- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile (TMUS): Assessing Valuation After Recent Modest Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for T-Mobile US.

T-Mobile US has seen momentum soften compared to last year, with its share price edging down and not quite keeping pace with broader market trends. While the stock’s 1-year total shareholder return stands at -10.8%, longer-term investors have still enjoyed a solid 42.8% total return over three years and 63.6% over five years. This suggests that despite recent volatility, the company’s fundamentals and growth story remain compelling for those with patience.

If you want more ideas beyond telecom, now is a smart time to broaden your market view and check out fast growing stocks with high insider ownership.

With its share price now well below analyst targets, is T-Mobile US being overlooked by the market, or is the current valuation simply reflecting a mature outlook with future growth already accounted for?

Most Popular Narrative: 23.8% Undervalued

Compared to its most widely followed fair value estimate of $275, T-Mobile US's last close of $209.48 signals a market price well below analyst consensus. This gap sets the stage for a closer look at growth catalysts underpinning the current valuation thesis.

Strategic fiber expansions and innovations in 5G and digital platforms could enhance margins and drive future earnings growth. Potential tariffs and competitor promotions could pressure T-Mobile's margins and earnings, while fiber expansion may initially strain short-term profits and service revenue growth.

What’s the secret ingredient behind this bold fair value? It’s not just network wins. This narrative hinges on game-changing growth rates, margin shifts, and ambitious rollouts that could redraw the wireless playbook. Curious which numbers power up this opportunity? Read on to see what’s driving the valuation higher.

Result: Fair Value of $275 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a spike in industry churn or tougher competitor promotions could quickly put pressure on T-Mobile’s growth story and affect future profit targets.

Find out about the key risks to this T-Mobile US narrative.

Another View: A Look at Price-to-Earnings

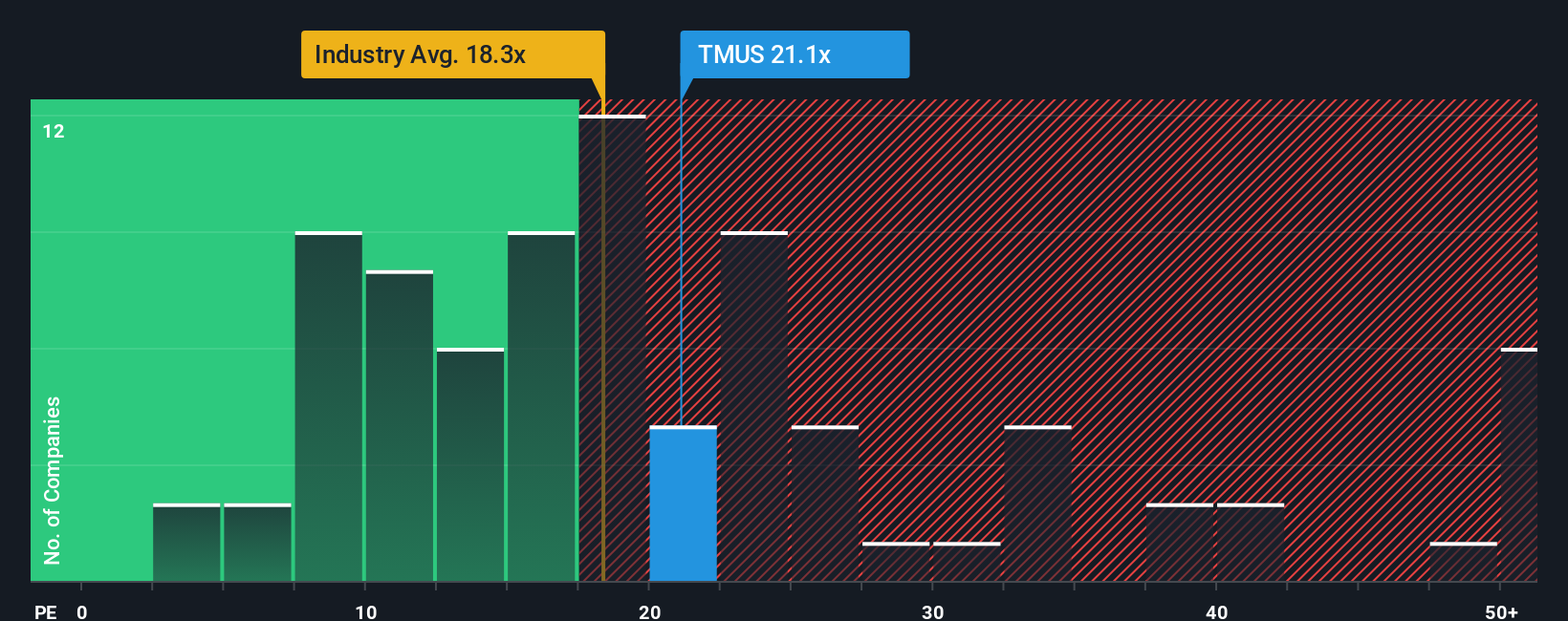

While the consensus fair value implies T-Mobile US is undervalued, the current price-to-earnings ratio of 19.7x is slightly higher than the global wireless industry average of 18x and is also above its fair ratio of 16.5x. Compared to direct peers, TMUS actually looks cheaper (peer average: 29.3x), but on a global basis, it appears a little expensive. This gap could signal either a value opportunity or greater risk, depending on how much weight investors put on future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T-Mobile US Narrative

If you see the data differently or want to put your own spin on the story, you can craft your own narrative in just a few minutes with Do it your way.

A great starting point for your T-Mobile US research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Sharpen your portfolio by tapping into hand-picked opportunities tailored for growth, value, or innovation. Missing out could mean leaving great returns on the table.

- Capture fresh growth by targeting these 3605 penny stocks with strong financials with strong fundamentals and significant upside potential.

- Unlock steady income streams as you review these 17 dividend stocks with yields > 3% with yields above 3% and robust payout histories.

- Ride the technology wave and accelerate your returns with these 25 AI penny stocks leading advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives