- United States

- /

- Airlines

- /

- NasdaqGS:ALGT

Allegiant Travel (ALGT): Evaluating Valuation After Upbeat 2025 Guidance and Growth Plans

Reviewed by Simply Wall St

Allegiant Travel (ALGT) has caught investors’ attention after raising its full year earnings guidance for 2025, as well as mapping out plans for fleet growth and increased seat capacity. This brighter outlook has helped boost the company’s recent performance.

See our latest analysis for Allegiant Travel.

Allegiant Travel’s mix of upbeat guidance and new route launches has helped revive momentum after a rough stretch, with the stock climbing over 13% in the past three months. Still, the one-year total shareholder return remains negative, reflecting the impact of prior volatility and industry headwinds. It looks like investors are starting to take notice of Allegiant’s growth initiatives, even as negotiations with pilots and external challenges keep risk on the radar.

If you’re looking to spot more interesting opportunities in travel and transportation, now is a great time to broaden your search and discover See the full list for free.

With Allegiant’s shares rallying on bullish guidance and ambitious expansion, the big question is whether this momentum signals an undervalued opportunity or if the market has already factored in the company’s anticipated growth.

Most Popular Narrative: 7.9% Undervalued

With Allegiant Travel's last close of $63.70 and the most widely followed narrative suggesting a fair value of $69.17, the current price sits below what analysts believe the company is worth. This points to a potential gap between market consensus and the forward-looking assumptions underlying that valuation.

The company’s efficient point-to-point network serving secondary and mid-sized cities is set to benefit from ongoing migration trends and the persistence of remote or hybrid work. This expansion of addressable markets supports steady capacity utilization and reduces exposure to the most competitive major hubs, which could help stabilize and grow revenues.

Think Allegiant’s advantage ends with low fares? Think again. This narrative is based on ambitious growth assumptions, innovative cost control, and the often overlooked strength of non-hub routes. Want to see exactly how strong revenue, profit margin, and future earnings projections support this valuation? The details behind these numbers might just surprise you.

Result: Fair Value of $69.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in leisure travel demand and volatility from fleet transitions could still pose significant challenges to Allegiant’s rebound narrative.

Find out about the key risks to this Allegiant Travel narrative.

Another View: What Do the Numbers Say?

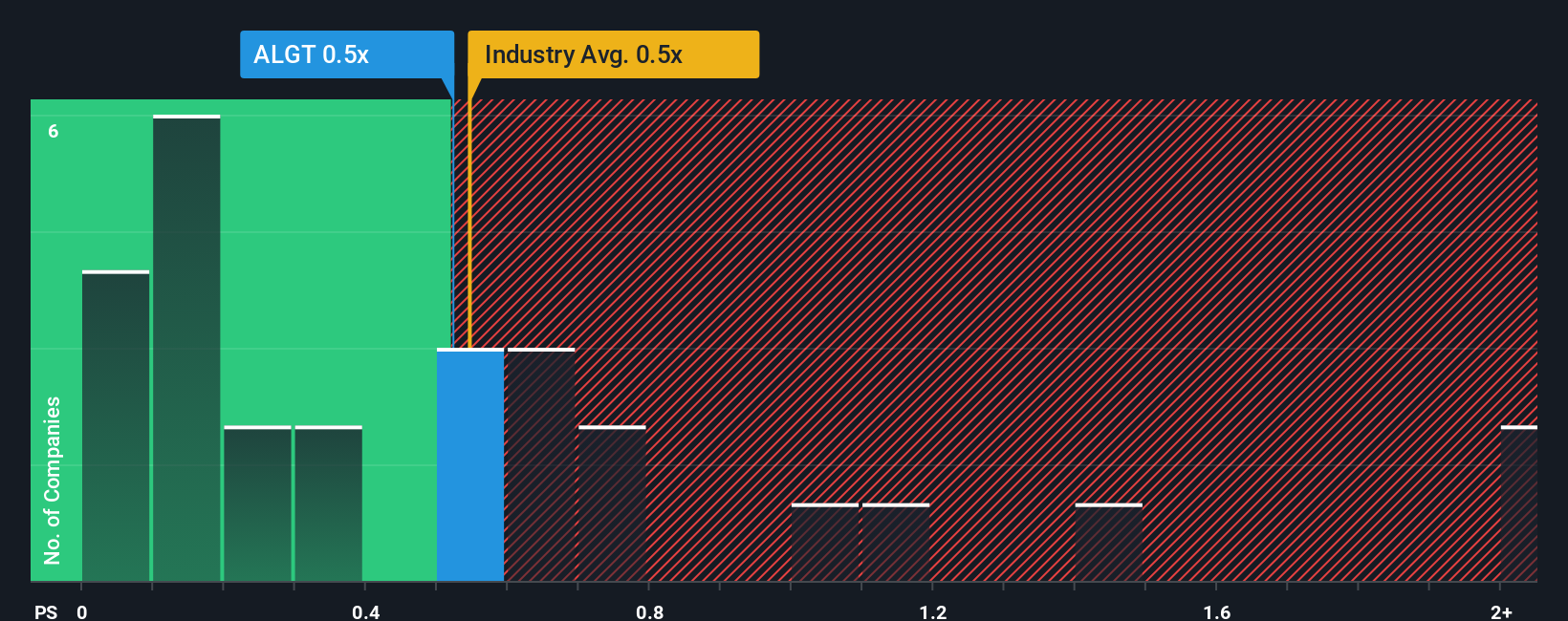

Taking a look at sales multiples offers a different perspective. Allegiant trades at 0.4x sales, making it appear attractively priced compared to the North American Airlines industry average of 0.5x and its own fair ratio, estimated at 0.7x. This gap could present a value opportunity, but does the market really see it that way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegiant Travel Narrative

If you think the story could unfold differently, or want to dig into the numbers yourself, you can easily craft your own view in just a few minutes. Do it your way

A great starting point for your Allegiant Travel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don't let standout opportunities pass you by. Use the Simply Wall Street Screener to pinpoint stocks with untapped upside, stable growth, and innovation that could reshape your portfolio.

- Uncover unique opportunities in companies at the forefront of artificial intelligence with these 27 AI penny stocks and see which innovators are making headlines.

- Capture potential market mispricings when you start seeking out value with these 900 undervalued stocks based on cash flows using rigorous cash flow analysis.

- Boost your potential income stream by checking out these 18 dividend stocks with yields > 3% for stocks offering yields above 3% and solid payment histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGT

Allegiant Travel

A leisure travel company, provides travel and leisure services and products to residents of under-served cities in the United States.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success