- United States

- /

- Biotech

- /

- NasdaqGM:ZNTL

Undervalued Opportunities: US Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The U.S. stock market has recently shown mixed performance, with the Nasdaq rising due to gains in technology stocks like Nvidia, while the Dow Jones and S&P 500 have pulled back from record highs. Amid these fluctuations, investors are exploring various opportunities across different market segments. Penny stocks, often associated with smaller or emerging companies, continue to attract attention for their potential value and growth prospects despite their somewhat outdated label. In this article, we will explore several penny stocks that exhibit financial strength and could offer intriguing opportunities for those looking to invest in this niche area of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7988 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.15 | $485.02M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.47 | $45.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.62 | $2.1B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.77 | $114.05M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $52.63M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.63 | $137.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.09 | $96.23M | ★★★★★☆ |

Click here to see the full list of 752 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Blade Air Mobility (NasdaqCM:BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation alternatives to alleviate congested ground routes in the United States and has a market cap of approximately $293.03 million.

Operations: The company's revenue is derived from two main segments: Medical, generating $139.81 million, and Passenger, contributing $98.57 million.

Market Cap: $293.03M

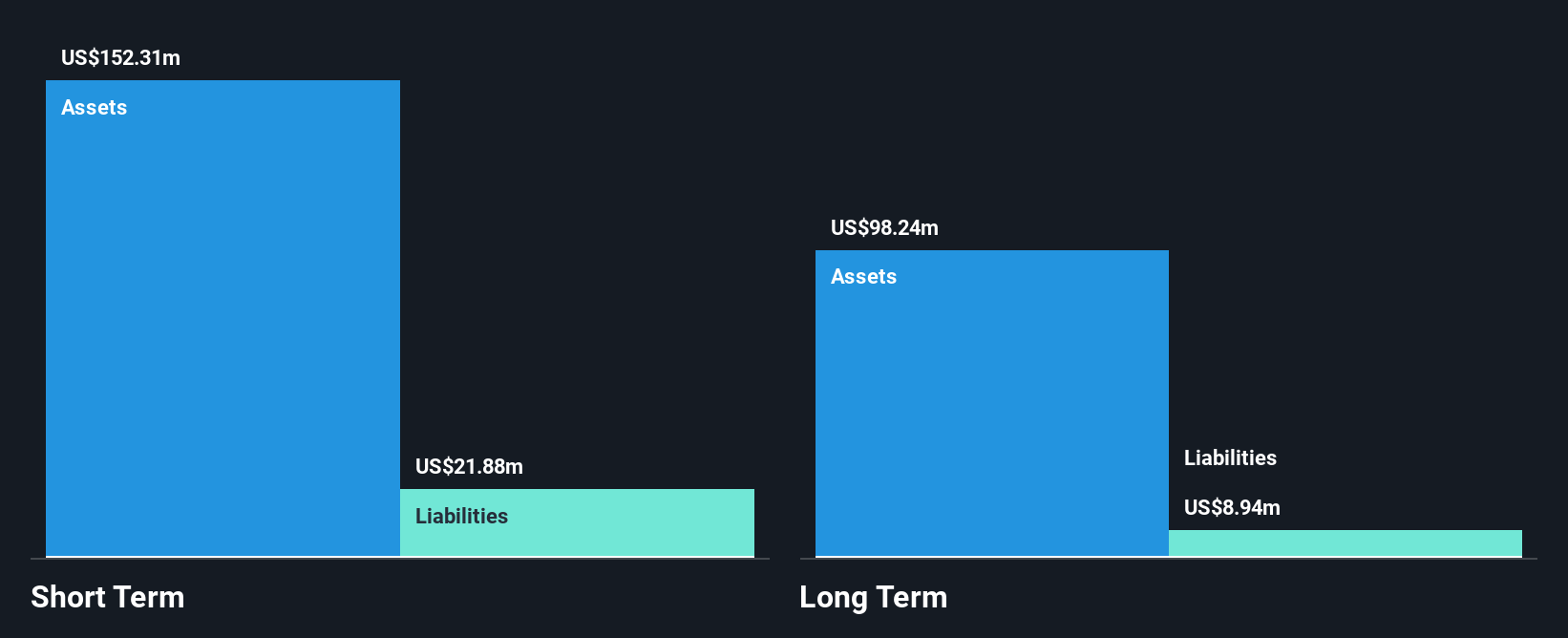

Blade Air Mobility, Inc. presents a mixed outlook within the penny stock landscape. The company is debt-free and has sufficient cash runway for over three years, providing some financial stability amidst its unprofitable status and negative return on equity of -21.45%. Recent strategic partnerships with major airlines like Qatar Airways and Emirates highlight its efforts to expand market reach, although shareholders have faced dilution with shares outstanding increasing by 5.2% over the past year. Despite reporting increased sales of US$67.95 million in Q2 2024, Blade remains unprofitable but anticipates revenue growth into 2025.

- Click to explore a detailed breakdown of our findings in Blade Air Mobility's financial health report.

- Explore Blade Air Mobility's analyst forecasts in our growth report.

Zentalis Pharmaceuticals (NasdaqGM:ZNTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zentalis Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to developing small molecule therapeutics for cancer treatment, with a market cap of approximately $223.28 million.

Operations: Zentalis Pharmaceuticals, Inc. does not report any revenue segments as it is a clinical-stage biopharmaceutical company focused on developing cancer therapeutics.

Market Cap: $223.28M

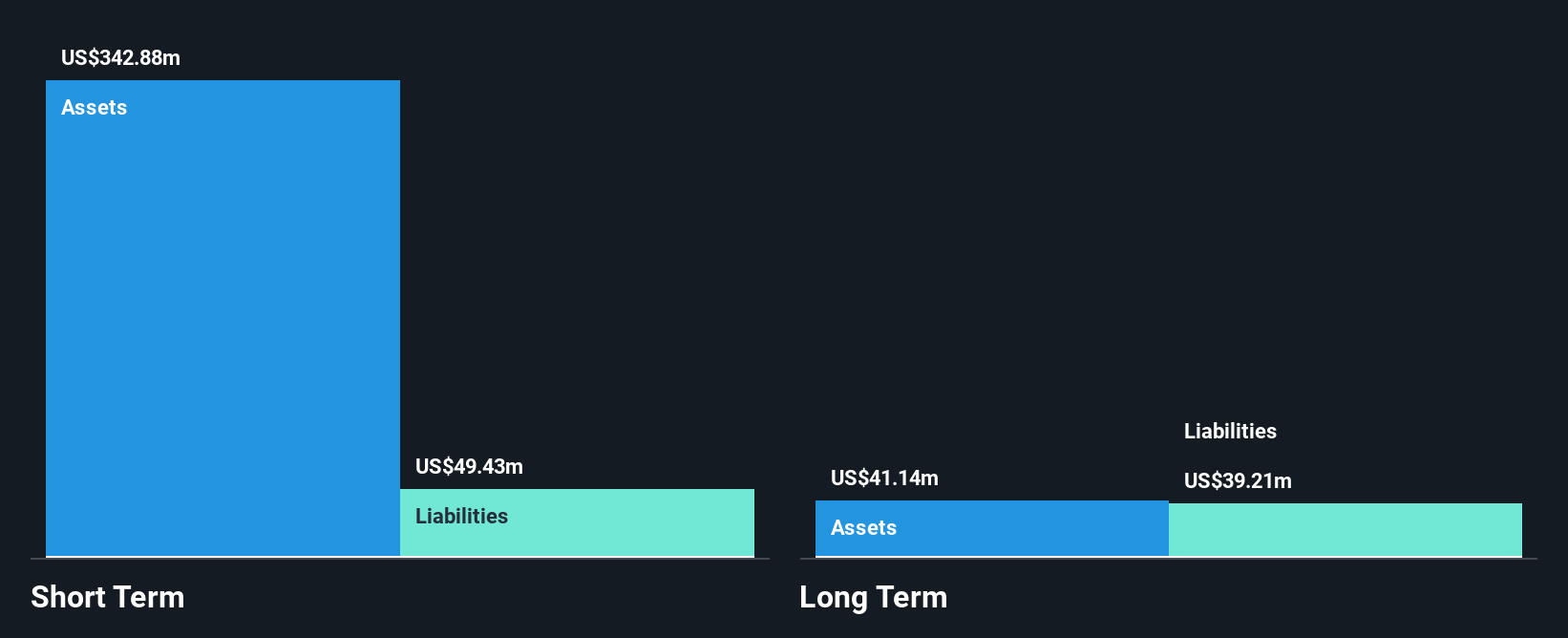

Zentalis Pharmaceuticals, Inc. navigates the penny stock domain with a focus on cancer therapeutics development, yet remains pre-revenue and unprofitable. The company benefits from a debt-free balance sheet and short-term assets of US$439.6 million surpassing liabilities, offering some financial cushion despite high volatility in share price. Recent FDA clearance to resume clinical studies for its WEE1 inhibitor, azenosertib, marks progress in its pipeline but does not immediately translate to revenue generation. With earnings forecasted to decline by 3% annually over the next three years, Zentalis faces challenges ahead in achieving profitability amidst ongoing operational losses.

- Click here to discover the nuances of Zentalis Pharmaceuticals with our detailed analytical financial health report.

- Examine Zentalis Pharmaceuticals' earnings growth report to understand how analysts expect it to perform.

loanDepot (NYSE:LDI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans, with a market cap of approximately $701.90 million.

Operations: The company generates revenue of $911.64 million from the originating, financing, and selling of mortgage loans.

Market Cap: $701.9M

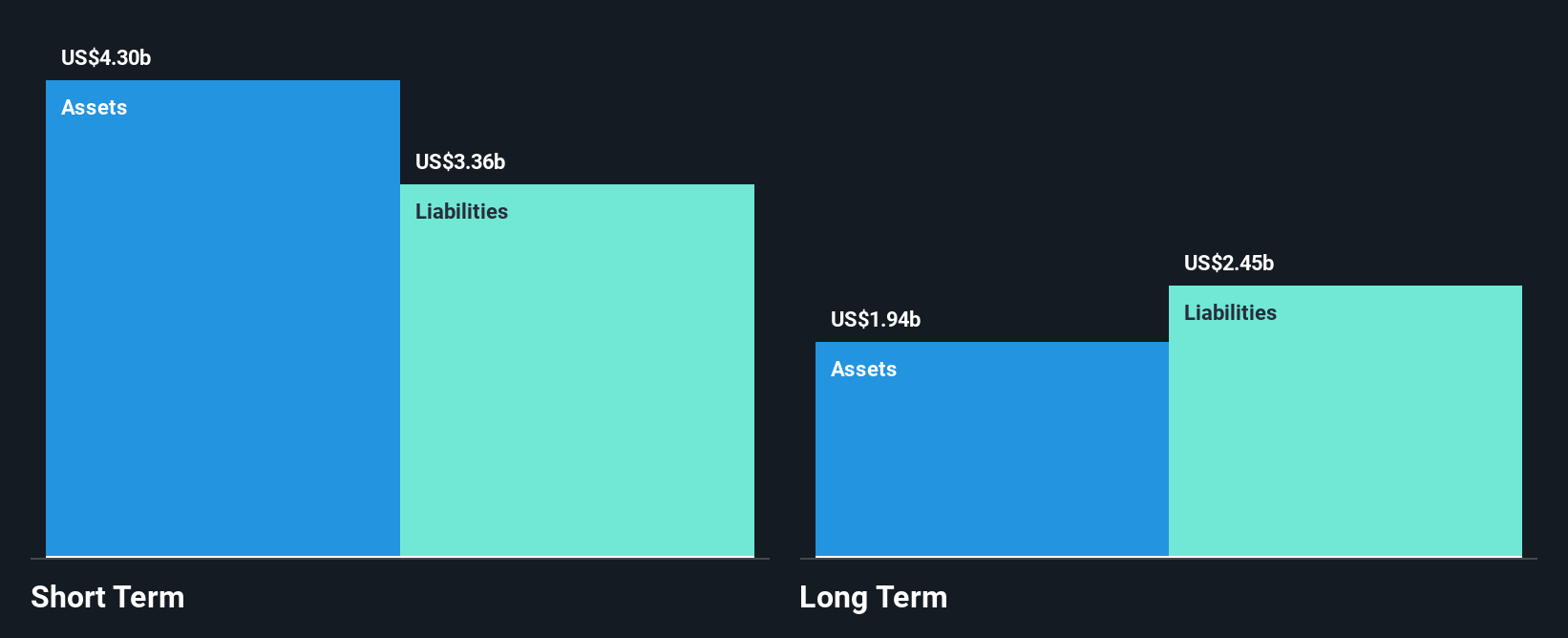

loanDepot, Inc. operates in the mortgage lending sector with a market cap of approximately US$701.90 million, facing challenges typical of penny stocks such as high volatility and significant insider selling. Despite being unprofitable with increasing losses over five years, the company maintains strong short-term assets exceeding both its short and long-term liabilities. Recent strategic moves include a $300 million debt financing transaction and expanding its product suite with a first-lien HELOC, potentially enhancing revenue streams. However, shareholder dilution remains a concern as shares outstanding have increased by 3.2% over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of loanDepot.

- Review our growth performance report to gain insights into loanDepot's future.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 749 more companies for you to explore.Click here to unveil our expertly curated list of 752 US Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zentalis Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ZNTL

Zentalis Pharmaceuticals

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics for the treatment of various cancers.

Flawless balance sheet and fair value.