- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:TSAT

Telesat (TSAT) Losses Accelerate 54% Annually, Challenging Bullish Revenue Growth Narrative

Reviewed by Simply Wall St

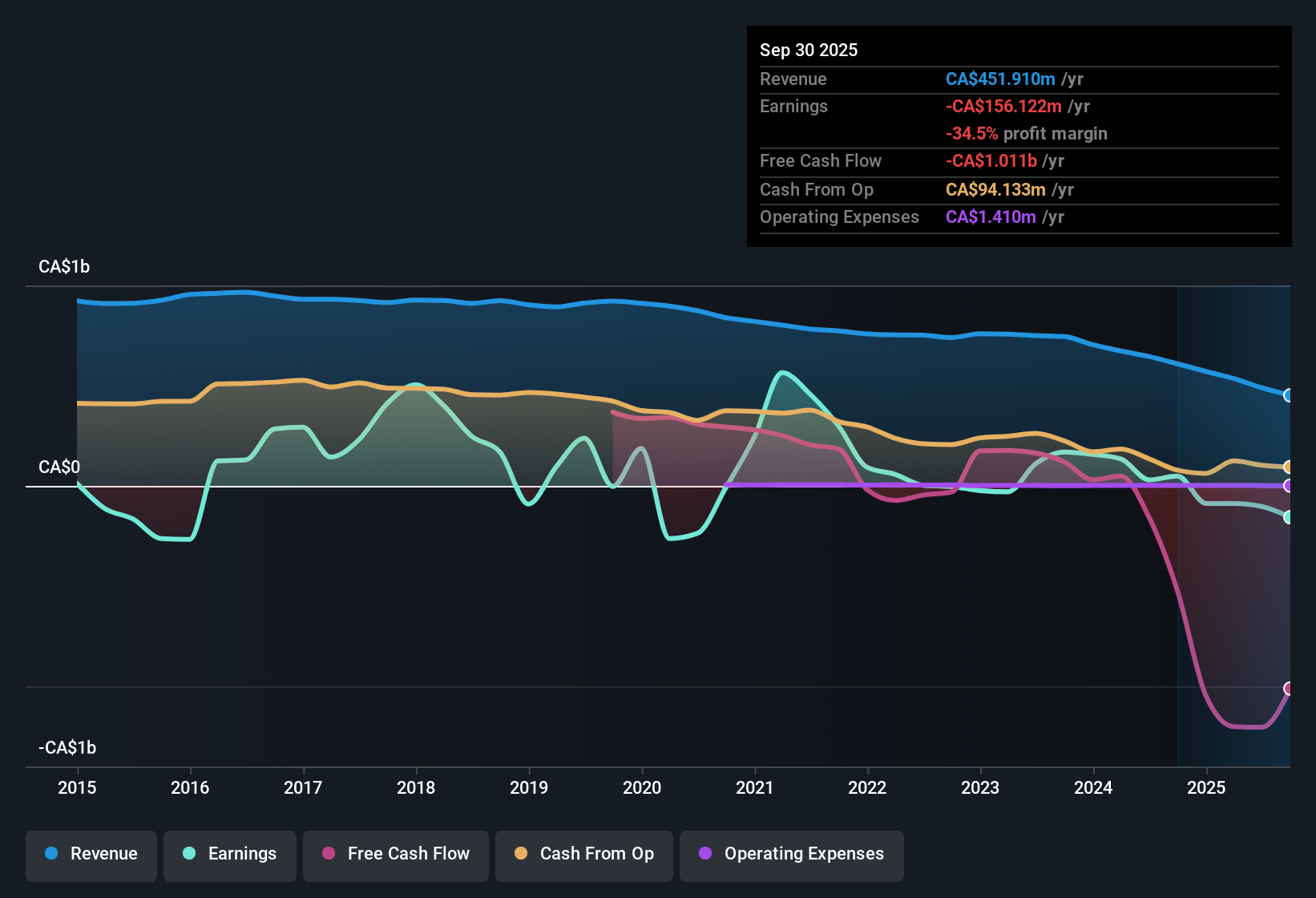

Telesat (TSAT) remains unprofitable, with losses accelerating at an average rate of 54.1% a year over the past five years. Despite the red ink, the company’s revenue is forecast to grow 23.6% annually, outpacing the US market’s 10.5% projection. While top-line expansion is impressive, TSAT’s net profit margin has yet to improve and the company is expected to stay unprofitable for at least the next three years, putting sustained pressure on investor confidence.

See our full analysis for Telesat.Next, we will see how these headline numbers compare with the big narratives surrounding Telesat. This will show where consensus is backed up by data and where it might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Escalate at a Rapid Pace

- Telesat’s losses have been rising at an average rate of 54.1% annually over the last five years, which highlights that despite expanding revenue, controlling costs remains a major unresolved challenge.

- While recent results confirm that revenue is growing faster than the industry, the persistent escalation in losses gives pause even to those betting on Telesat's long-term transformation.

- Bears argue that ongoing net margin struggles and unprofitability, despite the growth, reinforce the risk of deeper dilution or additional funding requirements down the line.

- This sustained loss trajectory weakens the bullish case that Telesat’s future growth will soon translate into improved bottom-line results.

Valuation Keeps Pace With Industry Peers

- The Price-To-Sales (P/S) Ratio for Telesat clocks in at 1.2x, matching the US telecom industry average and coming in just below the peer group’s 1.3x multiple. This suggests investors are not paying a premium or discount for the company’s growth profile.

- Even with outsized topline growth forecasts, the prevailing view is that the market is skeptical about near-term profitability. Investors are pricing Telesat on par with its sector, acknowledging growth but withholding any valuation premium until net margins start to recover.

- The lack of DCF fair value estimates underscores continued uncertainty over forecasting future profits, emphasizing that the current share price of 26.59 is supported only by sales multiples, not intrinsic cash flow projections.

- Peers and the industry as a whole seem to face similar skepticism, highlighting that Telesat’s challenges are not unique but may become a differentiator if results begin to outpace expectations.

No Progress on Profit Margins

- Telesat’s net profit margin has shown no improvement based on recent filings, maintaining the company’s status as unprofitable with at least another three years before profitability is expected.

- The prevailing market view notes that until Telesat demonstrates real traction in narrowing losses, investors will likely remain focused on the downside risk of ongoing negative margins.

- Analysts and commentators point out revenue momentum, but emphasize that without evidence of cost control or efficiency gains, headline growth will not be enough to shift the investment narrative.

- This dynamic amplifies the risk that any delays or overruns in executing the company’s satellite projects will quickly translate into added volatility and pressure on the share price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Telesat's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Telesat continues to struggle with persistent losses and stagnant profit margins. This makes sustainable financial health a long-term concern for investors.

If you value stronger fundamentals and resilience, check out solid balance sheet and fundamentals stocks screener (1980 results) to discover companies built on sounder balance sheets and less financial risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telesat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSAT

Telesat

A satellite operator, provides mission-critical communications solutions to support the requirements of satellite users in Canada, the United States, Asia, Australia, Latin America, the Caribbean, Europe, the Middle East, and Africa.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives