- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

Is October’s Passenger Surge Shifting the Investment Outlook for Allegiant Travel (ALGT)?

Reviewed by Sasha Jovanovic

- Allegiant Travel Company recently reported robust preliminary operating results for October 2025, with scheduled service passenger numbers rising to 1,488,444 from 1,168,344 a year earlier and load factor increasing to 81.9% from 78.5%.

- This growth in passenger traffic and capacity comes amid ongoing labor tensions and the announcement of new nonstop routes for 2026, highlighting both operational momentum and internal challenges.

- We'll examine how Allegiant's strong October traffic growth shapes its investment narrative in the face of labor negotiations and network expansion.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Allegiant Travel Investment Narrative Recap

To believe in Allegiant Travel as an investment, you have to trust in its ability to grow leisure traffic through network expansion and operational efficiency, while managing tight cost controls. The sharp increase in October passenger numbers boosts a key near-term catalyst, traffic and capacity growth, but ongoing labor tensions remain the most significant risk right now, potentially affecting future service reliability if not resolved. Overall, while the strong monthly results draw attention, labor challenges continue to be a material concern for short-term business stability.

Among recent announcements, Allegiant’s launch of 30 new nonstop routes stands out. This network expansion aligns directly with rising traffic and capacity figures, reinforcing the catalyst for higher route utilization and a broader customer base, even as labor tensions raise short-term questions about sustained operational performance.

On the other hand, investors should also be aware of the ongoing labor dispute among pilots and the risks that this presents if...

Read the full narrative on Allegiant Travel (it's free!)

Allegiant Travel's narrative projects $3.1 billion in revenue and $267.8 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $553.9 million increase in earnings from the current -$286.1 million.

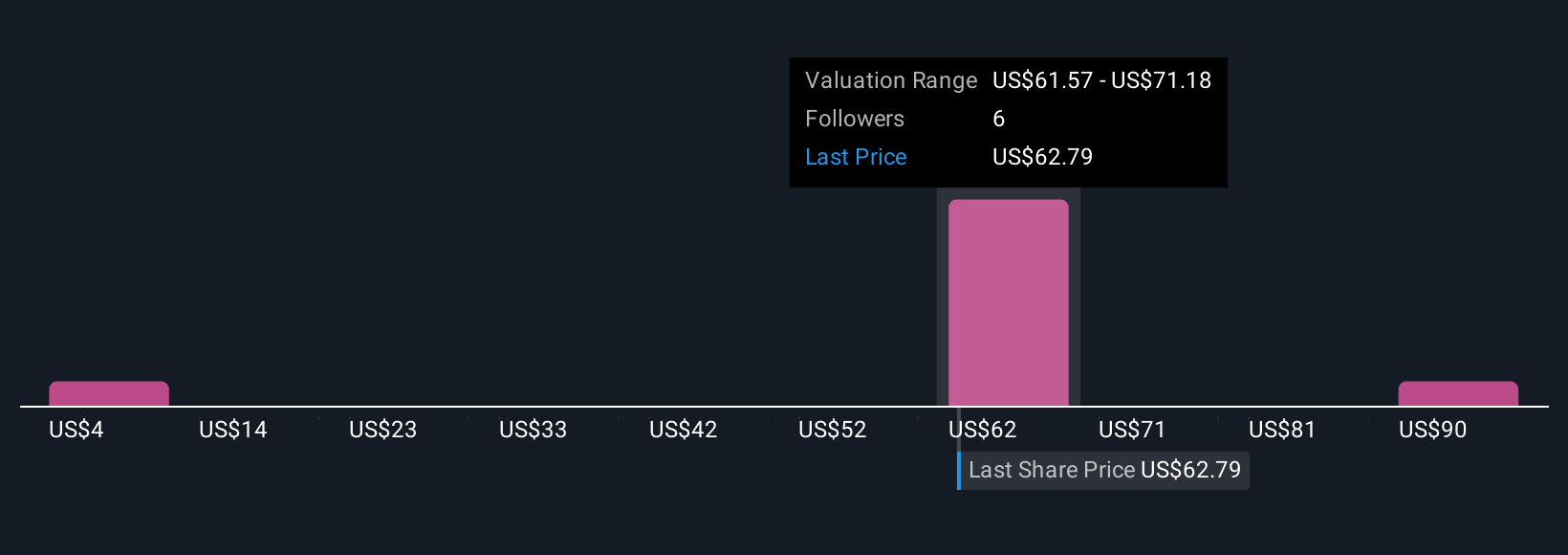

Uncover how Allegiant Travel's forecasts yield a $69.58 fair value, a 8% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted a single fair value estimate for Allegiant Travel at US$69.58, reflecting minimal diversity in outlooks. While passenger traffic is rising, ongoing labor uncertainty could play a critical role in shaping future performance, highlighting the importance of considering multiple viewpoints on value and risk.

Explore another fair value estimate on Allegiant Travel - why the stock might be worth 8% less than the current price!

Build Your Own Allegiant Travel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegiant Travel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Allegiant Travel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegiant Travel's overall financial health at a glance.

No Opportunity In Allegiant Travel?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026