AT&T (NYSE:T) Partners With Toyota Connected To Enhance Emergency Response Using AACN Data

Reviewed by Simply Wall St

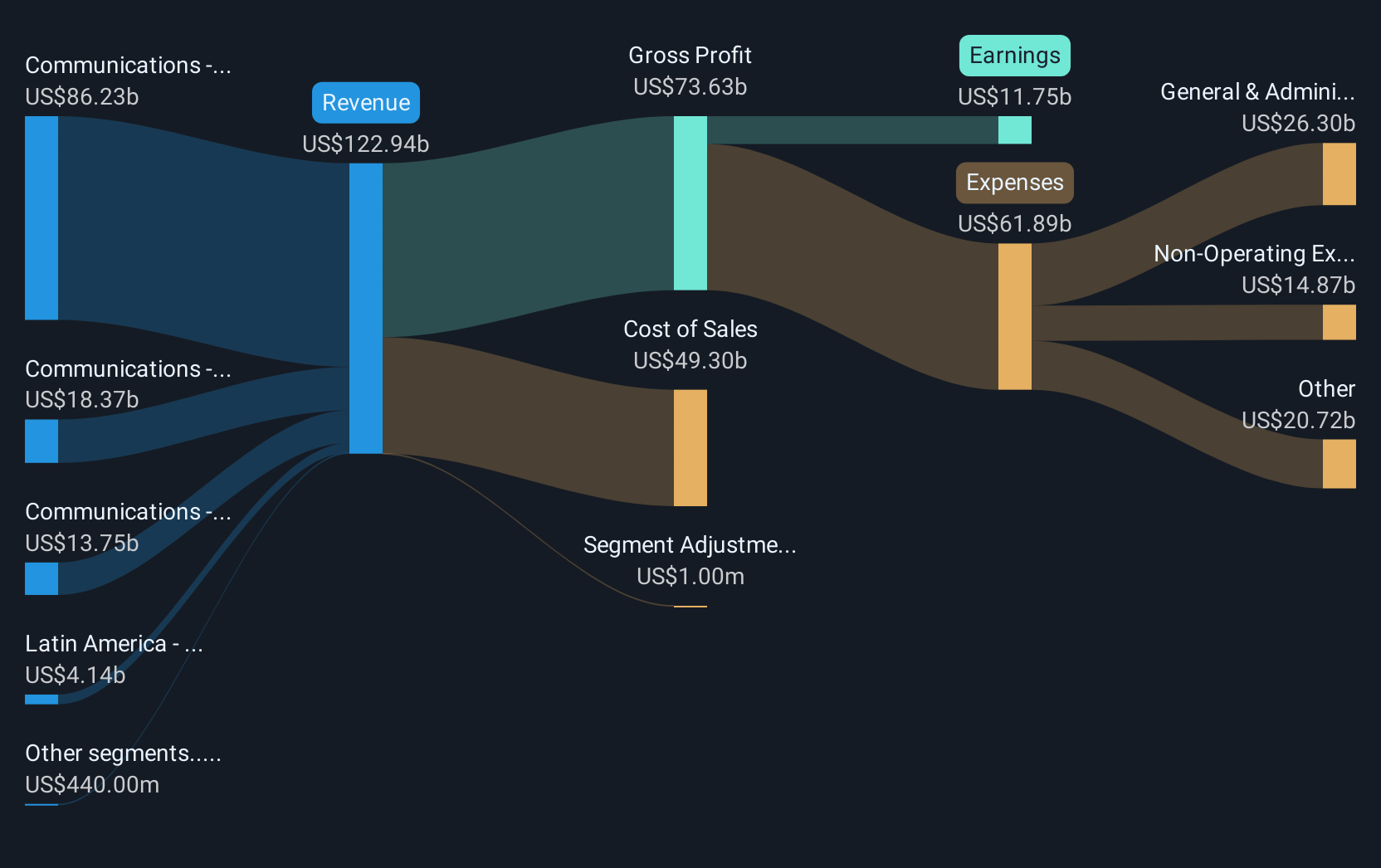

AT&T (NYSE:T) recently announced a collaboration with Intrado Life & Safety, Inc. and Toyota Connected North America to enhance emergency response systems through advanced telematics technology, utilizing AT&T's ESInet solution. This comes amidst several developments over the last quarter, including an earnings report showing increased revenue and net income, a decisive move in acquiring Lumen's fiber business, and ongoing legal challenges. Despite these company-specific activities, AT&T's 10.5% price rise aligns with broader market trends, which have seen modest growth amid easing global trade tensions and stable economic indicators.

We've spotted 3 warning signs for AT&T you should be aware of.

With AT&T's recent collaboration with Intrado Life & Safety and Toyota Connected North America utilizing ESInet, the company's ambition to integrate advanced telematics technology could enhance their telecommunication offerings, potentially boosting both revenue and earnings projections. This strategic move aligns with the ongoing 5G and fiber investments which are aimed at increasing market share and improving margins by enhancing network capabilities. Such advancements may solidify AT&T's competitive positioning in an evolving telecom landscape.

Over the past three years, AT&T has achieved a total shareholder return of 74.72%, signaling robust performance relative to its historic stock price and dividends. Within the last year, AT&T outperformed the US Market, which had a 12.8% return, while the US Telecom industry posted a 30.8% return. These figures underscore AT&T's resilience amidst industry and market challenges.

The recent developments concerning partnerships and technological enhancements have the potential to positively influence AT&T's revenue and earnings forecasts. The projection of revenue growth, albeit modest at 1.8% annually, and earnings growth anticipated at 8.4% per year, reflect a cautious optimism grounded in strategic investments. Compared to the most bullish estimates, AT&T's current share price of US$27.5 remains slightly below the price target of US$29.26. This gap indicates potential for appreciation if the forecasted improvements in revenue and net margins materialize.

Review our historical performance report to gain insights into AT&T's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:T

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives