If You Like EPS Growth Then Check Out Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia (NYSE:TLK) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia (NYSE:TLK). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia

How Quickly Is Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Over the last three years, Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia has grown EPS by 10% per year. That growth rate is fairly good, assuming the company can keep it up.

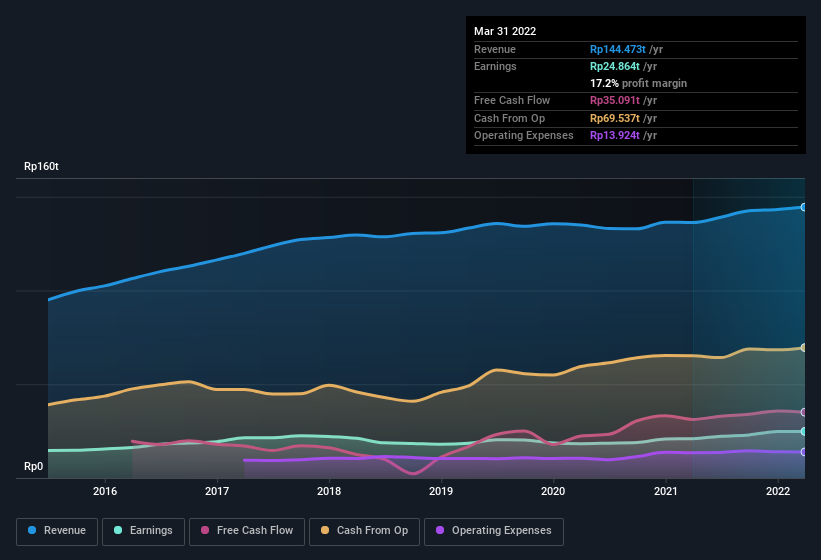

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia maintained stable EBIT margins over the last year, all while growing revenue 6.1% to Rp144t. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Insiders Aligned With All Shareholders?

Since Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia has a market capitalization of US$416t, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. As a group insiders own shares currently valued at Rp6.7b, which amounts to 0.002% of the business. That is a valuable holding, but it's worth noting the CEO has a took home a Rp5.4b salary in the year to .

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations over Rp117t, like Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia, the median CEO pay is around Rp193b.

The CEO of Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia only received Rp37b in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Deserve A Spot On Your Watchlist?

As I already mentioned, Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia is a growing business, which is what I like to see. Earnings growth might be the main game for Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TLK

Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia

Provides information and communications technology, and telecommunications network services worldwide.

Undervalued established dividend payer.