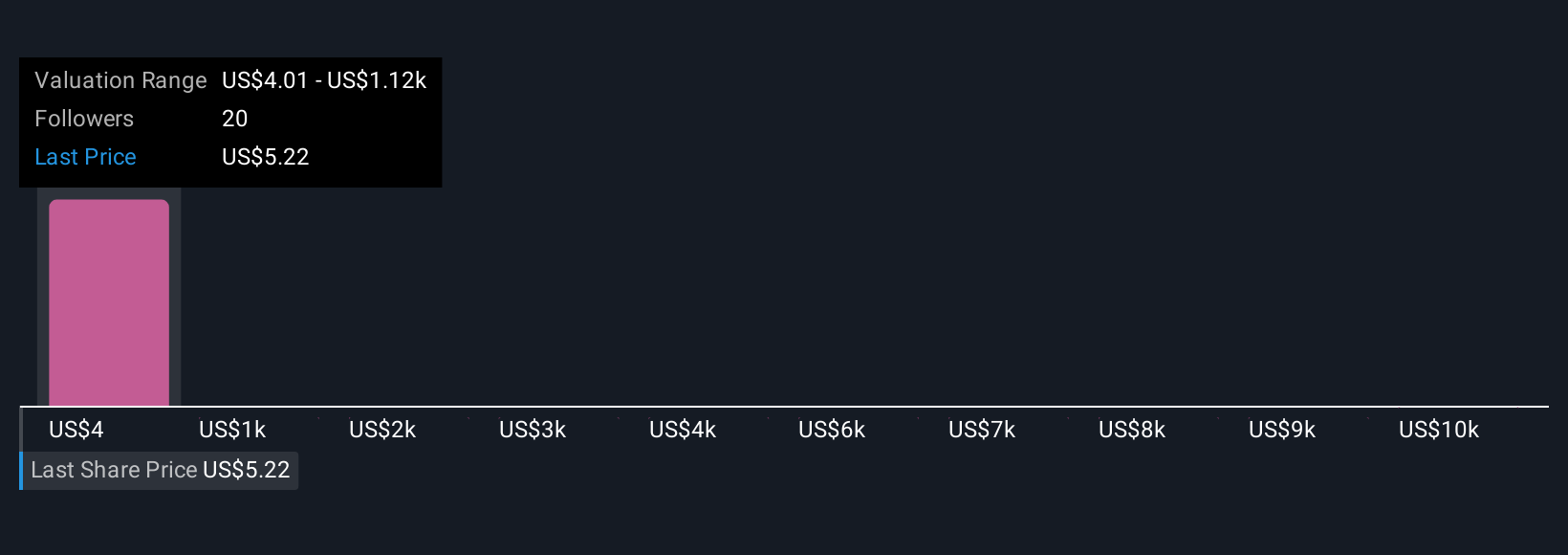

Seven Simply Wall St Community members put Hertz’s fair value between US$4.01 and US$11,155.34, revealing significant differences in outlook. As profitability remains elusive and high debt persists, many view these wide estimates as a reflection of deep uncertainty about execution and turnaround prospects; your take on the company’s future could be very different from the crowd’s.

Explore 7 other fair value estimates on Hertz Global Holdings - why the stock might be a potential multi-bagger!

Build Your Own Hertz Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hertz Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hertz Global Holdings' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives