- United States

- /

- Marine and Shipping

- /

- NasdaqGS:GOGL

Golden Ocean Group (GOGL) Exits Russell Indices Will Index Removal Reshape Its Investment Appeal?

Reviewed by Simply Wall St

- In August 2025, Golden Ocean Group Limited (NasdaqGM:GOGL) was dropped from a wide range of Russell equity indices, including the Russell 2000, 2500, and 3000 series and their value, defensive, and dynamic sub-indices.

- This broad index removal can prompt substantial trading activity from index funds and passive investors, with potential repercussions for the company's market presence and liquidity.

- We'll examine how the broad removal from Russell indices may influence Golden Ocean Group's investment narrative and outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Golden Ocean Group Investment Narrative Recap

For investors in Golden Ocean Group, belief in the future potential of global dry bulk shipping, amid cycles in iron ore demand and macroeconomic shifts, remains central. The company's broad removal from Russell equity indices, following the finalized acquisition by Cmb.Tech NV and imminent exchange delisting, is unlikely to impact any remaining short term catalysts or alter the business's most pressing risk: ongoing volatility in freight rates and profitability pressure due to trade uncertainty and market conditions.

Among recent announcements, the completed acquisition by Cmb.Tech NV stands out as directly relevant. This development brings structural change to Golden Ocean’s ownership and public listing status, with the company exiting major indices as a result, thus aligning expectations for short term liquidity and index-related trading with the business’s evolving outlook.

In contrast, investors should also be aware of the implications of shrinking net margins and freight market volatility as...

Read the full narrative on Golden Ocean Group (it's free!)

Golden Ocean Group is projected to reach $797.5 million in revenue and $355.0 million in earnings by 2028. This forecast assumes a 2.6% annual decline in revenue, while earnings are expected to increase by $241.3 million from the current $113.7 million.

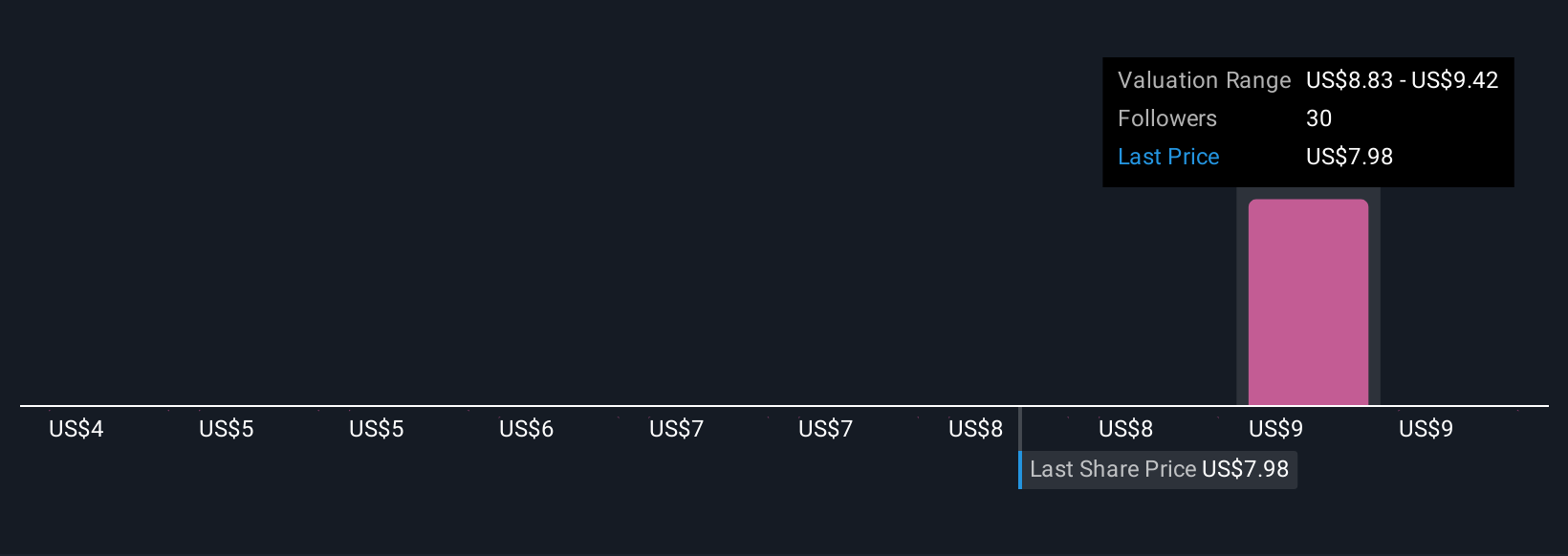

Uncover how Golden Ocean Group's forecasts yield a $9.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members put Golden Ocean's fair value between US$5.20 and US$61.42 per share. Given this wide range, it is clear that opinions differ significantly, especially as the company's removal from major indices shifts near-term trading behavior and may affect how members interpret profit risks.

Explore 5 other fair value estimates on Golden Ocean Group - why the stock might be worth over 7x more than the current price!

Build Your Own Golden Ocean Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Golden Ocean Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Golden Ocean Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Golden Ocean Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGL

Golden Ocean Group

A shipping company, owns and operates a fleet of dry bulk vessels worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion