- United States

- /

- Marine and Shipping

- /

- NasdaqCM:ESEA

US Market's Hidden Gems With Promising Potential

Reviewed by Simply Wall St

As the U.S. market experiences a period of solid weekly and monthly gains, driven by strong performances from tech giants like Amazon and Apple, investors are keenly observing the opportunities within smaller-cap stocks that may not yet be on everyone's radar. In this environment, identifying stocks with robust fundamentals and growth potential can be crucial for those looking to uncover hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Franklin Financial Services | 142.38% | 5.48% | -4.56% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Euroseas (ESEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market capitalization of $393.70 million.

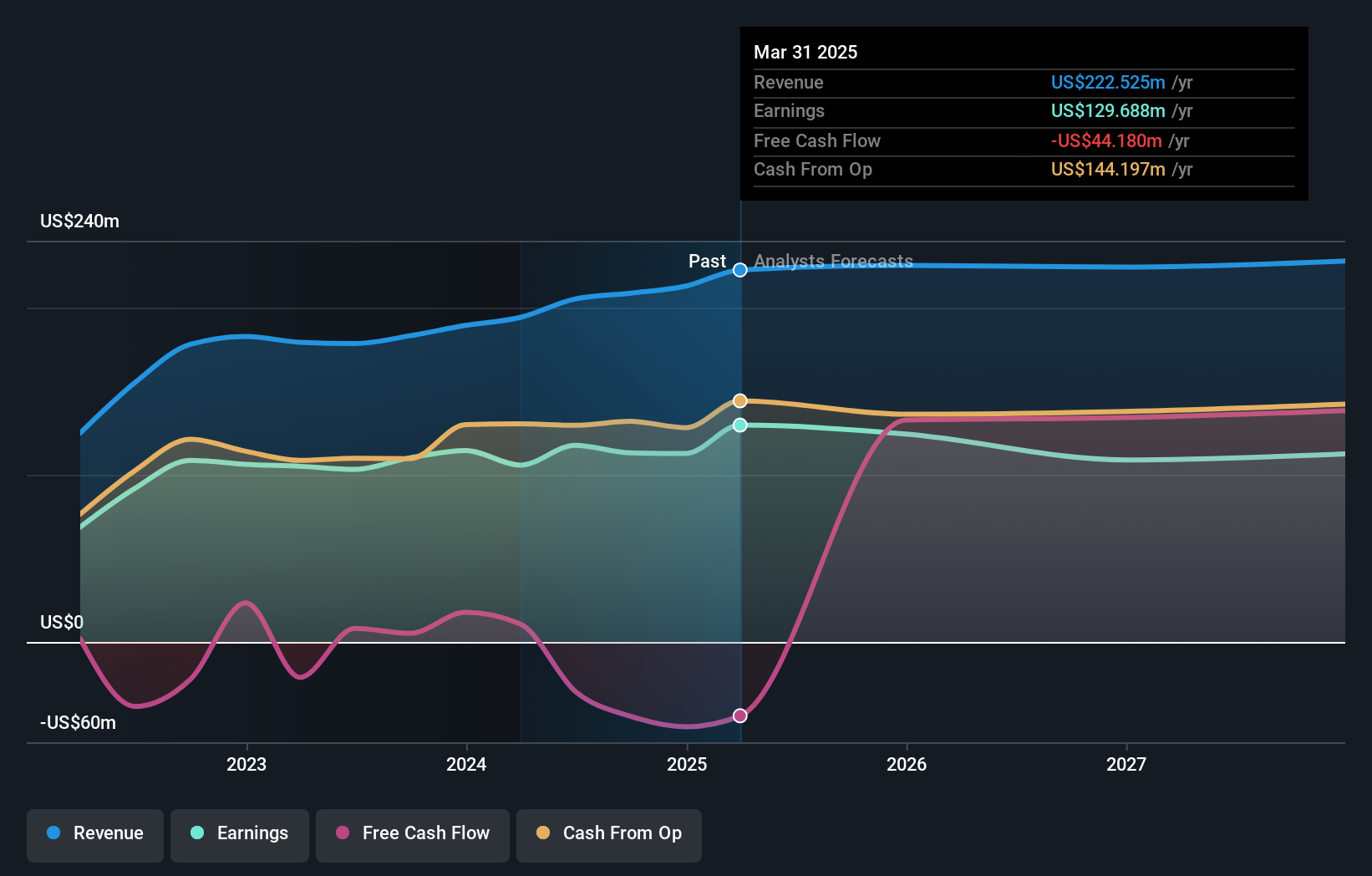

Operations: The company's revenue primarily stems from its transportation - shipping segment, generating $221.03 million.

Euroseas, a notable player in the shipping industry, has seen its debt to equity ratio improve significantly from 269.7% to 56.4% over five years, reflecting strengthened financial health. The company reported earnings growth of 1% last year, outpacing the shipping industry's -2%, and maintains a satisfactory net debt to equity ratio of 31.5%. Recent developments include securing a new time charter contract for M/V Jonathan P at $25,000 per day and repurchasing shares worth $1.32 million this year. Despite these positives, analysts foresee an average annual revenue decline of 0.4% over the next three years due to regulatory cost pressures and market exposure risks.

John B. Sanfilippo & Son (JBSS)

Simply Wall St Value Rating: ★★★★★★

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, is involved in processing and distributing tree nuts and peanuts across the United States with a market cap of $692.77 million.

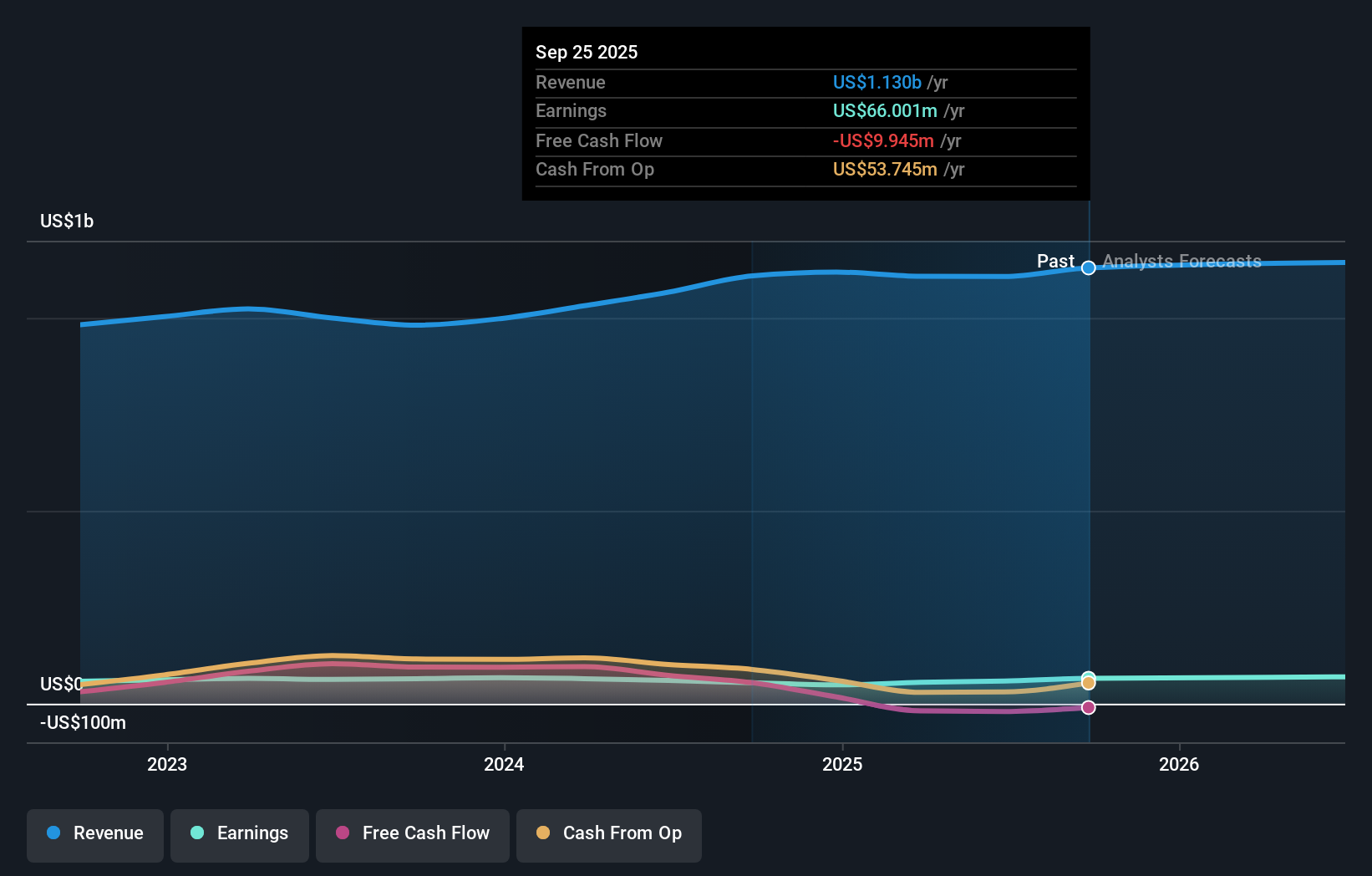

Operations: JBSS generates revenue primarily from the processing and distribution of tree nuts and peanuts. The company's cost structure includes expenses related to production, distribution, and raw material procurement. Its net profit margin has shown variability over recent periods.

John B. Sanfilippo & Son, a notable player in the food industry, recently reported impressive earnings growth of 21.4%, outpacing the industry's 5.6%. With a net debt to equity ratio of 22.9%, their financial health is solid, and interest payments are well-covered by EBIT at 22.7x coverage. The company trades at a favorable price-to-earnings ratio of 12.1x compared to the US market's average of 18.5x, suggesting potential value for investors seeking opportunities in smaller companies with robust earnings quality and promising future growth prospects forecasted at an annual rate of 9.59%.

- Navigate through the intricacies of John B. Sanfilippo & Son with our comprehensive health report here.

Learn about John B. Sanfilippo & Son's historical performance.

ASA Gold and Precious Metals (ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market cap of $855.48 million.

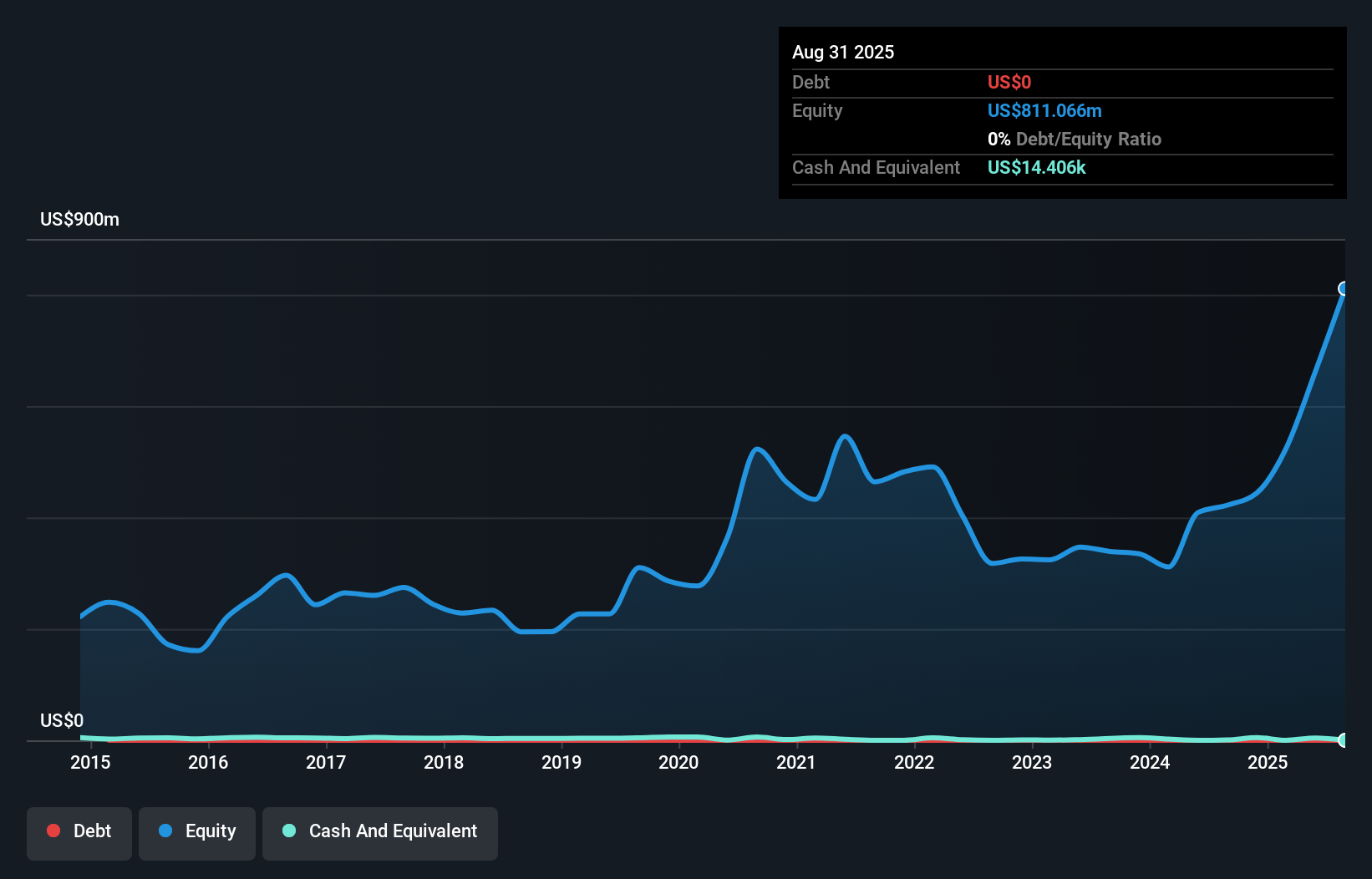

Operations: The company generates revenue of $3.98 million from its financial services segment, specifically through closed-end funds.

ASA Gold and Precious Metals, a nimble player in the precious metals sector, has seen its earnings soar by 330.7% over the past year, significantly outpacing the industry average of 12.1%. Despite reporting US$3.34 million in revenue for nine months ending August 2025, a substantial one-off gain of US$377.1 million heavily influenced its net income of US$351.41 million during this period. The company remains debt-free with a price-to-earnings ratio at an attractive 2.3x compared to the broader market's 18.5x, suggesting potential undervaluation amidst recent board changes and dividend affirmations of $0.03 per share payable November 2025.

Next Steps

- Click this link to deep-dive into the 300 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euroseas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESEA

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives