- United States

- /

- Wireless Telecom

- /

- NYSE:TDS

A Fresh Look at Telephone and Data Systems (TDS) Valuation Following Earnings and Share Buyback Update

Reviewed by Simply Wall St

Telephone and Data Systems (TDS) just posted its latest quarterly results, reporting a narrower net loss for the third quarter. However, the company also experienced a decline in revenue. In addition, TDS completed another tranche of its ongoing share buyback program.

See our latest analysis for Telephone and Data Systems.

Even with TDS trimming its quarterly net loss and progressing on share buybacks, recent trading momentum has cooled. After a rally earlier this year, the 2025 year-to-date share price return stands at 9.2%, while the 1-year total shareholder return jumps to 14.6%. The impressive three-year total shareholder return exceeds 300%. Long-term momentum is clearly strong, even if near-term price action suggests some caution is setting in.

If you’re watching these big swings and want to uncover more opportunities, now’s a perfect time to explore fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets, the question for investors is whether TDS is currently undervalued or if the market has already factored in its prospects for future growth.

Most Popular Narrative: 27.6% Undervalued

With the most widely followed narrative pointing to a fair value of $52 compared to the last close at $37.65, there is a striking gap between current trading levels and what the consensus expects. This sets the stage for a bold set of assumptions shaping the price outlook ahead.

The divestiture of UScellular and major spectrum assets has substantially deleveraged TDS's balance sheet, freeing up capital for aggressive expansion in fiber infrastructure and providing flexibility for opportunistic M&A. Both of these moves are positioned to drive long-term revenue and earnings growth as broadband demand intensifies.

Want to see what is fueling this bullish stance? The main factor is a daring forecast for margins, future profits, and a shift that reimagines how TDS earns its money. Curious how bold analyst projections unlock that higher price tag? Dive deeper to get the quantitative details that drive this fair value.

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in legacy business and intensifying competition in broadband could challenge TDS’s growth story and future margin expansion.

Find out about the key risks to this Telephone and Data Systems narrative.

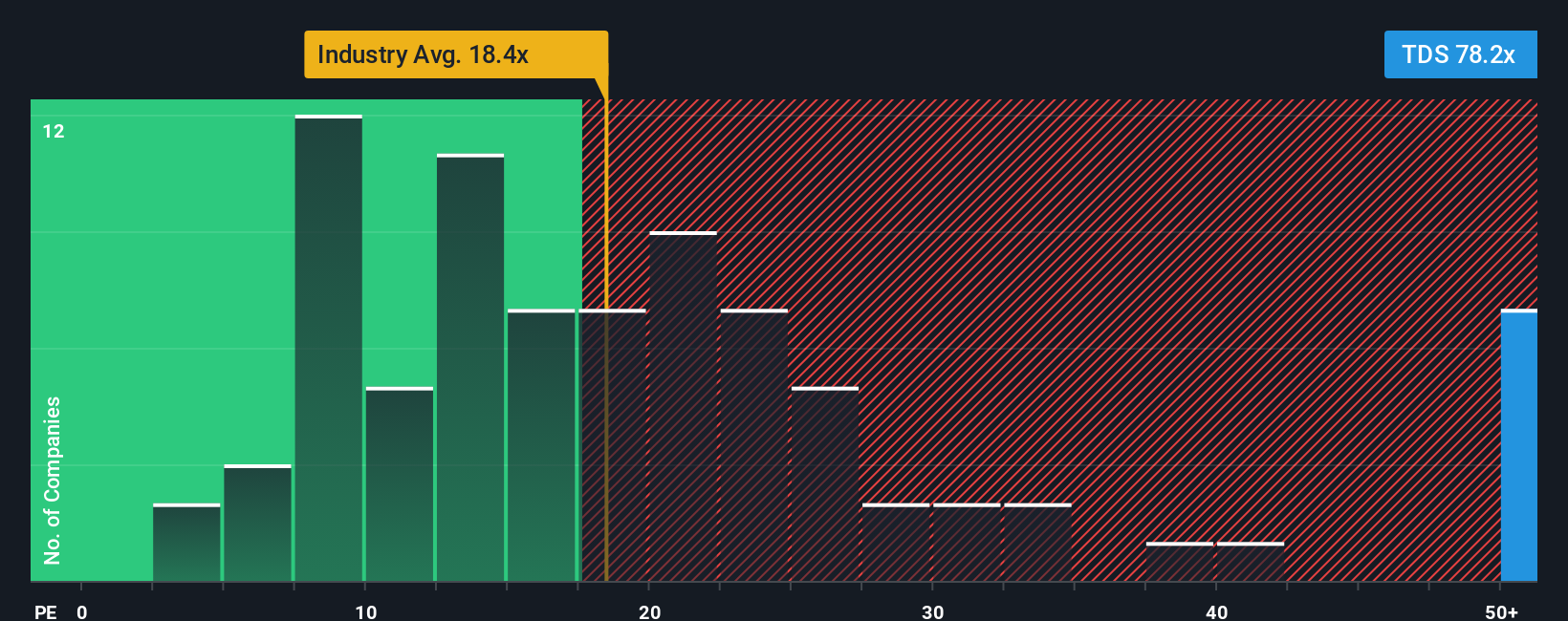

Another View: Market Ratios Tell a Different Story

Looking at price-to-earnings ratios, TDS appears expensive, trading far above both its industry peers and even the fair ratio our research suggests the market could move toward. This wide gap means investors face more valuation risk than opportunity if current expectations change. Could the market be overestimating TDS's growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telephone and Data Systems Narrative

If this perspective doesn't quite fit your view or you'd rather dig into the numbers yourself, you can easily build your own version of the TDS story in just a few minutes. Do it your way.

A great starting point for your Telephone and Data Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your search for potential winners stop here. With the right strategy, you can get ahead of the market and spot tomorrow’s opportunities before others catch on.

- Spot rising stars in the tech sector and access next-generation opportunities with these 26 AI penny stocks, which are primed for rapid growth and innovation.

- Tap into the growing demand for strong, consistent income by reviewing these 16 dividend stocks with yields > 3%, which are yielding over 3% and are suitable for building reliable cash flow.

- Gain a competitive edge by scanning these 81 cryptocurrency and blockchain stocks, positioned at the forefront of blockchain and digital currency evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telephone and Data Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDS

Telephone and Data Systems

A telecommunications company, provides communications services to consumer, business, and government in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives