- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL): Assessing Valuation as Investors Reconsider the Airline's Prospects

Reviewed by Simply Wall St

American Airlines Group (AAL) shares have been on the move this week, catching the attention of investors who are assessing whether recent trends in the airline sector might affect the company’s valuation and prospects in the coming months.

See our latest analysis for American Airlines Group.

American Airlines Group has seen its share price pull back this year, with a year-to-date share price return of -24.94 percent. This reflects some lingering concerns about the sector. Still, the recent 1-month share price return of 2.08 percent hints at possible appetite returning among investors, even as management adapts to industry headwinds. Over the longer term, American Airlines’ 1-year total shareholder return stands at -11.33 percent. This suggests that momentum is still finding its footing as the company looks ahead to potential recovery and revaluation.

If you're seeking fresh ideas beyond airlines, now’s a good time to discover fast growing stocks with high insider ownership.

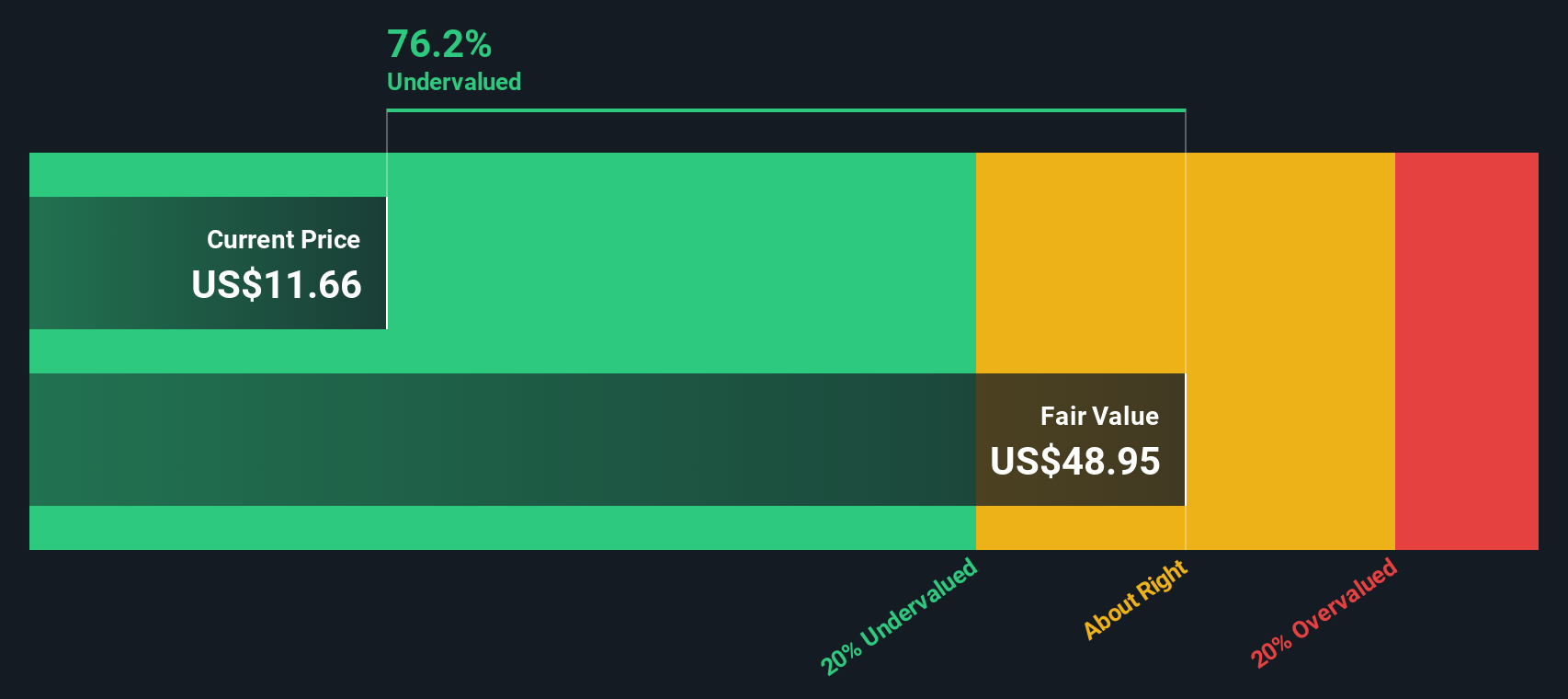

After months of volatility and recent gains, investors are left wondering if American Airlines Group’s current share price offers an undervalued entry point or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 20.3% Overvalued

American Airlines Group’s latest narrative pegs its fair value at $10.61, significantly below the last close price of $12.76. This sets the tone for a sharp debate about whether today’s market optimism is sustainable or misplaced.

There’s a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity, any startup would go belly-up with a balance sheet such as this one.

Curious what makes this narrative so bearish? There’s one controversial assumption at the heart of this fair value. If you can spot it, you’ll understand what’s really driving this story. Want to know if American’s future hinges on a single bold operational shift or a dramatic financial turnaround? Dig into the full narrative and discover exactly how far optimism stretches against these daunting numbers.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if travel demand unexpectedly rebounds or if American successfully boosts premium revenue, the current skepticism could quickly turn to renewed optimism.

Find out about the key risks to this American Airlines Group narrative.

Another View: DCF Model Points to Undervaluation

While the most popular narrative suggests American Airlines Group is overvalued, our SWS DCF model offers a sharply different perspective by estimating a fair value of $23.15, which is far above the recent share price. Does this mean market worries have gone too far, or is the future less clear than either method suggests?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Airlines Group Narrative

If you see the story differently, or you’d rather base your view on your own research, you can craft your own narrative in just minutes with Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never rely on a single story. Broaden your opportunities with new strategies and sectors you may have overlooked. Your next portfolio win could be just a decision away.

- Chase future returns by targeting stable income streams through these 16 dividend stocks with yields > 3%, which consistently deliver yields above 3 percent.

- Jump on tomorrow’s biggest breakthroughs by following these 26 quantum computing stocks, featuring innovators in quantum tech and advanced computing.

- Capture market-beating upside by tracking these 877 undervalued stocks based on cash flows, a collection of overlooked stocks that trade below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives