- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

How Investors May Respond To TDS (TDS) Expanding Share Buyback After Oaktree Stake and Wireless Divestiture

Reviewed by Sasha Jovanovic

- Earlier this month, Telephone and Data Systems announced third quarter results, an expanded US$500 million share buyback program, and that Oaktree Capital Management acquired nearly 3.7 million shares for US$144.7 million.

- This renewed institutional interest follows the company’s restructuring and divestiture of its wireless business, with a sharper focus on fiber infrastructure and capital return initiatives.

- We’ll examine how the new share repurchase authorization may influence the company’s investment narrative and future direction.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Telephone and Data Systems Investment Narrative Recap

To be a shareholder in Telephone and Data Systems, one needs conviction that its exit from wireless, focus on fiber, and capital return programs will drive sustainable long-term value, despite near-term operational challenges. The latest earnings and buyback news do not materially reduce the ongoing risk that copper and cable headwinds will offset fiber gains, making top-line recovery and margin improvement TDS's most important catalyst and risk in the short term. The expansion of the share repurchase plan by an additional US$500 million stands out as particularly relevant, as it could offer support to the stock while TDS executes its operational transition and works to accelerate fiber growth. With institutional interest rising and management prioritizing fiber and capital return, investors have cause to watch closely for...

Read the full narrative on Telephone and Data Systems (it's free!)

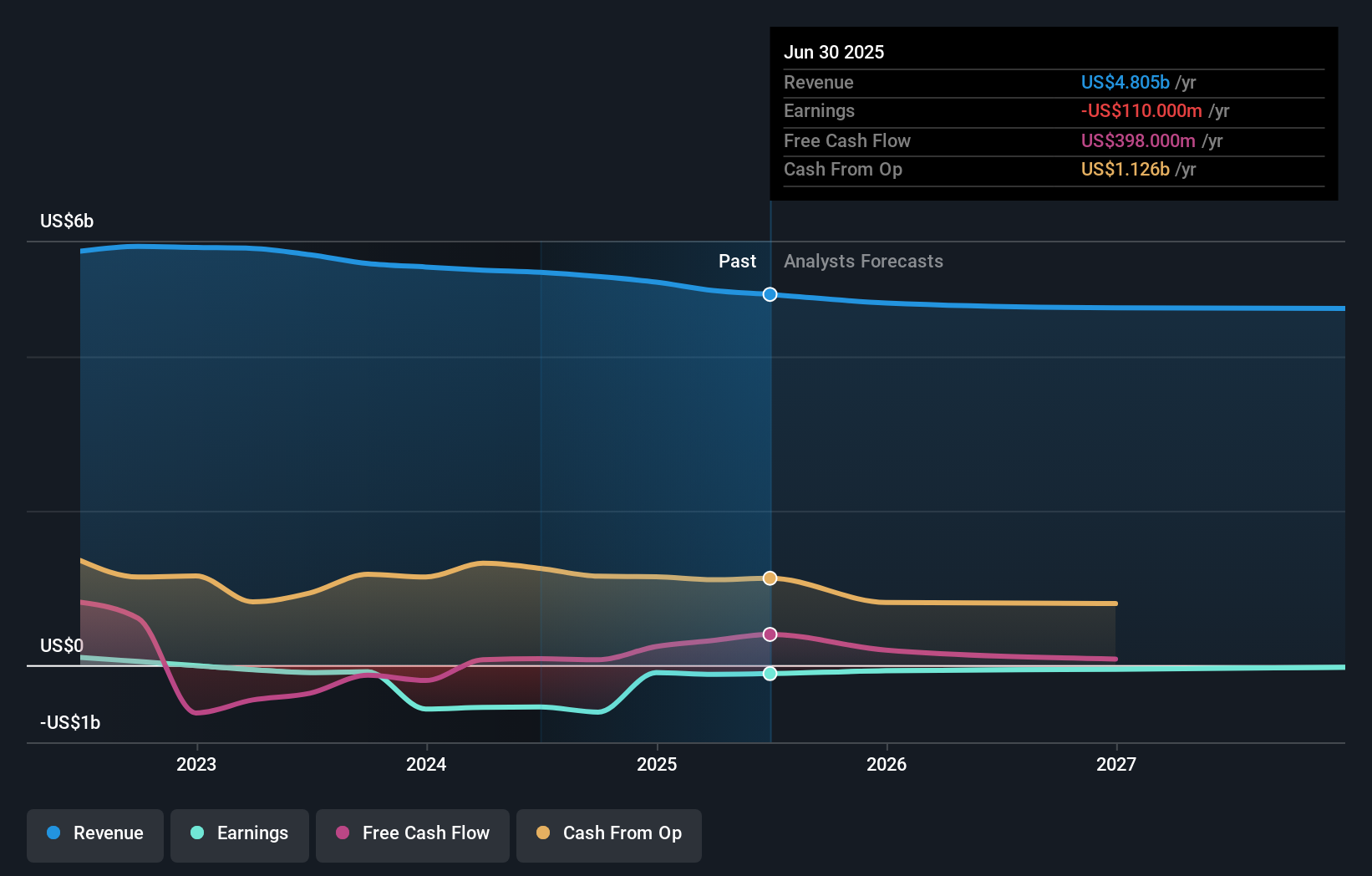

Telephone and Data Systems' narrative projects $4.6 billion revenue and $577.2 million earnings by 2028. This requires a 1.7% annual revenue decline and a $687 million earnings increase from current earnings of -$110.0 million.

Uncover how Telephone and Data Systems' forecasts yield a $52.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted 2 fair value estimates for TDS, ranging widely from just over US$1.93 to US$52. These varied perspectives reflect ongoing debate over whether fiber investments can outpace the decline in TDS's legacy copper and cable business, prompting you to weigh both optimism and skepticism as you explore alternative viewpoints.

Explore 2 other fair value estimates on Telephone and Data Systems - why the stock might be worth as much as 37% more than the current price!

Build Your Own Telephone and Data Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telephone and Data Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Telephone and Data Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telephone and Data Systems' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives