- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

How Hertz's Swing to Profitability with Lower Sales Will Impact Hertz Global Holdings (HTZ) Investors

Reviewed by Sasha Jovanovic

- On November 4, 2025, Hertz Global Holdings reported its third quarter results, showing net income of US$184 million compared to a net loss of US$1.33 billion in the prior year, while quarterly sales decreased to US$2.48 billion from US$2.58 billion over the same period.

- This return to profitability, despite lower year-over-year revenue, highlights substantial operational improvement and may indicate progress in the company's broader transformation efforts.

- We'll explore how Hertz's shift from a very large net loss to profitability this quarter impacts the company's investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hertz Global Holdings Investment Narrative Recap

To be a Hertz Global Holdings shareholder today, you need to believe in the company’s ability to transform its operations and deliver sustainable profitability, even as rental demand faces secular headwinds. The return to profitability this quarter is an encouraging sign, but persistent top-line weakness means the biggest near-term catalyst, continued margin improvement, remains at risk if revenues do not stabilize. On the other hand, the company’s high debt and ongoing financing needs are still a material risk to watch and are not offset by this quarter’s stronger numbers.

Of the recent announcements, Hertz’s completion of a major share buyback on August 7, 2025 stands out, especially given the company’s move back to profitability in Q3. While buybacks can amplify per-share results, the primary catalyst is still operational progress; consistent earnings improvement remains essential to support any long-term recovery in share value and investor confidence.

Yet, despite these financial milestones, investors should be aware that tremendous debt and financing obligations continue to weigh on future flexibility...

Read the full narrative on Hertz Global Holdings (it's free!)

Hertz Global Holdings' outlook forecasts $8.8 billion in revenue and $424.8 million in earnings by 2028. This implies a 0.8% annual revenue decline and a $2.9 billion improvement in earnings from the current -$2.5 billion.

Uncover how Hertz Global Holdings' forecasts yield a $4.39 fair value, a 28% downside to its current price.

Exploring Other Perspectives

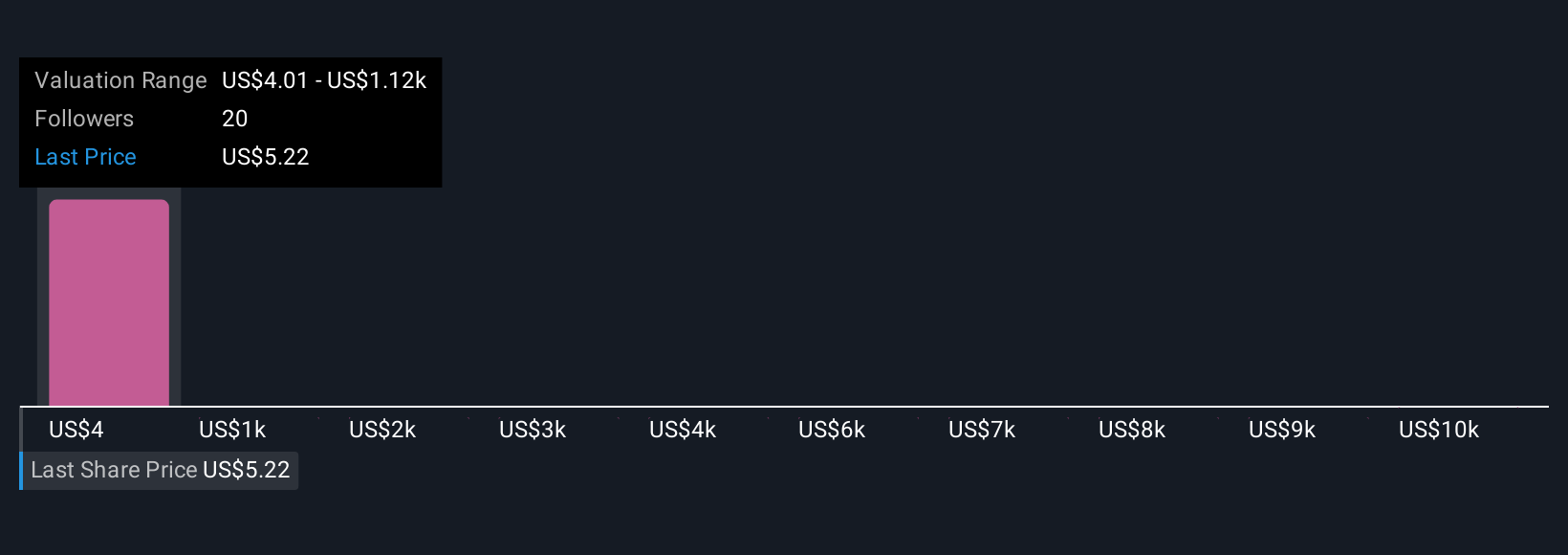

Six different fair value estimates from the Simply Wall St Community range from US$4.39 to US$11,155.34 per share. Against this backdrop of widely varying expectations, keep in mind that high debt loads continue to challenge Hertz’s ability to sustain its turnaround, explore more viewpoints for a well-rounded view.

Explore 6 other fair value estimates on Hertz Global Holdings - why the stock might be worth 28% less than the current price!

Build Your Own Hertz Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hertz Global Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hertz Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hertz Global Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives