- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) Valuation: Strong Q3 Operations and Upgrades Spark Investor Optimism Despite Lower Yearly Sales

Reviewed by Simply Wall St

CSX (CSX) delivered third-quarter results that caught investors’ attention, thanks to solid operational execution and fresh capacity expansions. Even with lower sales and profit year over year, the company’s recent upgrades are boosting sentiment.

See our latest analysis for CSX.

Following the strong operational results and fresh buybacks, CSX’s momentum has picked up, with a 1-month share price return of 11.2% and a year-to-date gain of 14%. Looking longer term, shareholders have enjoyed a 10% total return over the past year and more than 50% across five years. This indicates that short-term optimism is building on a foundation of steady long-term growth.

If you’re curious what else is on the move in transportation, it’s a great time to discover See the full list for free.

With these achievements and upbeat analyst reactions, the big question now is whether CSX’s recent rally still leaves the stock undervalued or if investors have already accounted for the company’s future growth prospects in the current price.

Most Popular Narrative: 6.2% Undervalued

According to the narrative, CSX’s fair value is set higher than its recent closing price, thanks to upgraded growth forecasts and improved margins. Investors tracking the latest rally have every reason to examine what is fueling this upbeat consensus.

CSX's completion of major infrastructure projects, such as the Howard Street Tunnel and Blue Ridge subdivision rebuild, is expected to improve network fluidity. This should lead to increased operational efficiency and service reliability, potentially enhancing revenue and margin growth.

What specific upgrades are powering this optimistic price target? The narrative is built upon bold estimates for CSX’s revenue, profit margins, and future earnings. If you're wondering how these figures transform into a valuation above the current share price, don’t miss the financial details that might surprise you.

Result: Fair Value of $39.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and potential delays in infrastructure projects could undermine CSX’s growth forecasts and place pressure on future earnings momentum.

Find out about the key risks to this CSX narrative.

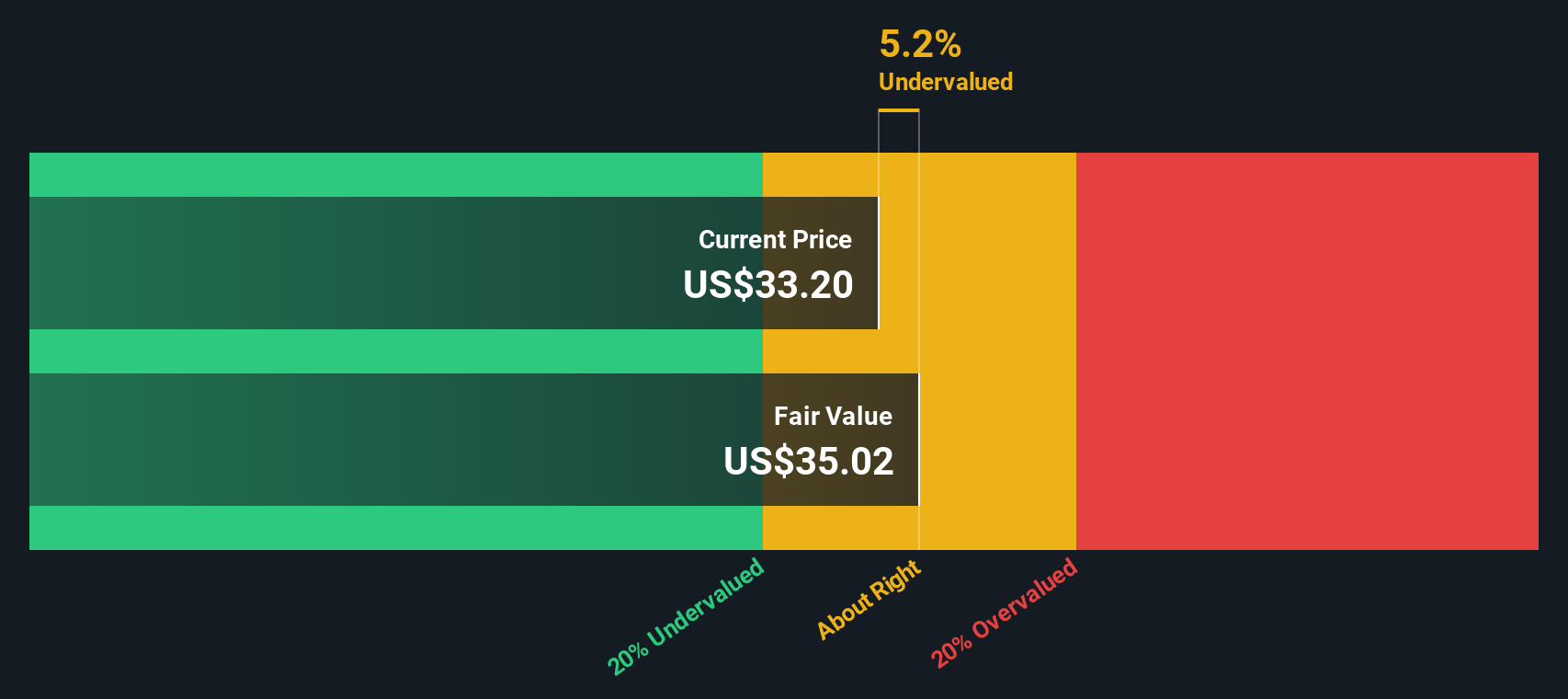

Another View: SWS DCF Model Offers a Cloudier Picture

While analyst consensus suggests CSX is undervalued at current prices, the SWS DCF model actually presents a different picture. According to our calculations, CSX is trading above its estimated fair value of $33.22, which indicates the stock could be overvalued by DCF standards. Does this mean the market is a step ahead, or does it suggest that cautious optimism might have gone too far?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSX Narrative

If the current analysis doesn’t match your outlook or you want to dig into the numbers yourself, you can quickly craft your own perspective: Do it your way

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you can broaden your strategy and spot new trends first? Take control and gain your edge now.

- Capture high potential by targeting these 24 AI penny stocks that are transforming industries with artificial intelligence breakthroughs and robust growth prospects.

- Benefit from reliable income streams and consider these 17 dividend stocks with yields > 3% offering yields above 3 percent. This can be helpful for building a resilient portfolio.

- Tap into tomorrow’s technology and growth by checking out these 26 quantum computing stocks, where pioneering advancements are reshaping entire sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives