- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

Further Upside For Sify Technologies Limited (NASDAQ:SIFY) Shares Could Introduce Price Risks After 31% Bounce

Despite an already strong run, Sify Technologies Limited (NASDAQ:SIFY) shares have been powering on, with a gain of 31% in the last thirty days. But the last month did very little to improve the 66% share price decline over the last year.

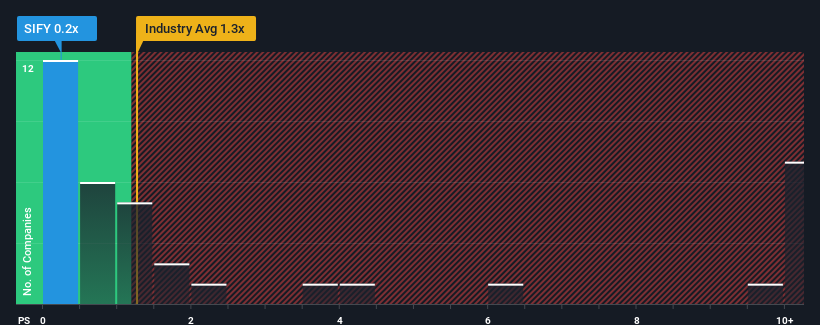

Although its price has surged higher, Sify Technologies' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Telecom industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sify Technologies

How Has Sify Technologies Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Sify Technologies has been doing quite well of late. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Sify Technologies will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on Sify Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Sify Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. The latest three year period has also seen an excellent 43% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 47% as estimated by the lone analyst watching the company. With the industry predicted to deliver 50% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Sify Technologies' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Despite Sify Technologies' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Sify Technologies remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Sify Technologies (2 are a bit concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Inotiv NAMs Test Center

Credo Technology Group (CRDO): High-Speed Growth Meets Margin Compression in 2026.

MongoDB Inc. (MDB): The Data Platform Pivot – Navigating the FY2027 Outlook in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks