- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TIGO

How Millicom’s Telefónica Acquisitions and Profit Growth Could Shape TIGO’s Investment Narrative

Reviewed by Sasha Jovanovic

- Millicom International Cellular recently expanded its Latin American footprint by acquiring Telefónica’s operations in Uruguay and Ecuador, with the company reporting strong profit growth and subscriber additions earlier in 2025, despite softening revenues.

- This consolidation not only strengthens Millicom's regional presence, but also places added focus on upcoming regulatory decisions and integration milestones, which are pivotal for assessing future company performance.

- We will explore how Millicom’s recent acquisitions and profit growth may influence its investment narrative in light of evolving market conditions.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Millicom International Cellular Investment Narrative Recap

To own Millicom International Cellular stock, you have to believe in the company’s ability to turn scale and operational efficiency in Latin America into stable returns, especially through disciplined M&A and cost management amid fast-changing telecom trends. The recent acquisition of Telefónica’s operations in Uruguay and Ecuador strengthens Millicom’s reach, but near-term catalysts, such as integration progress and regulatory approvals, remain the key focus. Rising competition and the risk of slower revenue growth are still the most pressing concerns, with this expansion not materially changing those headline risks. Of all recent corporate developments, the approval of a special interim dividend of US$2.50 per share following these acquisitions best highlights Millicom’s shareholder-friendly approach, supported by strong cash flow. This dividend move offers investors a timely signal of confidence, but its sustainability may depend on how effectively Millicom manages post-acquisition integration and continues to deliver on its stated margin and efficiency targets. Yet, despite the attractive headline dividends, investors should carefully consider how prolonged integration challenges or difficult regulatory environments could…

Read the full narrative on Millicom International Cellular (it's free!)

Millicom International Cellular is projected to generate $5.9 billion in revenue and $628.3 million in earnings by 2028. This outlook is based on a 1.7% annual revenue growth rate but implies a decrease in earnings of $326.7 million from the current $955.0 million level.

Uncover how Millicom International Cellular's forecasts yield a $49.14 fair value, in line with its current price.

Exploring Other Perspectives

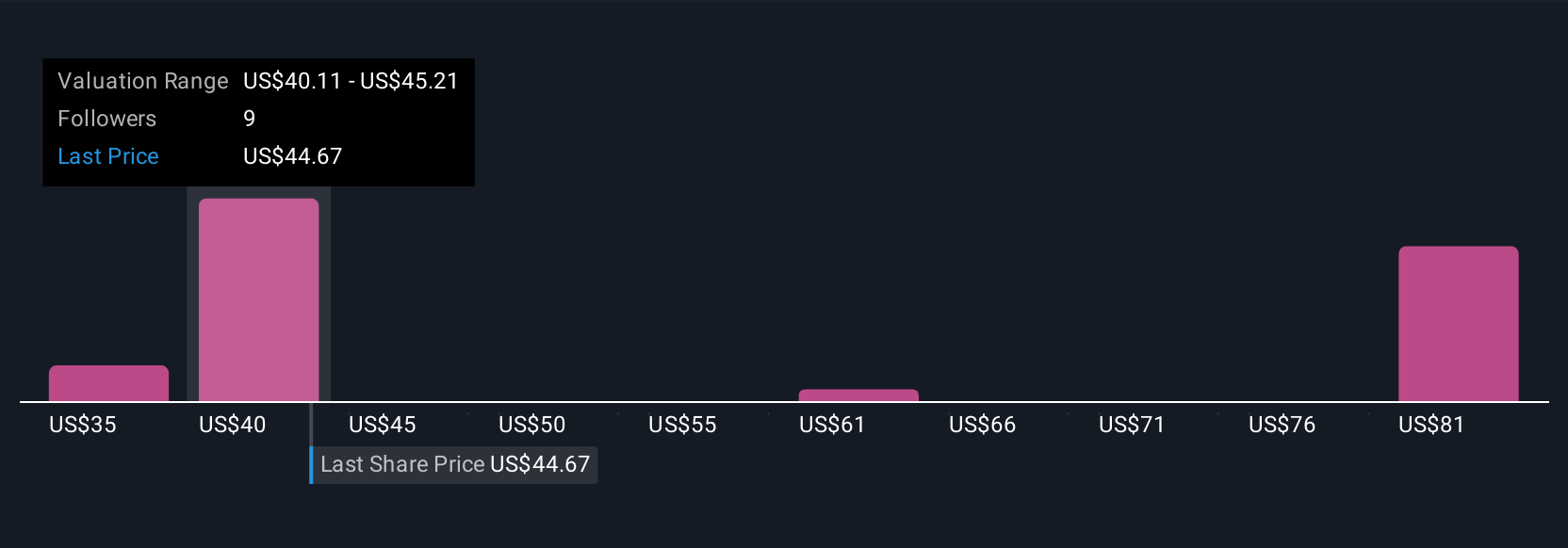

Seven estimates from the Simply Wall St Community put Millicom’s fair value between US$35 and US$89.49 per share. Many see potential but remain cautious, as rising capital expenditures for network expansion could limit free cash flow growth in the coming years.

Explore 7 other fair value estimates on Millicom International Cellular - why the stock might be worth as much as 81% more than the current price!

Build Your Own Millicom International Cellular Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Millicom International Cellular research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Millicom International Cellular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Millicom International Cellular's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TIGO

Millicom International Cellular

Provides cable and mobile services in Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives