- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

C.H. Robinson (CHRW) Net Margin Jumps to 3.1%, Reinforcing Profitability Narrative

Reviewed by Simply Wall St

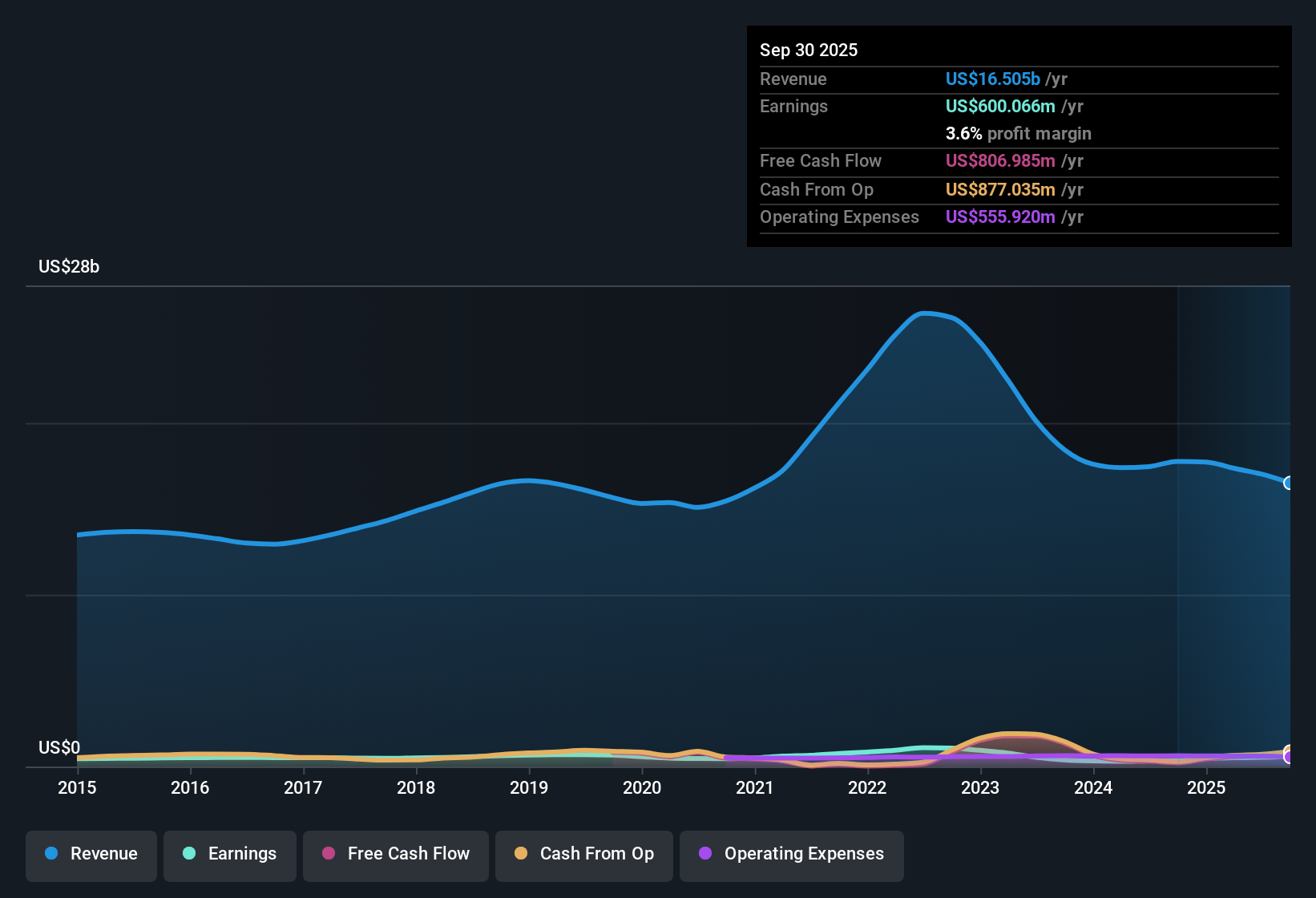

C.H. Robinson Worldwide (CHRW) reported a net profit margin of 3.1%, improving from last year’s 1.9%, with annual earnings growth of 60.9%. This sharply contrasts its past five-year average decline of 11.5% per year. Looking forward, analysts expect earnings to grow at an annual rate of 7.6%, while revenue is forecast to rise by 4.5% per year. Despite high earnings quality and ongoing dividends, valuation remains a talking point as shares trade above estimated fair value and appear expensive compared to the global logistics peer group. Financial positioning has also been flagged as a potential risk for investors.

See our full analysis for C.H. Robinson Worldwide.Next, we’ll see how these results stack up against the market narratives. Some ideas may get reinforced, while others could be up for debate.

See what the community is saying about C.H. Robinson Worldwide

AI-Driven Margin Gains Support Resilience

- Analysts forecast profit margins to rise from 3.1% today to 3.7% in three years, suggesting future improvements are expected beyond the recent short-term uptick.

- According to the analysts' consensus view, technology investments in automation and digital tools are expected to drive productivity and bolster gross margin expansion.

- Consensus notes these upgrades boost efficiency and allow growth without proportionally increasing costs. This helps defend and expand operating margins.

- This margin improvement is seen as critical for sustaining earnings momentum as the company manages both global supply chain shifts and increasing industry competition.

Consensus narrative suggests the latest margin progress directly supports the company's digital transformation story. See if this outlook matches your own by reading the full consensus narrative. 📊 Read the full C.H. Robinson Worldwide Consensus Narrative.

Analyst Price Target Trails Current Share Price

- With a current share price of $154.88, C.H. Robinson trades 4.6% above the official analyst price target of $148.12, showing a disconnect between what the market is willing to pay and the latest consensus valuation.

- The consensus narrative expects steady, but not breakaway, growth thanks to incremental improvements in profit margins and revenue, but ongoing trade and tech risks are seen as limiting significant upside.

- Analysts broadly agree on the 2028 earnings target and margin outlook, but the pricing gap suggests the market might be more optimistic about near-term results or resilience to risks.

- Investors should scrutinize whether current price momentum is justified, given analyst models forecast the company to be fairly valued at a lower level versus where it currently trades.

Customs Exposure and Competition Heighten Risks

- The consensus narrative flags that increasing technology-driven competition and exposure to volatile customs revenue could threaten margin gains and stability in future earnings.

- Analysts point out that while recent results are propped up by complexity in tariffs, this advantage may be temporary. Any easing of global trade uncertainty could negatively impact high-margin customs-related income.

- Competitive pressures from smaller brokers with digital tools challenge the company’s technology edge and potentially compress long-term profitability.

- Analyst focus on these risks highlights why forecasts for C.H. Robinson's growth, though positive, are more muted relative to broader market expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for C.H. Robinson Worldwide on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Bring your perspective to life and shape your own narrative in just a few minutes. Do it your way

A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

C.H. Robinson faces valuation concerns as shares trade above fair value. There are risks regarding its financial positioning and the sustainability of recent gains.

If you want to find companies trading at more attractive prices with stronger upside potential, check out these 848 undervalued stocks based on cash flows for investment ideas that may offer better value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives