What IHS Holding (IHS)'s Major Brazil Infrastructure Pact With TIM Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, IHS Brazil announced it has signed a new site agreement with TIM S.A. to build up to 3,000 communications infrastructure sites, with a minimum initial rollout of 500 sites across Brazil.

- This expansion underscores IHS Brazil's deepening role in advancing mobile connectivity in Brazil's diverse regions through continued collaboration with a major telecom operator.

- We'll explore how the new large-scale buildout agreement with TIM S.A. could influence IHS's long-term growth expectations and risk profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

IHS Holding Investment Narrative Recap

As a shareholder in IHS Holding, you need to believe in the ongoing growth of mobile connectivity demand across emerging markets, with Brazil offering strong long-term potential. The new TIM S.A. agreement signals further expansion but does not materially shift the biggest near-term catalyst, organic growth from rising mobile data usage, or the persistent risk of customer concentration, as major telecom partners still account for much of IHS’s revenue.

Among recent announcements, the renewal of the MTN Nigeria Master Lease Agreement stands out. This multi-year extension stabilizes a crucial revenue stream in another core market, directly supporting the narrative that secure, long-term operating partnerships underlie IHS's growth catalysts, especially as it moves forward with new projects like the TIM S.A. agreement.

In contrast, investors should also remain alert to how concentrated customer exposure could..

Read the full narrative on IHS Holding (it's free!)

IHS Holding's narrative projects $2.0 billion in revenue and $268.3 million in earnings by 2028. This requires 4.1% yearly revenue growth and a $157.4 million increase in earnings from the current $110.9 million.

Uncover how IHS Holding's forecasts yield a $9.66 fair value, a 45% upside to its current price.

Exploring Other Perspectives

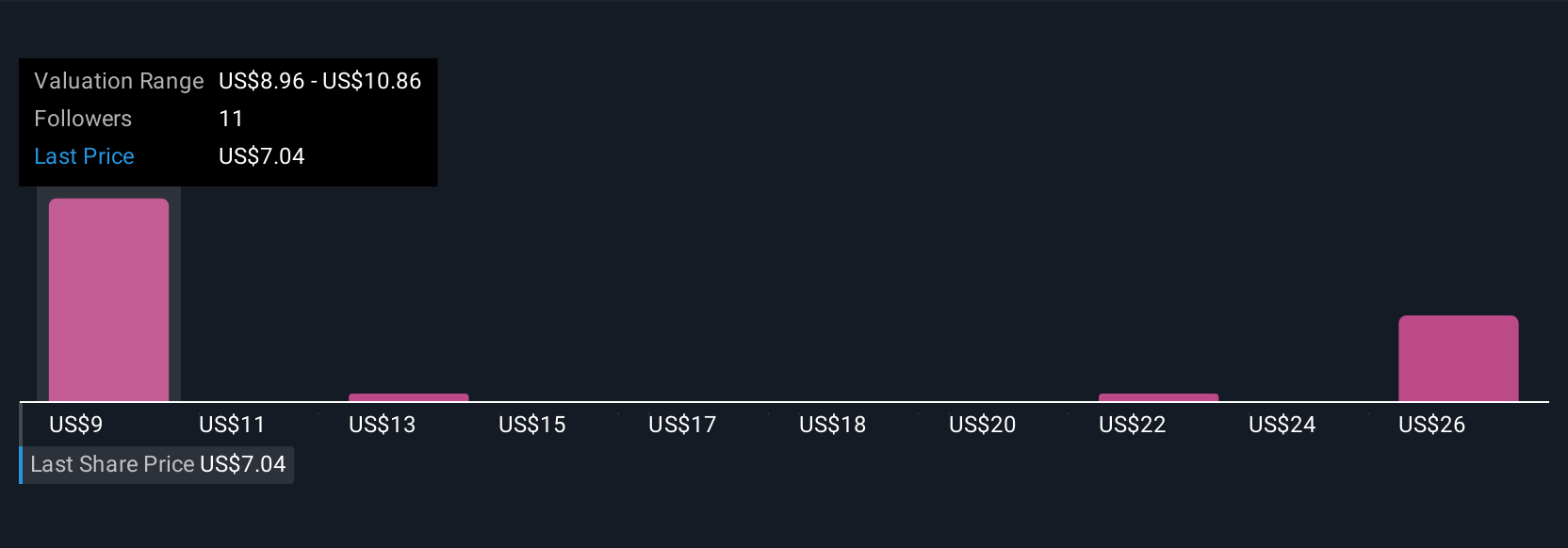

Six members of the Simply Wall St Community provided fair value estimates for IHS ranging from US$9.66 to US$24.08 per share. While these views vary significantly, the continued reliance on a few major telecom clients shapes ongoing debate about the company’s growth stability, compare perspectives to see if your outlook aligns.

Explore 6 other fair value estimates on IHS Holding - why the stock might be worth over 3x more than the current price!

Build Your Own IHS Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IHS Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free IHS Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IHS Holding's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives