- United States

- /

- Marine and Shipping

- /

- NasdaqGS:CCEC

A Look at Capital Clean Energy Carriers's (NasdaqGS:CCEC) Valuation After Major LNG Charter Wins and Strategic Vessel Shift

Reviewed by Simply Wall St

Capital Clean Energy Carriers (CCEC) recently secured a series of long-term charters for its LNG carriers under construction, finalized the sale of container vessels, and locked in financing for all multi-gas carriers.

See our latest analysis for Capital Clean Energy Carriers.

Following its string of long-term charter signings and timely divestment of container vessels, Capital Clean Energy Carriers has seen a steady build in momentum this year. The company’s latest earnings and dividend announcement come against a backdrop of a 16.75% year-to-date share price return, while its one-year total shareholder return stands at 19.07%. Taken together, these recent strategic moves and solid performance suggest investors are growing more optimistic about both short-term prospects and CCEC’s positioning in the evolving LNG and gas transport space.

If these market shifts have you curious about broader opportunities, now is a great moment to discover fast growing stocks with high insider ownership

With solid recent results and increased momentum, the key question now is whether Capital Clean Energy Carriers stock remains undervalued at current levels or if the market has already priced in its next phase of growth.

Most Popular Narrative: 17.3% Undervalued

Compared to the last close at $21.33, the widely followed narrative places Capital Clean Energy Carriers' fair value much higher, hinting that analysts believe the real story is yet to be fully recognized by the market. Let's look at one of the major drivers fueling this optimism.

The company's first-mover advantage in specialized LCO2 and multi-gas carriers, together with limited global shipyard capacity for these complex vessels, is likely to support higher fleet utilization and premium rates in these market segments. This may drive incremental revenue and EBITDA growth as new vessels are delivered from 2026 onward.

Want to know what bold expectations justify this premium valuation? The big reveal lies in ambitious revenue expansion, margin improvement, and a future profit multiple usually reserved for industry leaders. Curious which projections send valuation targets soaring? Dive in to uncover the details behind this eye-catching price estimate.

Result: Fair Value of $25.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates or delays in securing long-term contracts could derail growth. This makes CCEC's projected upside less certain than it appears.

Find out about the key risks to this Capital Clean Energy Carriers narrative.

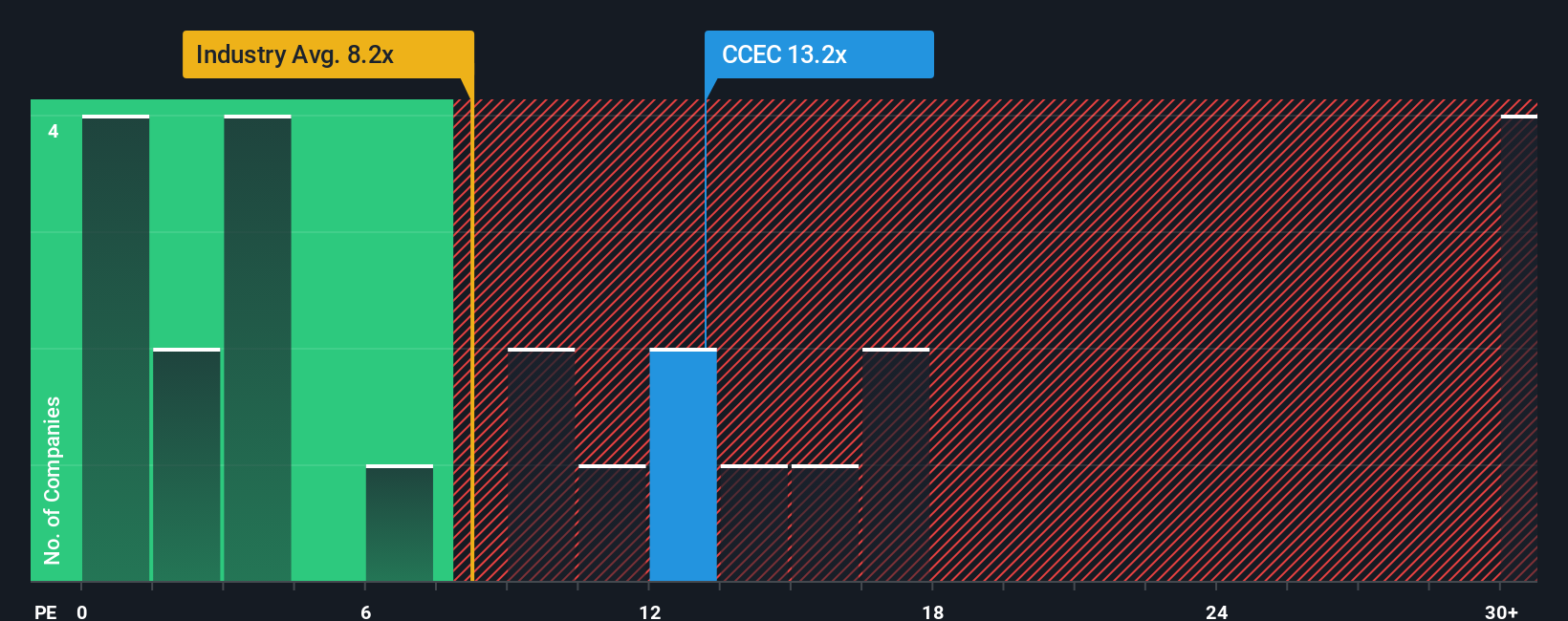

Another View: Sizing Up with Earnings Ratios

While analyst targets see notable upside, a different perspective comes from looking at the current earnings ratio. Capital Clean Energy Carriers trades at 8.3 times earnings, which is higher than both its peer average of 4 times and above the industry’s 6.8 times. Interestingly, the fair ratio our models suggest is 9.6 times. This means the market could easily re-rate the stock in either direction. Does this premium point to confidence, or potential overexcitement?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital Clean Energy Carriers Narrative

If you see things differently or want to chart your own path, you can dive into the numbers and craft your own view in just a few minutes. Do it your way

A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors broaden their horizons, and Simply Wall Street Screener unlocks countless new opportunities. Take action now and spot the movers before everyone else does.

- Capture high-yield potential and tap into steady income by scanning these 22 dividend stocks with yields > 3% offering attractive payouts and resilient cash flows.

- Spot the innovators shaking up medicine and health by filtering for these 33 healthcare AI stocks making headlines with AI-powered breakthroughs.

- Step into fast-growing markets with these 26 AI penny stocks riding the AI wave and transforming entire industries with intelligent technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCEC

Capital Clean Energy Carriers

A shipping company, provides marine transportation services in Greece.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives