- United States

- /

- Airlines

- /

- NasdaqGS:AAL

American Airlines (AAL): $689 Million One-Off Loss Sharpens Focus on Earnings Quality Debate

Reviewed by Simply Wall St

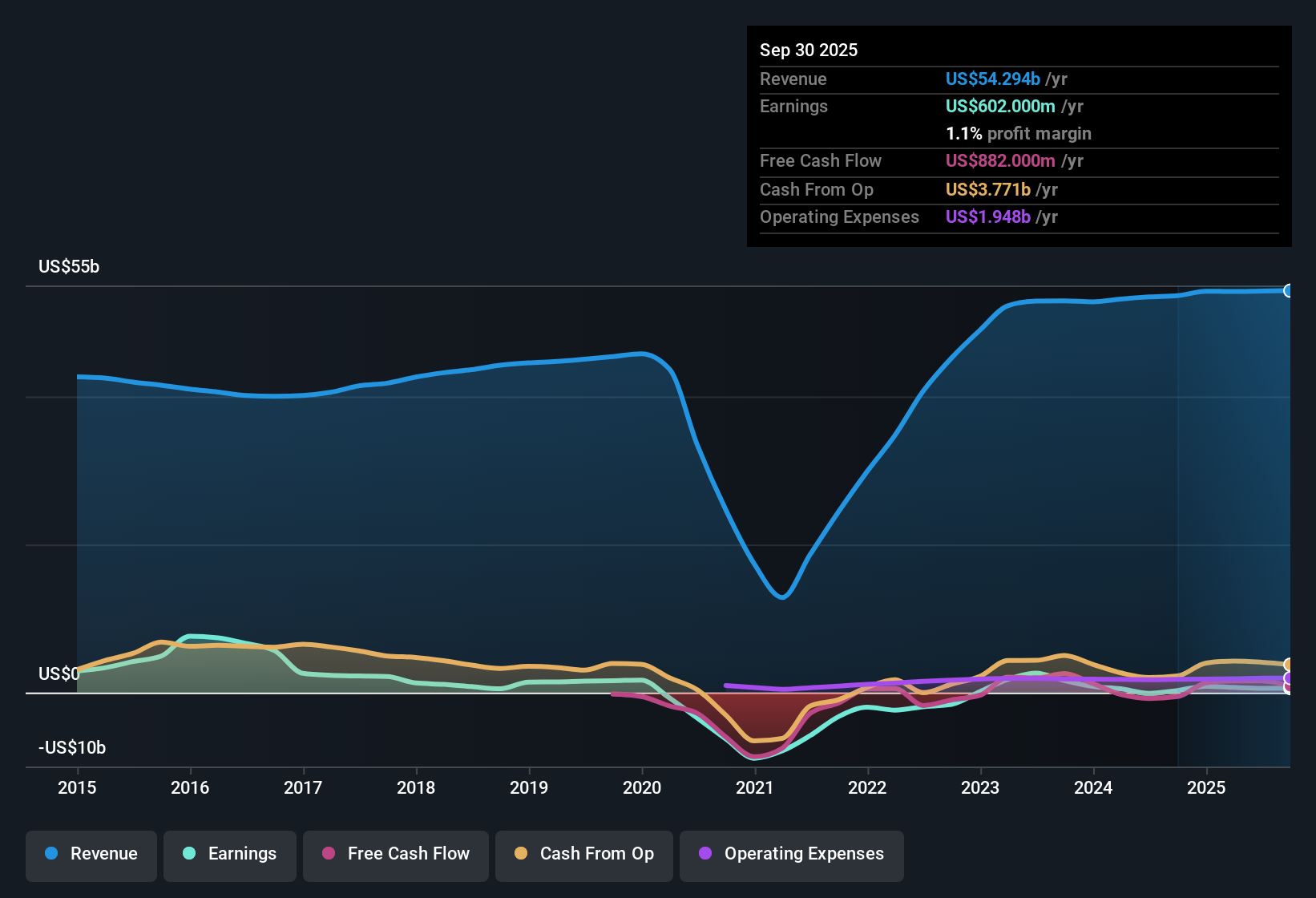

American Airlines Group (AAL) has returned to profitability, growing earnings at an impressive 73.9% annual rate over the past five years. Looking ahead, analysts forecast earnings will continue to surge at about 40.7% per year, well ahead of the broader US market's growth rate. Revenue, however, is expected to rise by a more modest 4.7% annually compared to the US market's 10%. The latest twelve-month results include a significant one-off loss of $689 million. This makes the path to sustainable profit growth a key consideration for investors as they weigh the company’s improving outlook against risks tied to earnings quality.

See our full analysis for American Airlines Group.Next, we'll break down how the latest numbers compare to the key narratives shaping market sentiment and community views on American Airlines.

See what the community is saying about American Airlines Group

Margins Ride Loyalty and Efficiency Boosts

- Profit margins are expected to nearly triple from 1.0% today to 2.9% in three years. This improvement is anchored in loyalty program expansion and earlier-than-planned delivery of more fuel-efficient aircraft.

- Analysts' consensus view notes that these margin gains are heavily supported by two structural shifts:

- The new 10-year Citi card partnership, launching in 2026, is projected to significantly lift high-margin partnership revenues and provide steadier cash flow.

- Unit costs are set to fall through modernized fleets, helping offset higher labor expenses and supporting better net margins, even as some cost headwinds persist.

- Consensus narrative underscores that stepwise profit margin gains are central to long-term earnings stability and, if realized, will provide American a buffer against volatile demand cycles.

📊 Read the full American Airlines Group Consensus Narrative.

Debt and Heavy CapEx Weigh on Flexibility

- American’s hefty $29 billion net debt and expected annual capital expenditures of $3.5 billion through decade-end are notable constraints. These may limit its agility in challenging industry conditions.

- Analysts' consensus view highlights several tensions:

- Critics point out that ongoing high CapEx and significant leverage could pressure free cash flow and net income, especially if industry growth or profitability targets are not met.

- Elevated debt burdens also increase sensitivity to downturns, as well as to shocks like rising interest rates or operational disruptions.

Valuation Discount Versus Peers, Premium to Industry

- At a current share price of $12.77, American trades below its own estimated fair value of $46.40 (DCF fair value) and at a lower price-to-earnings ratio than direct peers. However, it still appears expensive compared to global airline industry averages.

- According to the consensus narrative, this valuation gap reflects a market caught between optimism for improving profit momentum and caution about American’s established risks:

- Bulls view the discount to fair value and peer group PE ratios as a signal of undervaluation if growth projections are met.

- Bears counter that sector-wide risks, plus specific balance sheet and cost overhangs, warrant the lower multiple relative to the global airline industry.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Airlines Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the numbers? Put your perspective to work and share your outlook in just a few minutes. Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite renewed profit momentum, American Airlines’ heavy debt load and aggressive capital spending could strain its flexibility and resilience if unforeseen challenges arise.

If you want to prioritize financial strength, use solid balance sheet and fundamentals stocks screener (1983 results) to identify companies built on steadier balance sheets and stronger liquidity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAL

American Airlines Group

Through its subsidiaries, operates as a network air carrier in the United States, Latin America, Atlantic, and Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives