- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Assessing Grab (NasdaqGS:GRAB) Valuation as Investor Optimism Follows Strong Three-Year Shareholder Returns

Reviewed by Simply Wall St

Grab Holdings (GRAB) stock has been trending steadily, drawing interest from investors looking at shifts in Southeast Asia's ride-hailing and delivery markets. The stock has seen a mix of momentum and pullbacks over the past month.

See our latest analysis for Grab Holdings.

The share price has shown a burst of energy this year, up 23.4% year-to-date and rallying over 9% in the past three months. While the recent 1-day and 7-day share price returns have been positive, it is the 1-year total shareholder return of nearly 44% and a striking 130% over three years that really stand out. This suggests that momentum is continuing to build as market confidence grows around Grab’s growth story.

If you're keeping an eye on fast movers and want to spot the next breakout, now is a perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares up strongly and future growth expected, the key question now is whether Grab Holdings remains undervalued or if market optimism has already been fully priced in. This could mean there is little room for an upside surprise.

Most Popular Narrative: 28.7% Undervalued

According to BlackGoat, the fair value estimate for Grab Holdings is notably higher than the last close price. This suggests buyers see untapped upside. Since the narrative anchors expectations above current levels, the story driving this valuation deserves a closer look.

Margins: Profit margin hit 3.6% in Q2 2025, up from -8.2% from 2024. Revenue: $819M in Q2 2025, +23% YoY. Revenues have compounded at >20% annually for three years.

Curious what bold growth rates power such a premium? It is all about ambitious profit expansion and a confident projection for future margins. Find out which aggressive bets and numbers support this compelling fair value when you read the full narrative.

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny in Indonesia and thin profit margins could quickly alter Grab's compelling growth narrative if these challenges are not managed effectively.

Find out about the key risks to this Grab Holdings narrative.

Another View: Looking at the Numbers from a Different Angle

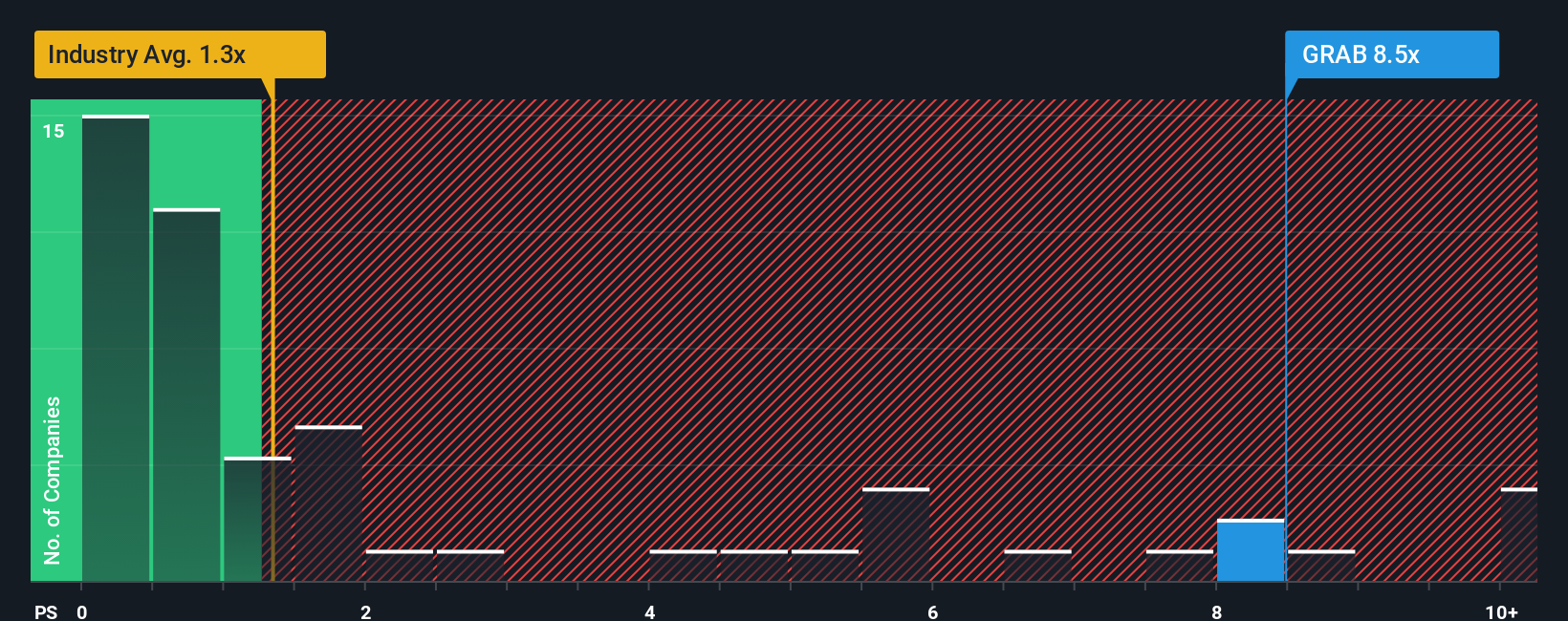

While many see Grab Holdings as undervalued based on fair value estimates, a look at its price-to-sales ratio tells a different story. The company trades at 7.8 times sales, which is well above the US industry average of 1.3x and a fair ratio of 3.4x. This premium means investors are betting on rapid future growth, but it also signals greater valuation risk if expectations shift. Will Grab’s growth outpace these high multiples, or will caution from the market set in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, it's quick and easy to build your personal fair value case in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grab Holdings.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Unlock fresh investing angles with powerful screeners that put strong ideas at your fingertips and help you stay ahead.

- Tap into promising future returns by targeting these 877 undervalued stocks based on cash flows based on robust cash flows overlooked by most investors.

- Capitalize on growing demand for intelligent automation by getting involved with these 27 AI penny stocks at the cutting edge of artificial intelligence innovation.

- Enhance your long-term portfolio income potential when you select these 17 dividend stocks with yields > 3% offering yields above 3% and dependable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives