A Fresh Look at IDT (IDT) Valuation Following Strong NRS Retail Sales Growth

Reviewed by Simply Wall St

See our latest analysis for IDT.

IDT’s latest NRS update fits into a year that has seen plenty of action for shareholders. While the stock delivered a solid 1-year total shareholder return of 0.8%, what really stands out is its impressive 97% total return over three years and more than 430% for those who held on over five. After a strong run earlier in the fall, momentum has leveled out somewhat as the market weighs both the fundamental gains and periods of short-term volatility. Still, recent operational results hint at ongoing growth potential, which could reignite interest if performance stays on track.

If you’re curious what other companies are generating real momentum, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock pulling back from its highs despite robust long-term gains and strong data from NRS, the key question becomes whether the market is underestimating IDT’s ongoing growth story or if future upside is already reflected in the current price.

Most Popular Narrative: 36.9% Undervalued

IDT’s widely followed narrative signals a valuation well above its last close, suggesting considerable upside compared to current levels. The contrast between analyst assumptions and recent market hesitation makes for a compelling valuation story.

IDT's NRS segment is launching new features and functionalities, which are expected to deepen market penetration and drive revenue growth in the independent retailer market. This is anticipated to bolster recurring revenue and adjusted EBITDA.

What is the secret behind this bullish fair value? The narrative leans on aggressive revenue and profit forecasts, plus a premium future earnings multiple that rivals some of the hottest stocks around. Ready to see the bold projections and hidden drivers that power this upside target?

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in federal policy or currency headwinds could quickly change the outlook and stall IDT’s projected margin improvement and earnings growth.

Find out about the key risks to this IDT narrative.

Another View: Looking at Valuation Ratios

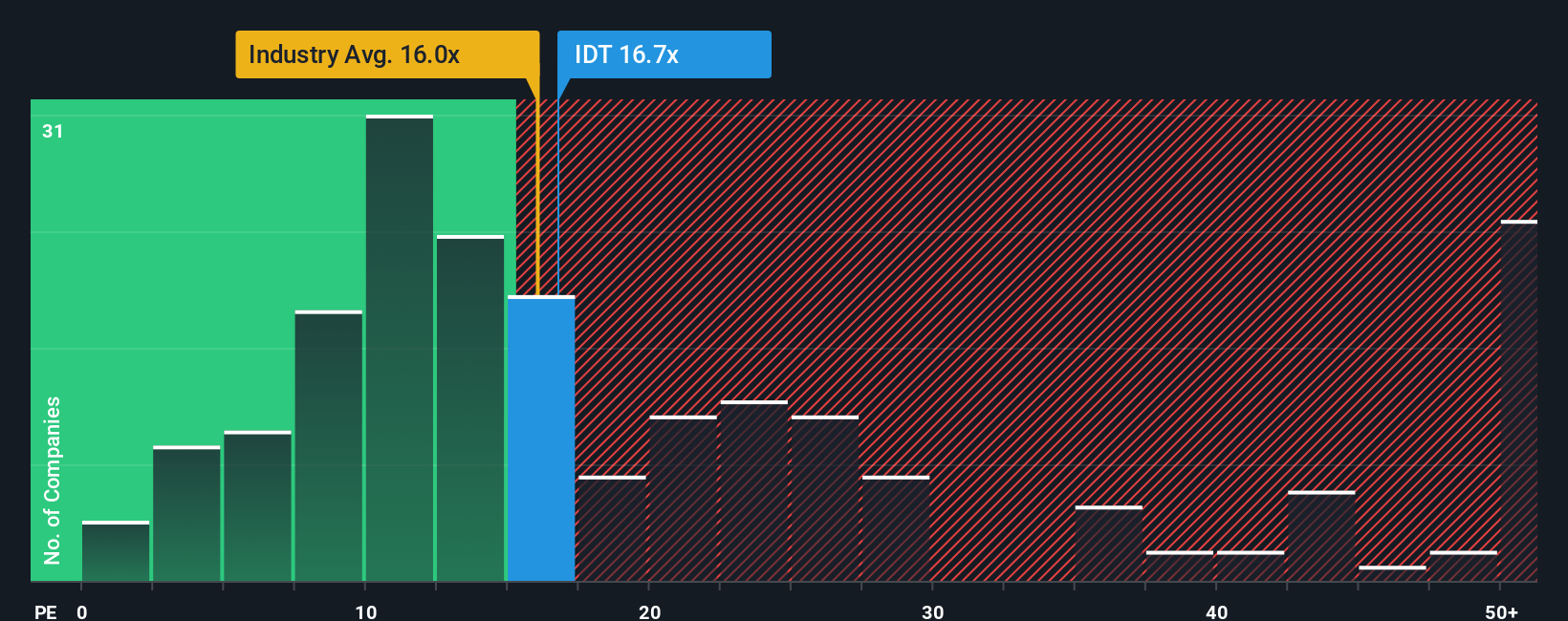

While analysts see upside using future earnings estimates, traditional valuation ratios tell a different story. Right now, IDT is trading at a price-to-earnings ratio of 16.7x, which is higher than its fair ratio of 13.6x and above the peer average of 11x. This suggests IDT could be more expensive than similar companies, adding some risk if growth does not accelerate. Does the market have this one right, or is there more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDT Narrative

If these viewpoints spark your curiosity or you’d rather dig into the numbers yourself, you can build your own research story in just minutes. Then make it your way with Do it your way.

A great starting point for your IDT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by tracking fresh opportunities beyond today’s headlines. Supercharge your research and spot tomorrow’s winners with these hand-picked stock ideas:

- Capture steady income streams by targeting companies with strong yields using these 16 dividend stocks with yields > 3%.

- Tap into the future of healthcare innovation and see which pioneers are leading breakthroughs in medical AI with these 32 healthcare AI stocks.

- Uncover market gems trading below their fair value, empowering your strategy with deep value opportunities. Start with these 870 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives