- United States

- /

- Transportation

- /

- NasdaqGS:CAR

Will Billing Controversy Challenge Avis Budget Group’s (CAR) Reputation for Service Excellence?

Reviewed by Sasha Jovanovic

- In recent days, Avis Budget Group has faced renewed scrutiny over its pricing practices after a viral TikTok post highlighted a four-day US$500 bill on a US$27-per-day advertised rental, following a US$19 million class action lawsuit loss for improperly charging ancillary fees.

- This spotlight on pricing transparency comes as the company was also recognized with two bronze Travvy Awards for excellence in both domestic and international car rentals, underscoring the contrast between industry accolades and customer concerns.

- We'll explore how public concern over billing transparency could reshape the investment narrative and future expectations for Avis Budget Group.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Avis Budget Group Investment Narrative Recap

To be a shareholder in Avis Budget Group, you need to believe the company can capture higher-margin, premium travelers and expand into new mobility markets through technology and partnerships. The recent pricing controversy may increase scrutiny over transparency and customer trust, but the biggest short-term catalyst, premiumization via Avis First, remains intact, while the primary risk now centers on regulatory and reputational damage impacting future revenue growth or margins.

The launch of Avis First, a premium rental service now available at major European airports, is particularly relevant. This product aims to drive revenue growth and margin expansion in line with industry trends. However, increased attention on billing practices and class action outcomes could challenge the intended uplift and reinforce the importance of trust as the company courts premium customers.

Yet, contrasted with these upgrades, investors should also consider the ongoing risks around transparency and legal exposure, which could...

Read the full narrative on Avis Budget Group (it's free!)

Avis Budget Group's narrative projects $12.2 billion revenue and $1.0 billion earnings by 2028. This requires 1.4% yearly revenue growth and a $3.2 billion increase in earnings from -$2.2 billion today.

Uncover how Avis Budget Group's forecasts yield a $135.75 fair value, in line with its current price.

Exploring Other Perspectives

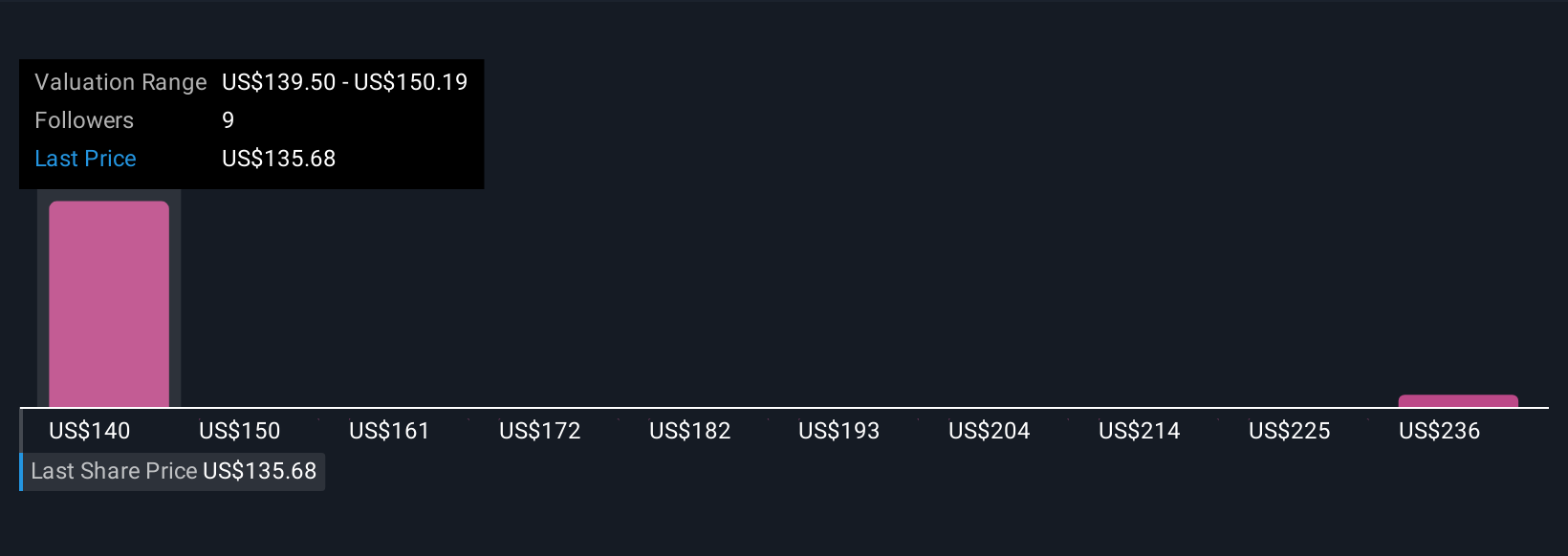

Two community members on Simply Wall St estimated Avis Budget Group’s fair value between US$135.75 and US$246.44 per share. As you review these ranges, keep in mind that customer perception and regulatory risks tied to transparency can influence both short and long-term business performance.

Explore 2 other fair value estimates on Avis Budget Group - why the stock might be worth as much as 79% more than the current price!

Build Your Own Avis Budget Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Avis Budget Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avis Budget Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives