- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Grab Holdings (NasdaqGS:GRAB): Assessing Valuation as Revenue Growth Drives Shareholder Optimism

Reviewed by Kshitija Bhandaru

Grab Holdings (GRAB) shares have attracted investor attention lately, with the stock showing a mix of performance in recent months. The company’s revenue and net income are both growing, which may spark fresh discussion about its longer-term outlook.

See our latest analysis for Grab Holdings.

Grab Holdings’ share price has seen ups and downs this year, but momentum is still building, with an 18.99% year-to-date gain. The real head-turner is the 51.21% total shareholder return over the past year, which hints at growing optimism among investors about the company’s medium-term potential.

If you’re watching trends in dynamic growth sectors, this could be an ideal moment to expand your search and discover fast growing stocks with high insider ownership

But with shares trading at a nearly 14% discount to analyst targets and strong double-digit revenue growth, the key question is whether Grab is undervalued or if the market has already accounted for future gains.

Most Popular Narrative: 31% Undervalued

According to BlackGoat, the fair value estimate for Grab Holdings stands well above the latest closing price. This narrative sets up an intriguing case for investors, especially given the stock’s steady progress into profitability this year.

Margins: Profit margin hit 3.6% in Q2 2025, up from -8.2% in 2024. Revenue: $819M in Q2 2025, a 23% increase year over year. Revenues have compounded at over 20% annually for three years.

Want a peek behind these results? This narrative is built on ambitious growth estimates, improved margins, and assumptions that challenge market expectations. Curious what bold projections lead to that striking fair value? Uncover the dramatic details in the full analysis.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty in Indonesia and rising competitive pressures could quickly alter Grab’s outlook. This bullish narrative may therefore be vulnerable to sudden change.

Find out about the key risks to this Grab Holdings narrative.

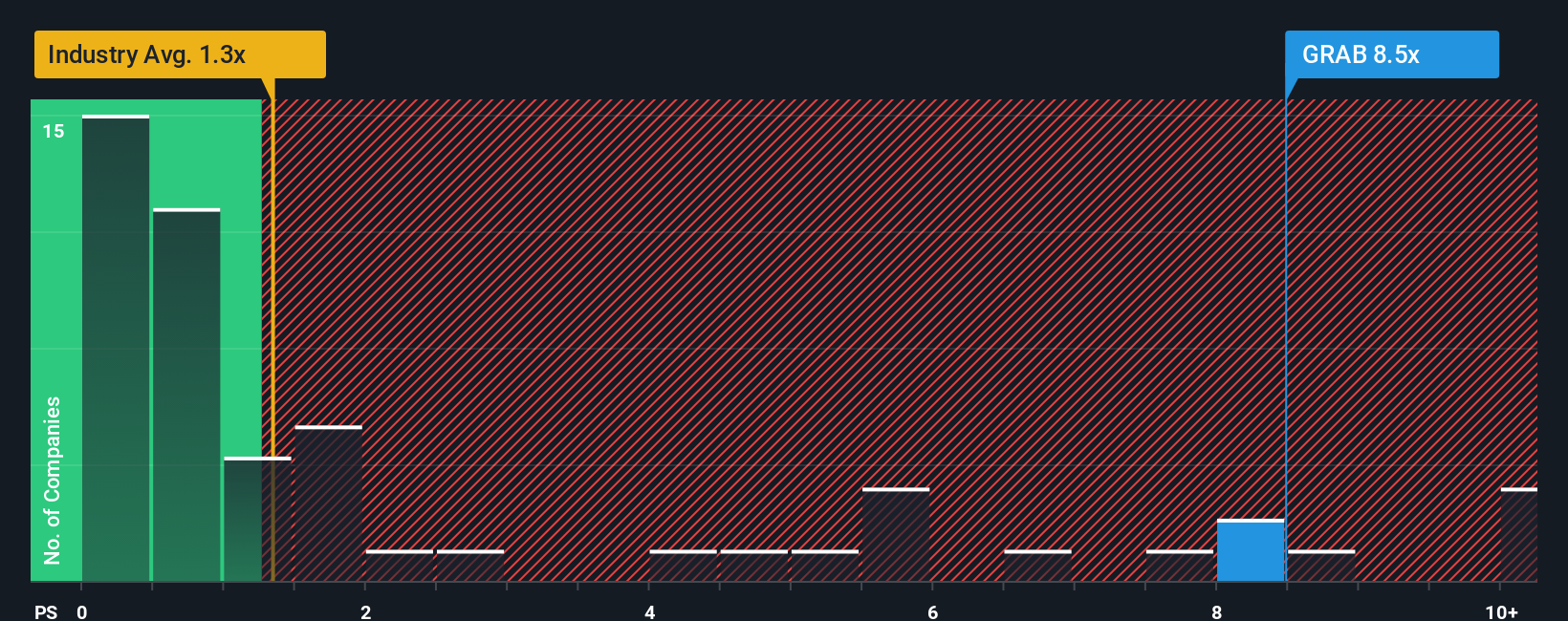

Another View: Market Multiples Complicate the Bullish Case

While the previous analysis points to Grab being undervalued, looking at its price-to-sales ratio tells a different story. Grab trades at 7.5 times sales, noticeably higher than the US Transportation industry average of 1.4 times and the peer group average of 1.7 times. The fair ratio, based on regression analysis, stands at just 3.4 times sales. This wide gap suggests the market might already be pricing in years of growth, which raises the stakes for investors if Grab's progress stalls or slows. Does this mean there is more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

Not sold on these conclusions or want a fresh perspective? Dive into the numbers yourself and craft your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

Great investors stay one step ahead by searching for opportunities others overlook. Don’t miss out. Power your portfolio by using these proven, data-backed tools today:

- Capitalize on emerging tech trends when you check out these 24 AI penny stocks transforming machine learning, automation, and data intelligence in real-world industries.

- Grow your income intelligently by reviewing these 18 dividend stocks with yields > 3% with high yields, ideal for building steady returns into your financial plan.

- Unlock market inefficiencies with these 877 undervalued stocks based on cash flows, revealing stocks trading below their intrinsic worth before they hit the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives