- United States

- /

- Wireless Telecom

- /

- NasdaqGM:UCL

Earnings Not Telling The Story For uCloudlink Group Inc. (NASDAQ:UCL) After Shares Rise 26%

Despite an already strong run, uCloudlink Group Inc. (NASDAQ:UCL) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 41%.

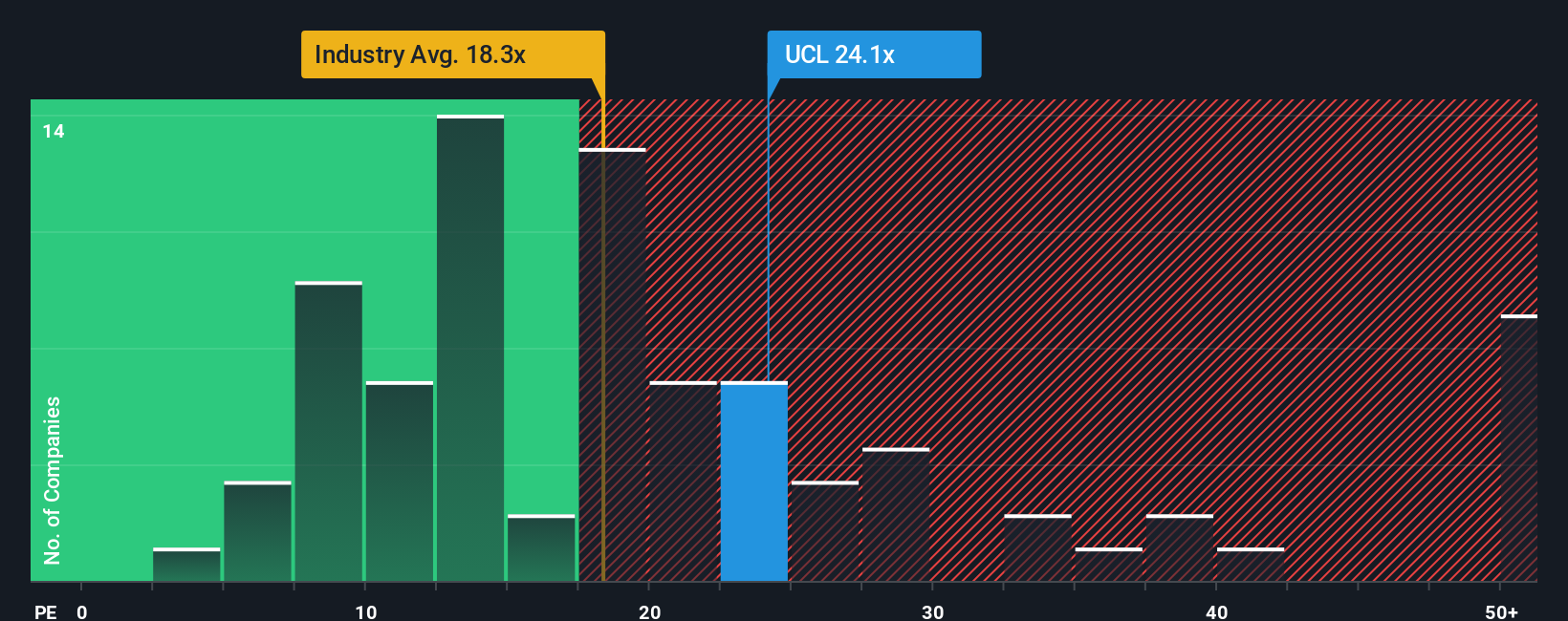

After such a large jump in price, uCloudlink Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.1x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for uCloudlink Group as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for uCloudlink Group

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like uCloudlink Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 198%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 100% as estimated by the only analyst watching the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

With this information, we find it concerning that uCloudlink Group is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

The large bounce in uCloudlink Group's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that uCloudlink Group currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with uCloudlink Group, and understanding them should be part of your investment process.

If you're unsure about the strength of uCloudlink Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if uCloudlink Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:UCL

uCloudlink Group

Operates as a mobile data traffic sharing marketplace in the telecommunications industry.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives