- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Grab Holdings (NasdaqGS:GRAB): Evaluating Valuation After Strong Earnings, Raised Guidance, and New Tech Investments

Reviewed by Simply Wall St

Grab Holdings (NasdaqGS:GRAB) is back in the spotlight after reporting a 22% lift in revenue and a 51% jump in adjusted EBITDA, along with new investments in autonomous vehicle technology. The company also raised its fiscal year guidance, reflecting increasing confidence from both management and analysts about its future growth.

See our latest analysis for Grab Holdings.

After a choppy few months, Grab Holdings’ share price is making a comeback, up 14.98% year-to-date and delivering a solid 9% total shareholder return over the past year. With upbeat financials and a strengthened long-term outlook, momentum appears to be building again.

If you’re watching Grab’s turnaround, now is a great time to broaden your investing perspective and discover fast growing stocks with high insider ownership

But with Grab’s share price rebounding and analyst targets still implying upside, an important question arises: Is the stock undervalued given its strong growth and market dominance, or is all the good news already reflected in the price?

Most Popular Narrative: 33.5% Undervalued

Grab Holdings is trading well below what the most-followed narrative suggests is its fair value, with the current price at $5.45 and a much loftier fair value implied by the narrative’s bold long-term outlook. Key assumptions about dominant market share and financial transformation set the tone for what could be a major re-rating if the narrative plays out.

Grab has undergone a dramatic financial transformation.

• Margins: Profit margin hit 3.6% in Q2 2025, up from -8.2% from 2024.

• Revenue: $819M in Q2 2025, +23% YoY. Revenues have compounded at over 20% annually for three years.

• Profitability: First GAAP net profit in Q1 2025. Now profitable for two consecutive quarters.

• Balance Sheet: $7.3B cash vs. $1.7B debt, resulting in net cash, with over 37% of market cap in liquidity.

How did this stock go from heavy losses to profitability so quickly? This narrative hints at a turnaround built on rapid earnings growth, shifting margins, and ambitious projections. Curious just how high the profit runway goes, and what aggressive assumptions drive that valuation? The full story spells it out in detail.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Tougher competition or regulatory pushback in Indonesia could quickly test the narrative and shift investor sentiment against Grab.

Find out about the key risks to this Grab Holdings narrative.

Another View: Valuation Based on Price-to-Sales Ratio

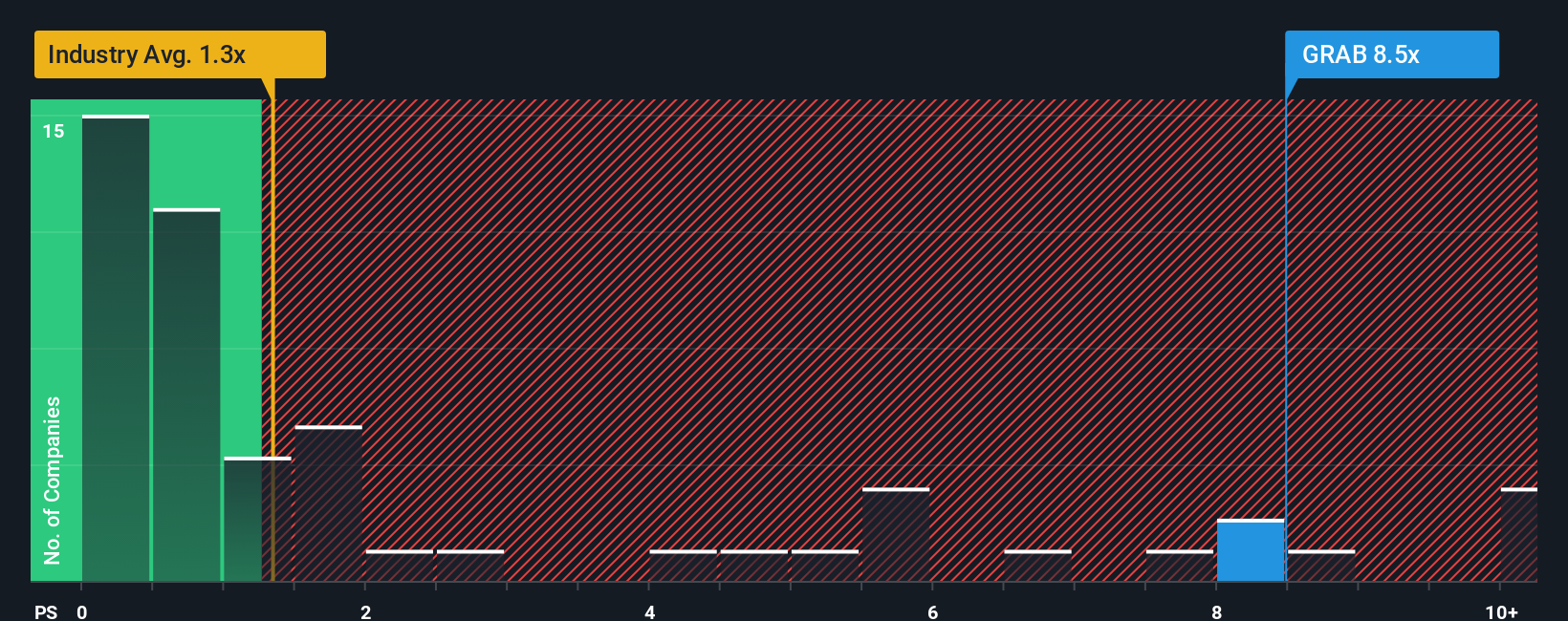

Looking at Grab Holdings’ price-to-sales ratio of 6.9x, there is a sharp disconnect versus the US Transportation industry average (1.1x), its peer group’s 1.6x, and even its own fair ratio of 3.6x. This premium means investors expect a lot of future growth, but it also increases the risk if those expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily craft your own Grab Holdings narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

Smart investors know opportunities rarely stay hidden for long. Give yourself an edge by checking out these high-potential areas on Simply Wall Street. Waiting could mean missing your next big win.

- Tap into the AI wave and move ahead of the crowd by following these 25 AI penny stocks with strong prospects for growth powered by artificial intelligence.

- Maximize your returns with consistent cash flow by locking in these 15 dividend stocks with yields > 3% offering attractive yields above 3% and proven stability.

- Position yourself early in the next frontier by tracking these 28 quantum computing stocks driving advances in quantum computing and tomorrow’s tech breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026