- United States

- /

- Transportation

- /

- NasdaqGS:CAR

Avis Budget Group (CAR): Rapid Earnings Growth Forecast Challenges Bearish Profit Narratives Heading Into Earnings

Reviewed by Simply Wall St

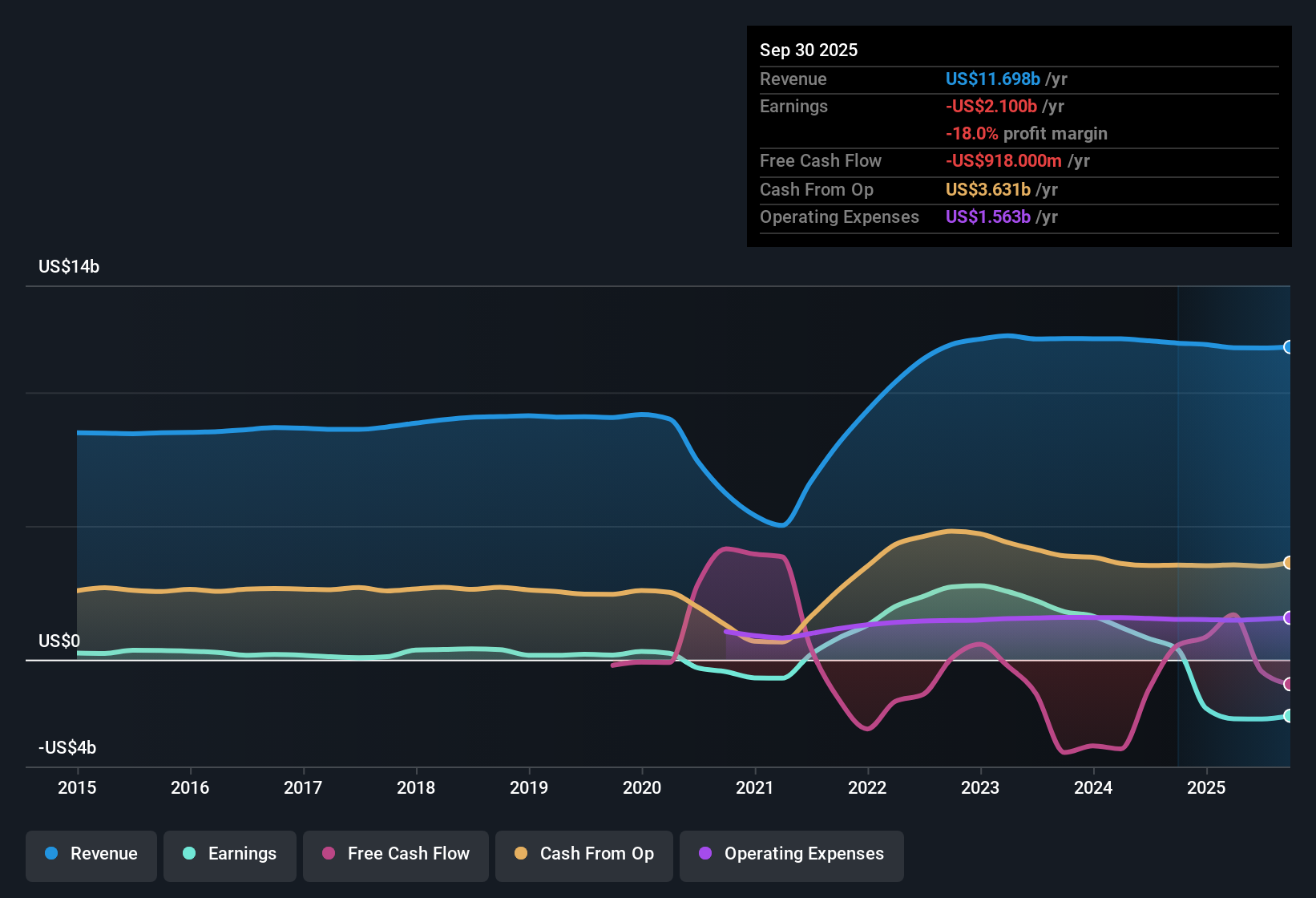

Avis Budget Group (CAR) is currently unprofitable, with net losses having grown at an annual rate of 23% over the past five years. Still, the company’s earnings are forecast to surge by 128.41% per year, putting profitability in reach within the next three years. This pace is well ahead of the broader market. While revenue is only expected to grow at 1.9% per year, significantly slower than the US market average, investors might be drawn in by CAR’s strong profit trajectory and its attractive value compared to sector peers.

See our full analysis for Avis Budget Group.Now, let's put these earnings numbers side by side with the dominant narratives to see not just where perceptions match the data, but also where the outlook could shift.

See what the community is saying about Avis Budget Group

Margin Shift: -19.0% Today, 8.3% in Three Years

- Analysts expect profit margins to increase from -19.0% now to 8.3% over the next three years, marking a significant turnaround toward profitability.

- According to the analysts' consensus view, that forecast for margin recovery is getting a lot of attention but comes with two big debates:

- Enthusiasm for premium offerings and digital upgrades could overstate the odds of hitting those profit targets, since margins hinge on risks such as successful execution and responses from competitors.

- Structural shifts in urban mobility, such as more ride-hailing and less car ownership, could put a lid on volume and profits. This means even substantial margin gains might not flow through to the bottom line as easily as the bullish pitch suggests.

Industry-Leading Value: 0.4x Price-to-Sales Against 2.6x Peers

- Avis Budget Group has a Price-to-Sales Ratio of just 0.4x compared to 2.6x for direct peers and 1.3x for the broader US transportation sector, a steep discount that stands out.

- Consensus narrative flags this valuation gap as a double-edged sword:

- Bulls lean on the low multiple to argue the market is undervaluing improving fundamentals, especially as earnings are projected to swing from losses to $1.0 billion within three years.

- Critics, however, point out that the current discount could actually reflect long-term risks, such as muted revenue growth at 1.9% per year (trailing the market). There is also the threat that competitive forces might erode future profits before the higher margin story plays out.

Share Count Set to Shrink 1.3% Annually

- Over the next three years, analysts anticipate Avis Budget Group will reduce its shares outstanding by about 1.32% per year, potentially boosting per-share earnings.

- Consensus narrative sees disciplined share reduction as a way management is backing up their growth plan with concrete capital allocation. Some caution, though, that buybacks alone will not overcome revenue headwinds if the mobility landscape changes faster than expected.

- This tension between share count discipline and top-line growth challenges is at the heart of whether upcoming earnings momentum will be fully realized by investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Avis Budget Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the outlook deserves a fresh take? Craft your own narrative in just a few minutes and let your perspective shine. Do it your way.

A great starting point for your Avis Budget Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite an improving profit outlook, Avis Budget Group faces persistent revenue headwinds and relies on margin recovery in an uncertain growth environment.

To sidestep that uncertainty, use stable growth stocks screener (2115 results) to quickly zero in on companies consistently expanding revenue and earnings, cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives