- United States

- /

- Transportation

- /

- NasdaqGS:CSX

Is CSX’s (CSX) New Leadership Lineup Signaling a Shift in Long-Term Strategic Priorities?

Reviewed by Sasha Jovanovic

- CSX recently announced significant executive leadership changes, with Kevin Boone returning as Chief Financial Officer and Maryclare Kenney promoted to Chief Commercial Officer, both effective October 29, 2025, following the departure of Sean Pelkey.

- This leadership transition, accompanied by new partnerships aimed at expanding customer value and operational efficiency, highlights CSX's intention to realign its strategic priorities for long-term growth.

- We'll explore how Kevin Boone's return to the CFO role could reshape CSX's investment outlook and operational direction.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CSX Investment Narrative Recap

To be a shareholder in CSX, you generally need to believe in the company's ability to drive operational improvements, capitalize on industrial growth, and address current headwinds in efficiency and macroeconomic conditions. The recent executive changes, including Kevin Boone's return as CFO, are unlikely to materially impact the most significant short-term catalyst, network fluidity gains from completed infrastructure projects. However, the main risk still lies in ongoing revenue weakness and vulnerability to commodity cycles and external shocks.

CSX's collaboration with Watco stands out among recent announcements, as it closely aligns with efforts to enhance customer value and realize operational efficiencies. This partnership is relevant given CSX's need to recover volumes and support revenue growth as legacy segments like coal face pressure, and it could help mitigate some of the earnings risks cited earlier.

Yet, in contrast to near-term efficiency gains, investors should be aware of ongoing pressures from commodity market swings and how sudden shifts in coal or fuel prices...

Read the full narrative on CSX (it's free!)

CSX's narrative projects $15.7 billion revenue and $3.9 billion earnings by 2028. This requires 3.6% yearly revenue growth and an $0.8 billion earnings increase from $3.1 billion.

Uncover how CSX's forecasts yield a $39.20 fair value, a 11% upside to its current price.

Exploring Other Perspectives

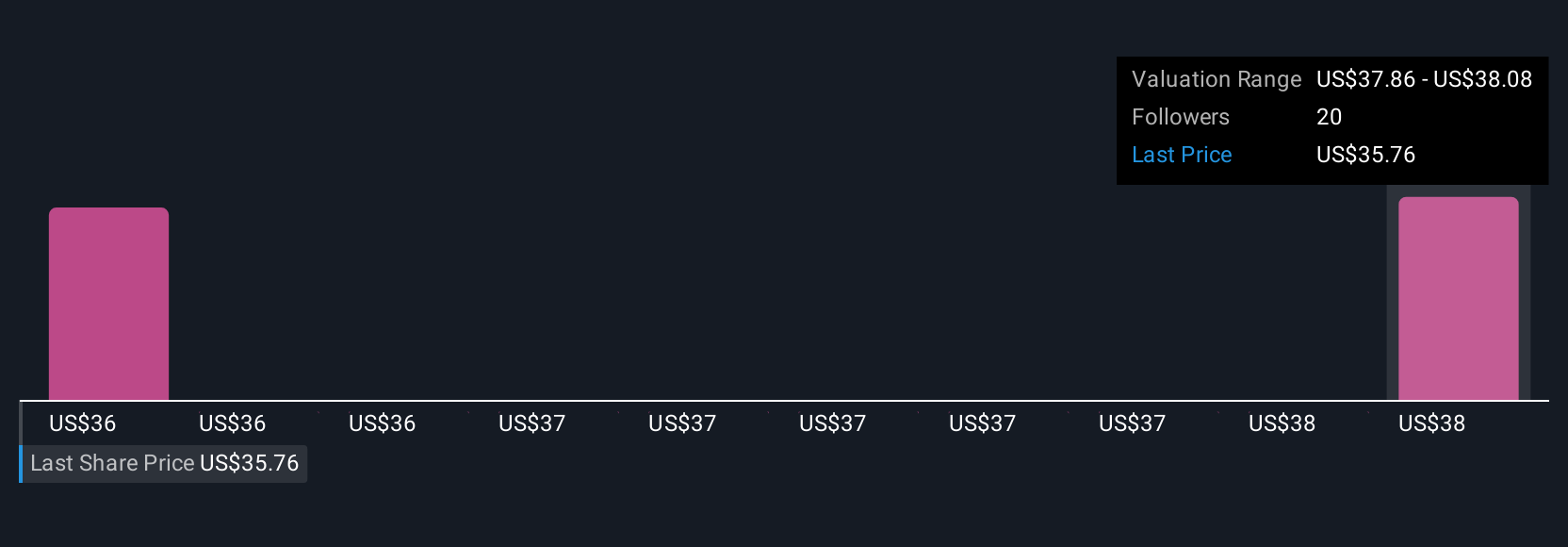

Community fair value estimates for CSX range from US$34.40 to US$39.20, based on analyses from 2 members of the Simply Wall St Community. While these opinions vary, ongoing commodity market exposure continues to raise concerns for future earnings and revenue consistency, check out additional viewpoints to see how your outlook compares.

Explore 2 other fair value estimates on CSX - why the stock might be worth just $34.40!

Build Your Own CSX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSX's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives