- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

Subdued Growth No Barrier To Telephone and Data Systems, Inc. (NYSE:TDS) With Shares Advancing 25%

Despite an already strong run, Telephone and Data Systems, Inc. (NYSE:TDS) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 80%.

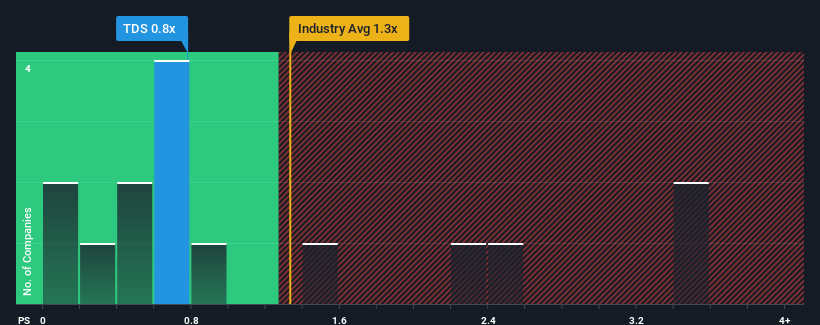

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Telephone and Data Systems' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Wireless Telecom industry in the United States is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Telephone and Data Systems

What Does Telephone and Data Systems' Recent Performance Look Like?

Telephone and Data Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Telephone and Data Systems.Is There Some Revenue Growth Forecasted For Telephone and Data Systems?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Telephone and Data Systems' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.2%. The last three years don't look nice either as the company has shrunk revenue by 5.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 4.0% over the next year. That's not great when the rest of the industry is expected to grow by 4.6%.

In light of this, it's somewhat alarming that Telephone and Data Systems' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Telephone and Data Systems' P/S?

Its shares have lifted substantially and now Telephone and Data Systems' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that Telephone and Data Systems currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Telephone and Data Systems you should know about.

If these risks are making you reconsider your opinion on Telephone and Data Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives