- United States

- /

- Wireless Telecom

- /

- NYSE:AD

How the New T-Mobile Partnership Impacts Array Digital Infrastructure’s 2025 Valuation Prospects

Reviewed by Bailey Pemberton

If you have been keeping an eye on Array Digital Infrastructure, you know this is a stock that rarely sits still. Investors weighing whether to buy, hold, or sell have plenty to consider as Array’s share price has bounced, sometimes sharply, over the past few years. In the past week, the stock has slipped by 0.9%, and over the past month, it has lost 3.3%. But zoom out, and the picture gets a lot more interesting: while Array is down 21.7% year-to-date, it is still showing an impressive 28.8% gain over the last year and a striking 170.6% return over three years. That long-term momentum set the stage for the run-up seen last year, as investors responded to industry-wide optimism about digital infrastructure growth and market shifts toward cloud and data solutions.

So what about today? Array’s valuation score, based on a simple check of six key factors, sits at 2. That means the company is undervalued in just two out of six categories, a mixed signal that might leave investors wanting more clarity. The numbers only tell part of the story, though, so let’s look at a few different ways analysts tend to value a company like Array. Also, after walking through those methods, there is an even more insightful way to size up where this stock might be headed.

Array Digital Infrastructure scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Array Digital Infrastructure Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model calculates a company’s intrinsic value by forecasting its future cash flows and then discounting those back to today's value. This approach helps investors estimate what a business is truly worth based on its ability to generate cash over time.

For Array Digital Infrastructure, the current Free Cash Flow (FCF) stands at $284.7 million. Over the next decade, analysts project that FCF will fluctuate but end around $168.5 million in 2035, according to Simply Wall St’s extrapolation methodology. While analysts typically only forecast five years ahead with confidence, the further projections help highlight longer-term trends in Array’s business.

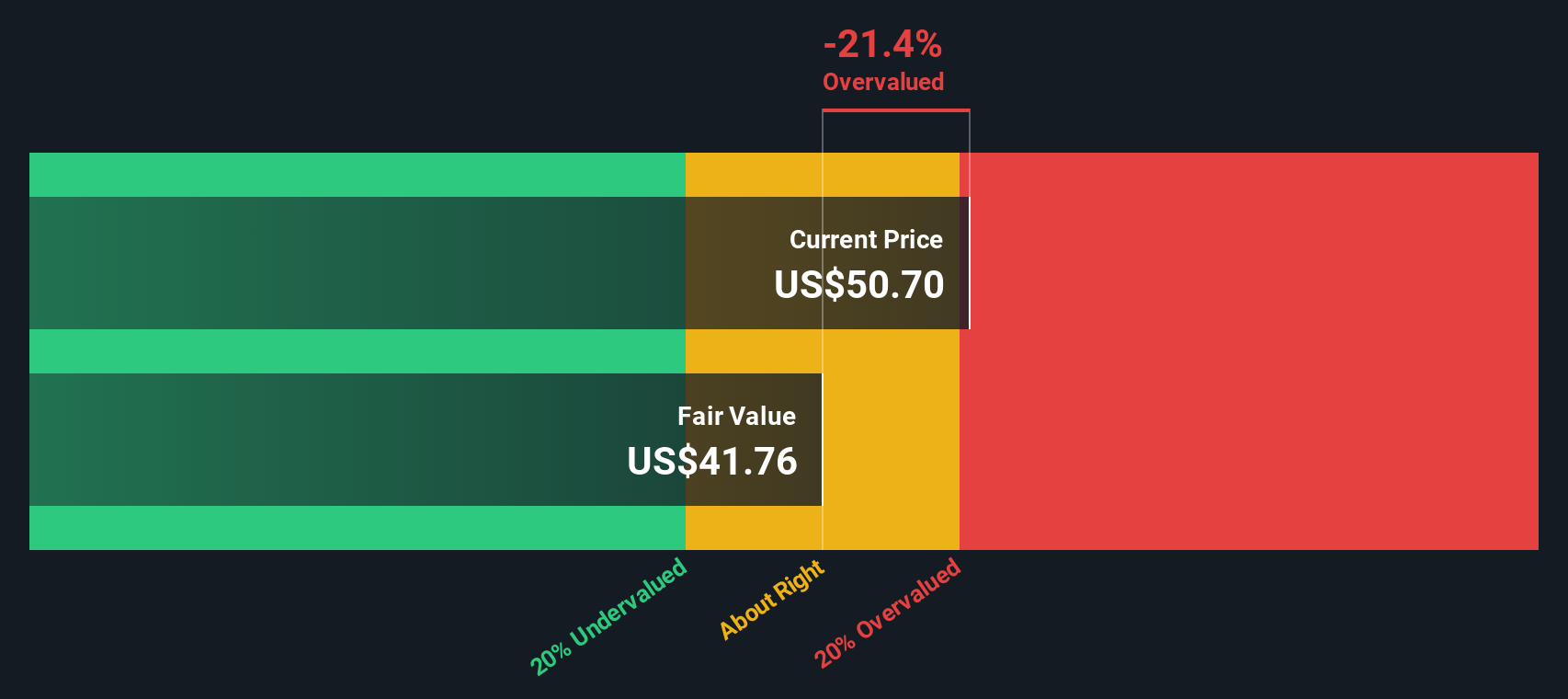

Using the 2 Stage Free Cash Flow to Equity DCF model, the estimated fair value per share comes to $41.62. Compared to the market price, this implies Array stock is currently about 19.2% overvalued based on this specific projection.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Array Digital Infrastructure may be overvalued by 19.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Array Digital Infrastructure Price vs Sales

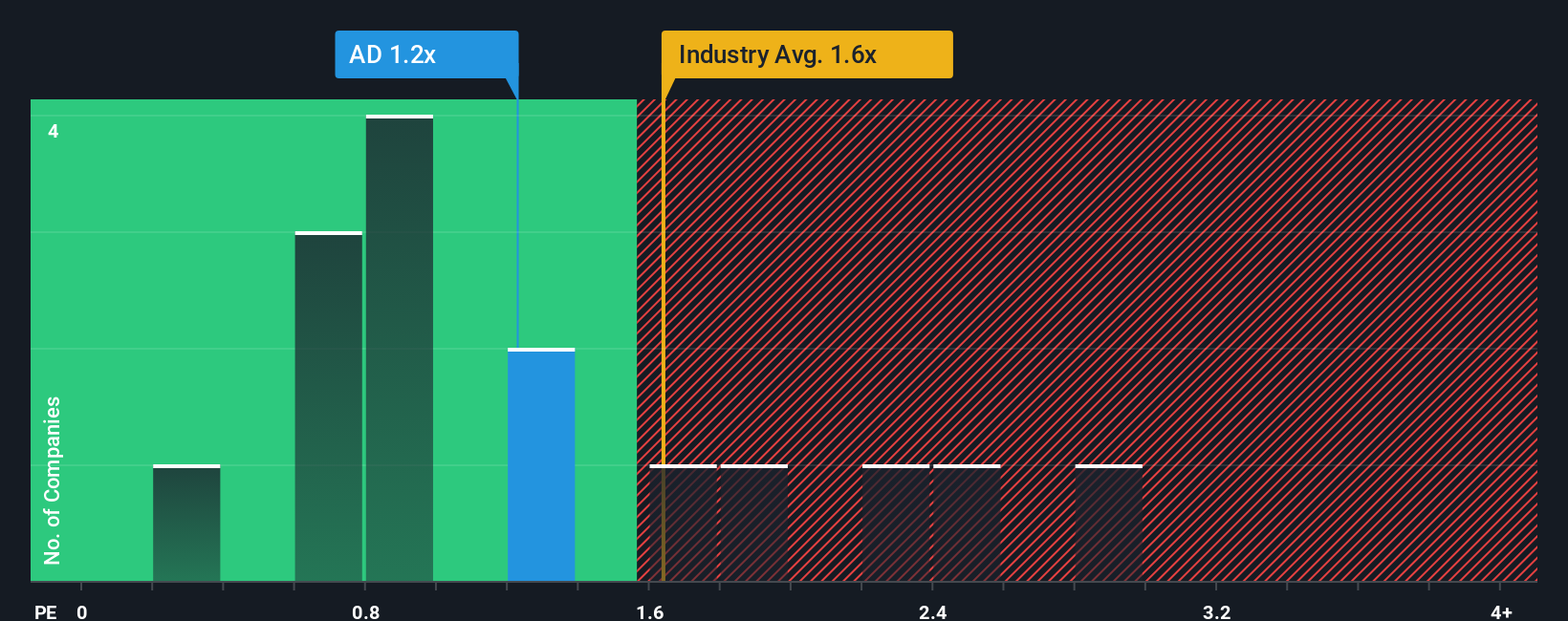

For many profitable companies, the Price-to-Sales (P/S) ratio can be an excellent tool for judging value, especially in sectors like wireless telecom where companies might not always show positive earnings but still generate substantial revenue. This metric tells investors how much they are paying for each dollar of Array's sales, helping to set expectations around growth prospects and the risks that come with them.

What is considered a "fair" P/S ratio often depends on a company's growth outlook and its perceived risk. Higher-growth or lower-risk businesses generally command higher multiples. Array Digital Infrastructure currently trades at a P/S ratio of 1.16x, which sits below the industry average of 1.54x and the peer group average of 1.46x. On the surface, this comparison suggests Array might be attractively valued versus its competitors.

However, Simply Wall St’s proprietary "Fair Ratio" digs deeper by considering not just industry numbers but also Array’s specific growth characteristics, risk profile, profit margins, and overall market capitalization. For Array, the calculated Fair Ratio is 0.24x, a level that suggests its stock should usually trade at a much lower multiple than both its current level and its industry peers. This more holistic approach offers a tailored sense-check instead of relying solely on broad benchmarks.

Comparing Array’s P/S of 1.16x with its Fair Ratio of 0.24x, the gap clearly signals that the stock is trading at a premium to its fundamentally derived fair value.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Array Digital Infrastructure Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful idea. It is your story about a company, supported by the numbers you believe in, such as your own estimates for future revenue, earnings, and margins, and the fair value these generate. Narratives link together a company’s real-world prospects, a personalized financial forecast, and a fair value in one place. On Simply Wall St’s Community page, millions of investors use Narratives to make sense of complex stocks by capturing the "why" behind an investment, then seeing how their story leads to a buy, hold, or sell call by comparing Fair Value to the current Price. As news, earnings, and big events happen, Narratives update in real time so your perspective always stays current. For example, some investors view Array Digital Infrastructure optimistically, believing the T-Mobile partnership and rising margins will justify a fair value around $85 per share. Others expect fierce industry competition to drag fair value closer to $72 per share. Narratives offer a quick, accessible way to anchor your investment decision to what matters most to you.

Do you think there's more to the story for Array Digital Infrastructure? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion