- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Should You Reassess Grab Holdings After Its 7.7% Price Surge and New Partnerships?

Reviewed by Bailey Pemberton

- Wondering whether Grab Holdings is actually a bargain right now? You’re not alone. Many investors are trying to figure out if its price reflects its true worth.

- The stock has jumped 7.7% in the past week and remains up 27.6% year-to-date, which has gotten a lot of attention from those watching for signs of growth or increased risk.

- Recently, Grab Holdings announced a suite of new partnerships and digital service expansions across Southeast Asia, fueling optimism about future revenue streams. Media coverage has spotlighted these moves as key reasons behind the renewed investor interest and the recent price uptick.

- Currently, Grab scores a 1 out of 6 on our undervaluation checks, meaning it only appears undervalued based on one metric so far. Let's dive into how analysts typically value the company. Plus, stay tuned for a better way to interpret the numbers by the end of this article.

Grab Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Grab Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those figures back to today's dollars. This method translates expected future performance into a single, present-day value and gives investors a way to judge if the current stock price is a good deal.

For Grab Holdings, the DCF analysis starts with its latest Free Cash Flow (FCF) of $610 million. Analyst consensus projects solid growth, reaching $1.05 billion in FCF by 2027. Looking ahead, modeling extrapolates these projections even further and suggests the company could generate around $1.72 billion in FCF in ten years' time. These figures reflect expectations of ongoing expansion in digital services across Southeast Asia.

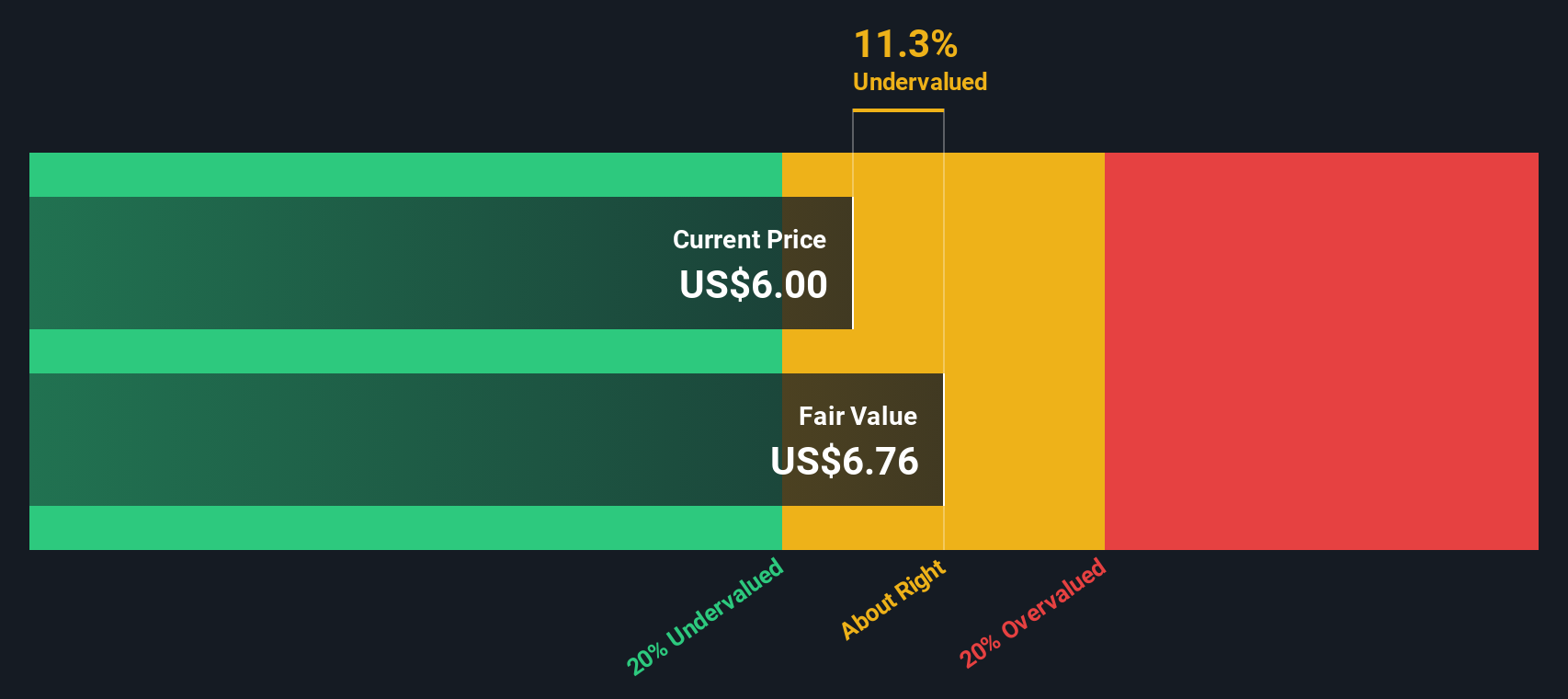

Based on these projections, the DCF model estimates Grab Holdings' intrinsic value at $6.77 per share. Comparing this figure to the current market price implies the stock trades at a 10.7% discount to its estimated fair value, indicating some potential upside for investors interested in the company's growth story.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Grab Holdings is undervalued by 10.7%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Grab Holdings Price vs Sales

For companies like Grab Holdings, which are in rapid growth phases and not yet consistently profitable, the Price-to-Sales (P/S) ratio is a common yardstick for valuation. This multiple helps investors assess how much they are paying for every dollar of revenue, which is particularly relevant when earnings are not yet the primary measure of performance.

Typically, higher P/S ratios can be justified for companies with strong growth prospects or a unique market position. Lower ratios suggest either slower growth or higher risks. However, comparing a company's P/S directly to industry or peers can sometimes miss important context, such as differing growth trajectories or risk profiles.

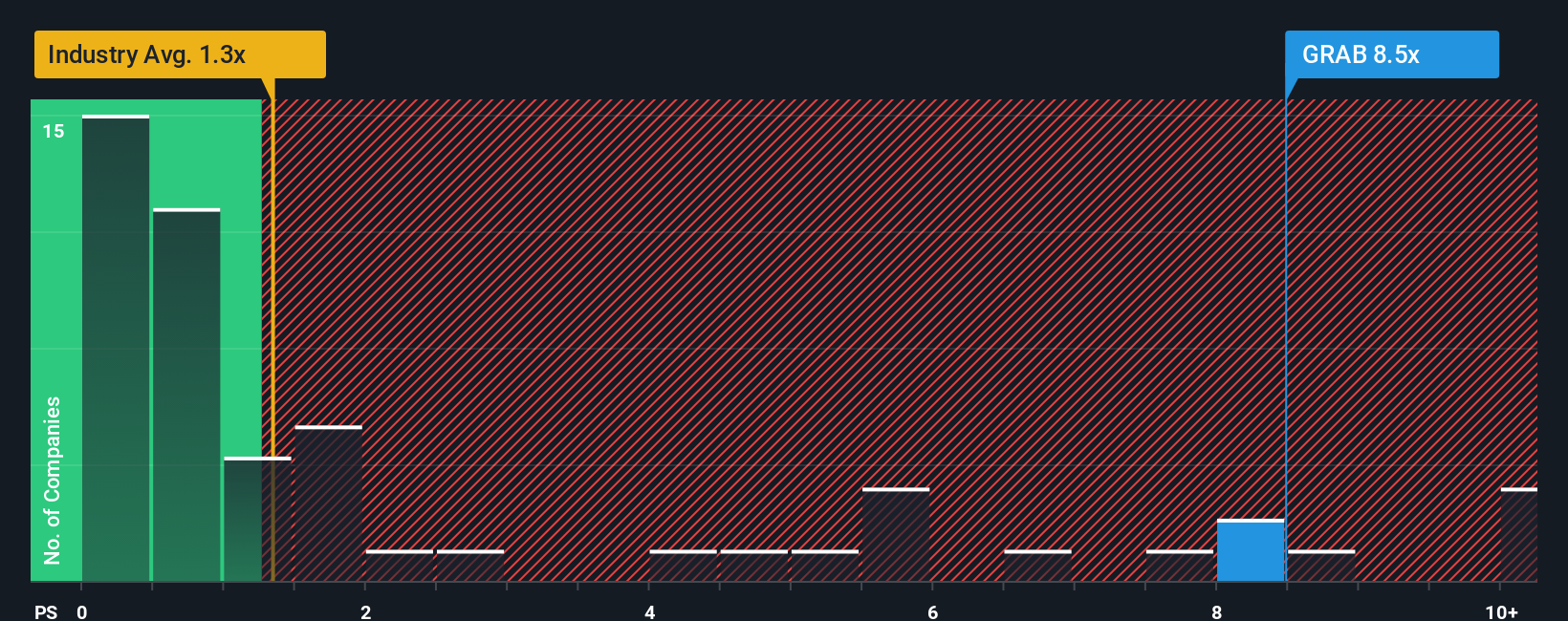

Currently, Grab Holdings trades at a P/S ratio of 8.0x. This is substantially above its industry average of 1.3x and higher than the peer average of 1.7x, which may initially seem expensive. However, Simply Wall St's proprietary "Fair Ratio" for Grab is 3.39x. This metric is designed to account for the company's earnings growth, risk factors, profit margins, market capitalization, and its competitive landscape. Unlike simple peer or industry comparisons, the Fair Ratio provides a more comprehensive and nuanced picture of what is reasonable for Grab Holdings specifically.

Comparing the Fair Ratio to the current P/S multiple suggests that Grab Holdings is trading noticeably above what is considered fair when taking all these factors into account, signaling that the stock is likely overvalued at current levels.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1381 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Grab Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story for a stock. It combines your personal view of the company’s future (like your forecasts for revenue, profits, and margins) with a financial model, to produce a fair value that fits the context behind your expectations.

Instead of focusing purely on static numbers or analyst targets, Narratives let you articulate your reasoning. This approach links Grab Holdings’ evolving story directly to a set of future outcomes and an updated estimate of what the stock is worth. On Simply Wall St’s Community page, millions of investors now use this intuitive tool to capture, share, and test their investment perspectives in just a few clicks.

Narratives don’t just help you estimate a fair value against today’s price. They also update automatically whenever new information is released, from earnings reports to major news events. This makes it much easier to spot opportunities to buy or sell based on your own thesis, rather than just reacting to the crowd.

For example, one investor’s Narrative might be bullish, projecting strong digital payments adoption and setting fair value at $8.20 per share, while another may take a more cautious view on competition, pinning fair value closer to $5.10. This demonstrates how Narratives empower you to make investment decisions that truly reflect your own understanding of Grab Holdings’ future.

Do you think there's more to the story for Grab Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives