- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

Telephone and Data Systems, Inc. (NYSE:TDS) Stock Rockets 34% As Investors Are Less Pessimistic Than Expected

Telephone and Data Systems, Inc. (NYSE:TDS) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The annual gain comes to 188% following the latest surge, making investors sit up and take notice.

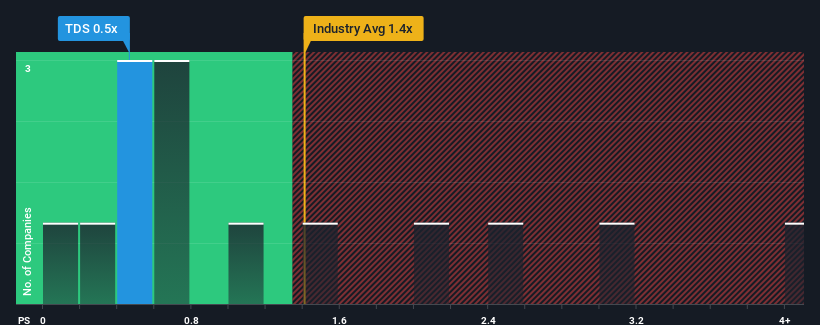

Although its price has surged higher, you could still be forgiven for feeling indifferent about Telephone and Data Systems' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Wireless Telecom industry in the United States is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Telephone and Data Systems

How Telephone and Data Systems Has Been Performing

Recent times haven't been great for Telephone and Data Systems as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Telephone and Data Systems' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Telephone and Data Systems?

Telephone and Data Systems' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 5.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 3.1% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.2% as estimated by the four analysts watching the company. That's not great when the rest of the industry is expected to grow by 2.9%.

With this in consideration, we think it doesn't make sense that Telephone and Data Systems' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Telephone and Data Systems' P/S?

Its shares have lifted substantially and now Telephone and Data Systems' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Telephone and Data Systems' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about these 3 warning signs we've spotted with Telephone and Data Systems (including 2 which are a bit unpleasant).

If you're unsure about the strength of Telephone and Data Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives