Is Verizon a Missed Opportunity After Recent Network Investment Headlines?

Reviewed by Bailey Pemberton

- Wondering if Verizon Communications is a bargain right now? Let’s break down what’s behind the price to see if there’s an opportunity you might be missing.

- Verizon’s stock price has nudged up 4.5% over the last month but remains almost flat for the year, hinting at shifting sentiment among investors.

- Market watchers have their eye on Verizon after recent headlines spotlighted continued industry competition and network investment announcements. Both factors have fueled fresh debates about growth versus risk, as telecom stocks return to focus for their stability amid uncertain markets.

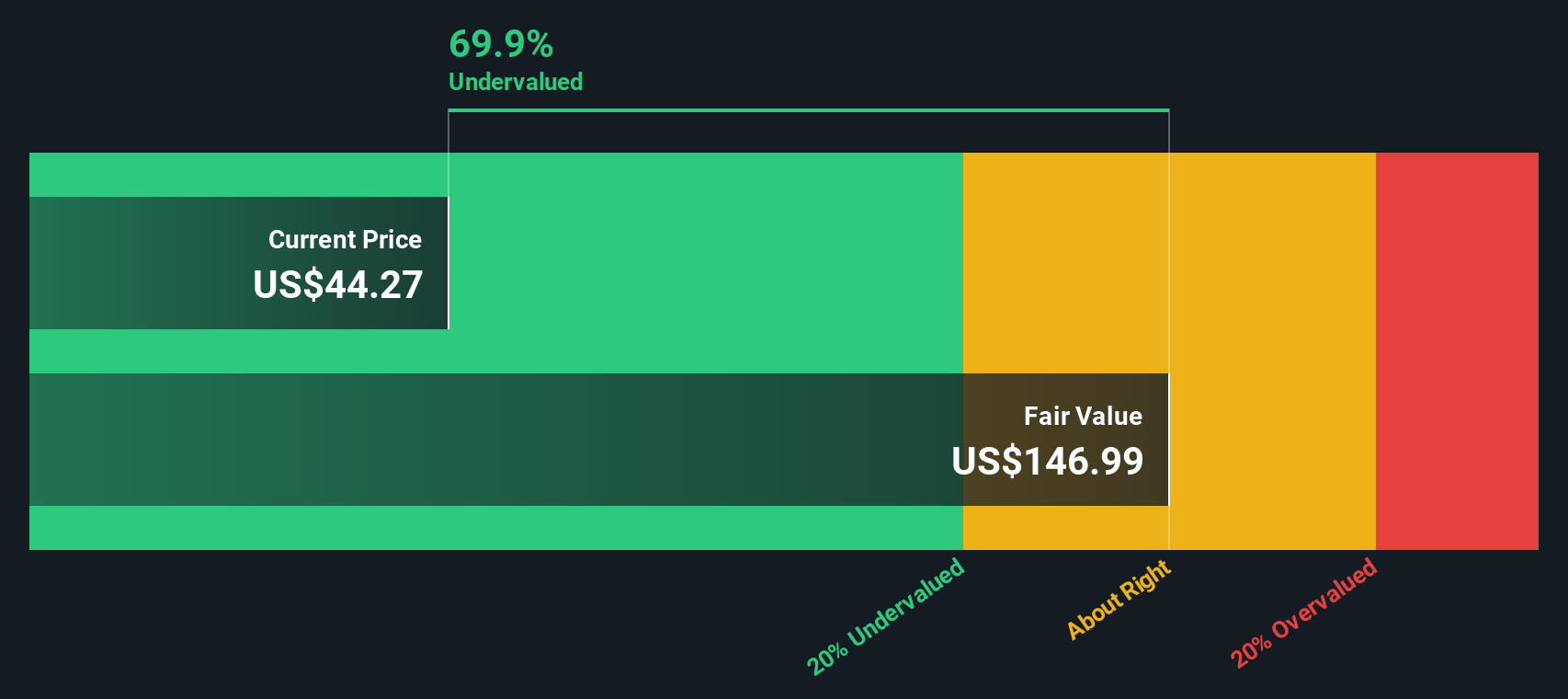

- On our valuation checks, Verizon scores a 4 out of 6 for being undervalued. This is solid, but not without room for improvement. Let’s dive into how different approaches value the company and stay tuned for a perspective on what really matters for long-term investors.

Find out why Verizon Communications's -2.3% return over the last year is lagging behind its peers.

Approach 1: Verizon Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today's value. This approach provides a current snapshot of what Verizon Communications may realistically be worth, based not just on past earnings but also on expectations for future cash generation.

Looking at the numbers, Verizon's latest reported Free Cash Flow is $17.0 billion. Analyst forecasts expect that figure to rise over time, with projections reaching $23.4 billion by 2029. Although analyst estimates go out five years, further projections are extrapolated by Simply Wall St to provide a reasonable long-term forecast using the Two-Stage Free Cash Flow to Equity method.

Bringing all these forecasts together, the DCF model values Verizon at $107.73 per share. When compared to its current trading price, this calculation implies the stock is trading at a significant 62.3% discount to its intrinsic value.

This sizable discount suggests Verizon could be an attractive opportunity for long-term investors who believe in the company's ability to sustain and grow its cash flow.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verizon Communications is undervalued by 62.3%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Verizon Communications Price vs Earnings (PE)

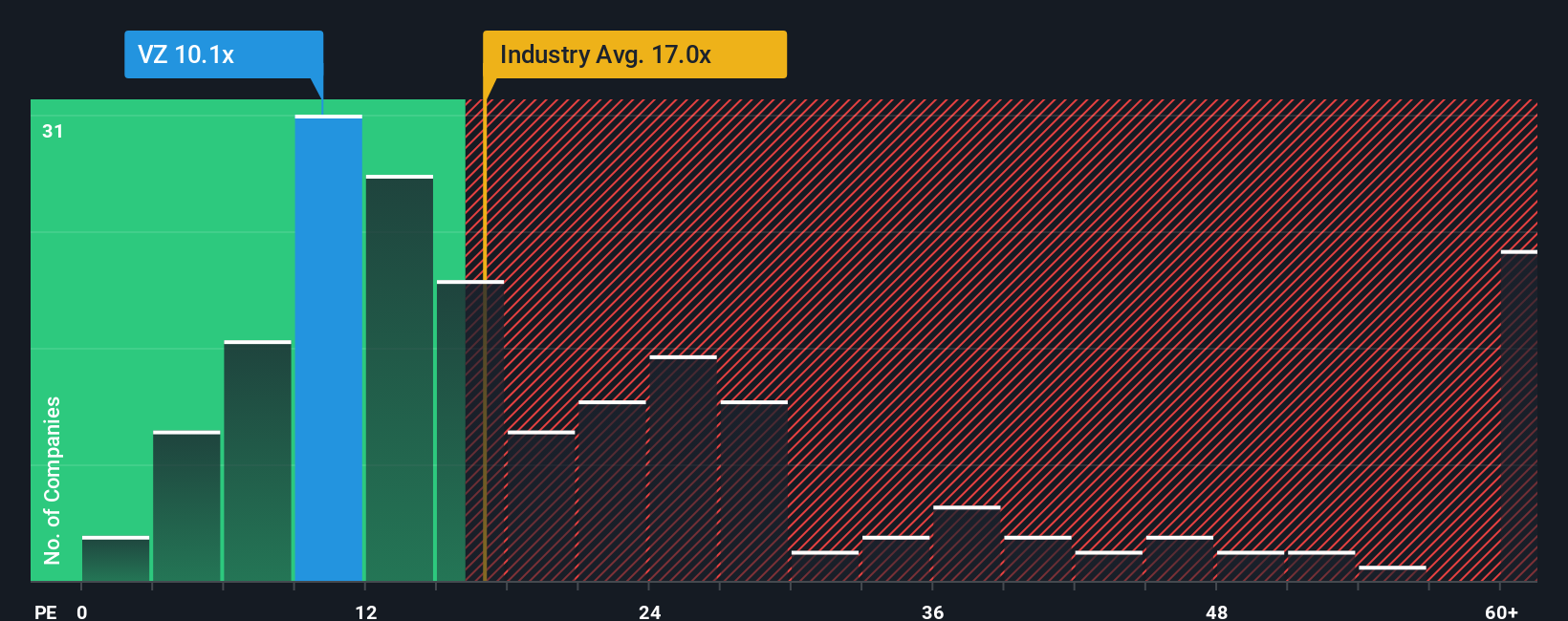

The Price-to-Earnings (PE) ratio is widely considered a reliable metric for valuing profitable companies like Verizon Communications. By comparing a company’s current share price to its earnings per share, the PE ratio helps investors gauge if a stock is relatively cheap or expensive versus its profits.

Growth expectations, profitability, and risk all influence what a "normal" or "fair" PE should look like. Higher growth and strong margins typically warrant a higher PE, while industries with more risk or less growth often see lower ratios. For Verizon, the current PE stands at 8.6x, which is right around the peer average of 8.4x and well below the telecom industry average of 16.4x. At first glance, this could make Verizon look undervalued against industry benchmarks.

However, it is important to take a step further and consider Simply Wall St's Fair Ratio. Unlike basic comparisons to industry or peers, the Fair Ratio incorporates essential factors such as Verizon's profit margins, earnings growth, risk profile, business size, and its position within the broader telecom sector. For Verizon, the Fair Ratio is calculated at 13.6x. Comparing this fair value to the company’s actual PE of 8.6x shows that the stock is trading at a meaningful discount to its anticipated fair multiple. This suggests undervaluation that stands out even after accounting for all the critical business factors that matter to long-term investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verizon Communications Narrative

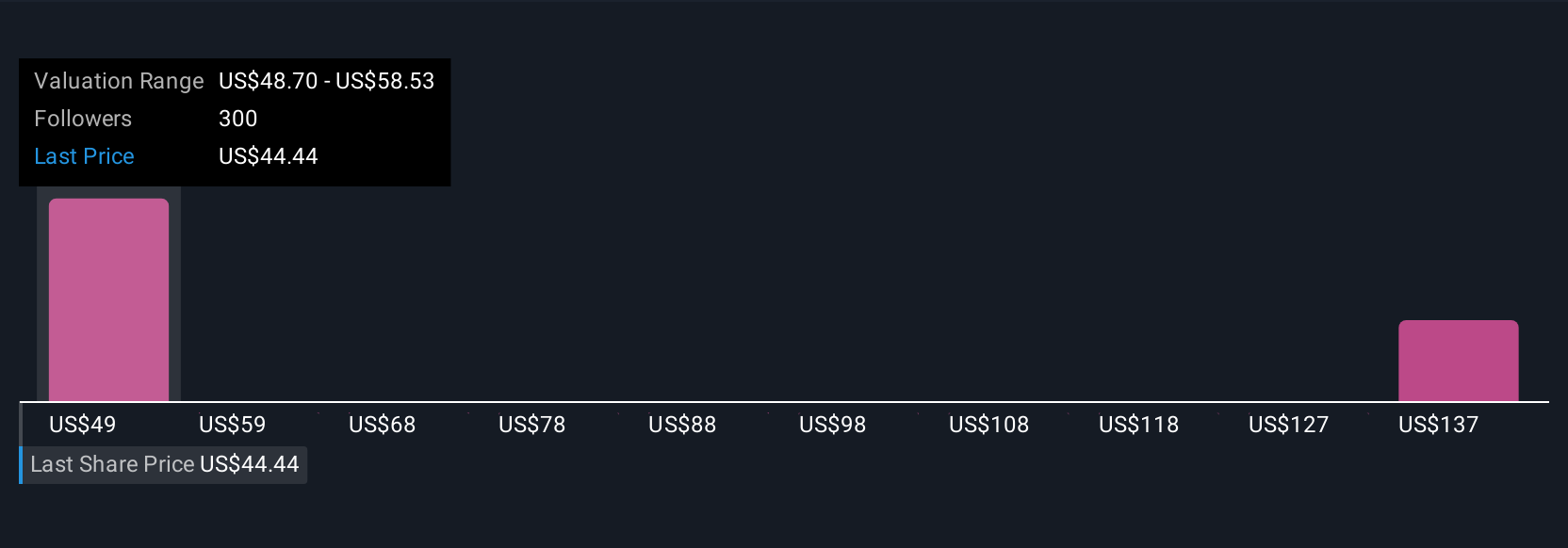

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment story; it is how you bring together your assumptions about Verizon Communications’s future (like revenue growth, earnings, or margins) with your own perspective, expressing why you think the company deserves a particular fair value.

Narratives make investing more approachable by connecting a company's real-world story and potential with financial forecasts and fair value estimates, allowing you to explore not just what the numbers say, but why they matter. With Simply Wall St’s easy-to-use Community Narratives tool (used by millions of investors), you can view, create, or adjust Narratives for Verizon on the Community page, directly seeing how each viewpoint plays out in the numbers.

This means you can see at a glance how different stories lead to different Fair Values, and quickly compare your view to the current price to spot opportunities for buying or selling. Importantly, Narratives are updated in real time when news, earnings, or forecasts change, so your story and valuation always reflect the latest information.

For example, some investors are bullish and peg Verizon’s fair value at $58 per share, citing transformation and new growth initiatives, while others see more risk and a fair value closer to $42, showcasing how Narratives help you find and act on the story that fits your outlook.

Do you think there's more to the story for Verizon Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VZ

Verizon Communications

Through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success