- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Hertz (HTZ): Assessing Valuation Following New Chief Legal Officer Appointment and Strategic Leadership Shift

Reviewed by Simply Wall St

Hertz Global Holdings (HTZ) just announced that Piero Bussani will step in as Executive Vice President and Chief Legal Officer on October 27. Bussani’s appointment highlights the company’s focus on strengthening its legal and strategic leadership as it navigates ongoing transformation.

See our latest analysis for Hertz Global Holdings.

Hertz’s appointment of a seasoned legal leader comes as the company’s share price faces headwinds after a period of optimism. Despite a strong year-to-date share price return of nearly 39% and an impressive 68% total shareholder return over the past year, momentum has faded recently. A 26% drop in the last month highlights ongoing challenges and shifting investor sentiment.

If you’re weighing what this leadership shakeup means for the broader market, this could be the perfect time to discover fast growing stocks with high insider ownership.

With shares trading at a significant discount to analyst targets amid ongoing uncertainty, investors might wonder whether Hertz is undervalued at current levels or if the market is already factoring in any potential turnaround.

Most Popular Narrative: 29% Overvalued

Compared to its recent closing price, the narrative’s fair value sits substantially below where Hertz Global Holdings currently trades. This sharp gap drives debate about whether the market is ignoring underlying headwinds or pricing in an unlikely turnaround.

Disruptive mobility trends and alternative transport solutions threaten to reduce demand for traditional rentals, shrinking Hertz's core market and revenue prospects.

Financial pressures from debt, fleet costs, and modernization needs constrain flexibility and jeopardize future profitability amid rising competitive and operational challenges.

What if everything you believe about Hertz’s future is built on shifting ground? The fair value calculation hinges on assumptions about new mobility threats, margin rebounds, and a dramatic earnings turnaround. Ready to uncover the aggressive growth targets and financial leaps this narrative is betting on? The details behind this valuation will surprise even the savviest investors.

Result: Fair Value of $4.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger fleet rotation and digital modernization could quickly boost margins. This could give Hertz unexpected resilience that challenges the prevailing negative outlook.

Find out about the key risks to this Hertz Global Holdings narrative.

Another View: Strong Value Signals by Sales Ratio

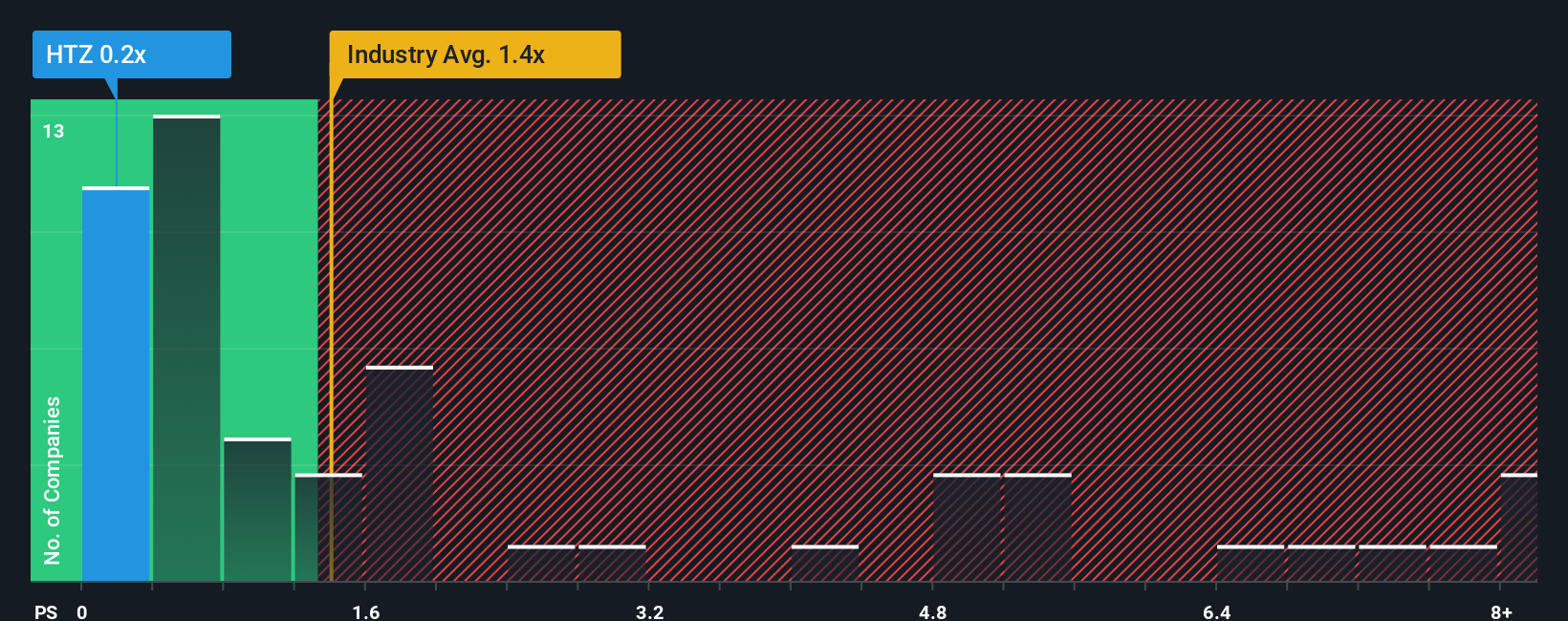

Looking beyond fair value estimates, Hertz trades at just 0.2x sales, well below both the peer average (2.6x) and the US Transportation sector (1.3x). This deep discount hints at heavy pessimism from the market, but it also means a small shift in sentiment could spark a sharp re-rating. Could the company’s challenges be more than priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hertz Global Holdings Narrative

If you see things differently or want to take the analysis further, you can craft your own custom narrative in just a few minutes: Do it your way.

A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at Hertz. The best moves could be just around the corner. Give your portfolio a boost with hand-picked investment opportunities you can act on now.

- Capitalize on rapid innovation by checking out these 27 AI penny stocks making waves in artificial intelligence.

- Catch cash-generating opportunities with these 17 dividend stocks with yields > 3% offering attractive yields above 3%.

- Seize potential undervalued gems by reviewing these 877 undervalued stocks based on cash flows where the market may be missing upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives