- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TIGO

Millicom (NasdaqGS:TIGO): Assessing Valuation After Strong Share Price Gains

Reviewed by Simply Wall St

Millicom International Cellular (NasdaqGS:TIGO) has seen its shares deliver steady gains over the past month, climbing 7%. For investors tracking telecom stocks, the company’s recent performance raises interesting questions around valuation and future growth.

See our latest analysis for Millicom International Cellular.

Momentum has clearly shifted in Millicom’s favor, with a sharp 100% share price return year to date and a remarkable 116% total shareholder return over the past year. This surge highlights renewed confidence in the company’s growth outlook after a prolonged period of underperformance.

If you’re watching these gains and thinking about your next move, it might be the perfect time to broaden your investment search and discover fast growing stocks with high insider ownership

With shares rallying so strongly, the key question is whether Millicom is still undervalued or if the latest run-up simply reflects the market pricing in all its anticipated growth. Is there a true buying opportunity left?

Most Popular Narrative: Fairly Valued

Despite recent momentum, the most-followed narrative places Millicom’s fair value at $49.14, almost in line with the last close of $50.33. The close gap between current price and estimated fair value suggests the market may already be reflecting the company’s future prospects.

The market may be overestimating Millicom's future revenue growth by assuming that rapid postpaid penetration and ARPU uplift, driven by digital transformation and rising data demand in Latin America, will consistently materialize. This is despite increasing price competition from low-cost entrants and aggressive offers (e.g., WOM, Telefonica), which could cap ARPU and slow subscriber acquisition, potentially impacting top-line growth.

Think this valuation is too cautious or perhaps too optimistic? There's one underlying financial assumption that could turn the whole narrative upside down. Get the full story and see the precise projections that shape this fair value. What if the market’s missing the bigger picture?

Result: Fair Value of $49.14 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong organic growth in core markets or meaningful margin improvements could quickly challenge current fair value assumptions and shift the outlook higher.

Find out about the key risks to this Millicom International Cellular narrative.

Another View: The Discounted Cash Flow Approach

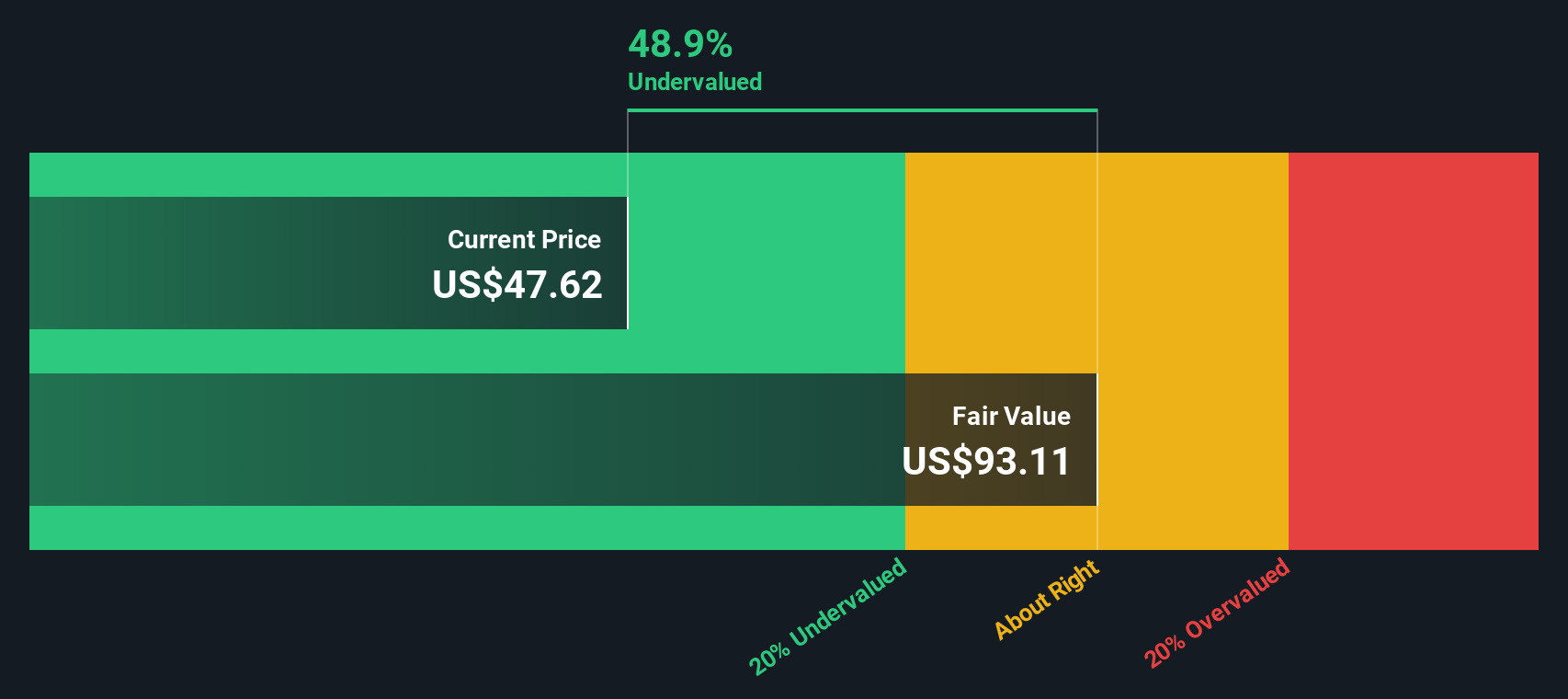

While the most popular narrative focuses on fair value estimates using price-to-earnings, our DCF model presents a much different perspective. According to this method, Millicom shares may actually be undervalued by a wide margin. Could the market be underestimating the company’s cash-generating potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Millicom International Cellular Narrative

If you see things differently or would rather dig into the numbers yourself, you can quickly build your own investment story in just a few minutes. Do it your way

A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart opportunities are everywhere, but only the most prepared investors spot them first. Give yourself a head start by checking out these tailored screens on Simply Wall Street.

- Capitalize on future medicine breakthroughs by browsing these 32 healthcare AI stocks, which are transforming patient care and healthcare analytics.

- Uncover unique income opportunities by reviewing these 16 dividend stocks with yields > 3%, offering yields above 3 percent for stable, long-term growth.

- Ride the momentum of digital assets by checking out these 82 cryptocurrency and blockchain stocks, involved in blockchain innovation and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGO

Millicom International Cellular

Provides cable and mobile services in Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives