- United States

- /

- Telecom Services and Carriers

- /

- NasdaqCM:SIFY

A Look At Sify Technologies (NasdaqCM:SIFY) Valuation After Data Center IPO Steps And Capital Structure Changes

Sify Technologies (SIFY) is drawing fresh attention after its data center arm, Sify Infinit Spaces, converted Kotak held compulsorily convertible debentures into equity and reshaped investor agreements ahead of a planned Indian IPO.

See our latest analysis for Sify Technologies.

At a share price of $15.05, Sify Technologies has seen a 24.79% 90 day share price return and a very large 1 year total shareholder return of 242.82%, suggesting momentum has recently been building.

If this data center news has you thinking about where digital infrastructure goes next, it could be a good moment to scan 34 AI infrastructure stocks as potential companions to your watchlist.

With Sify posting a very large 1 year total shareholder return and analysts setting a US$22 price target above the current US$15.05 share price, the key question is whether there is still an opportunity to invest here or if markets are already pricing in future growth.

Most Popular Narrative: 31.6% Undervalued

With Sify Technologies last closing at $15.05 against a widely followed fair value estimate of $22, the current market price sits well below that narrative anchor.

Sify Technologies is investing in AI capabilities, likely leading to increased demand from enterprises seeking mature network, data center, and digital services. This is expected to impact revenue and earnings positively as AI workloads grow in India.

Want to see what sits behind that valuation gap? The narrative leans heavily on fast rising revenue, a clear earnings swing, and a future profit multiple that assumes sustained traction. Curious which specific forecasts and margin shifts need to land for $22 to make sense? The full breakdown lays out the numbers and timing in detail.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh execution risks, including ongoing losses and high SG&A and expansion costs that could keep margins under pressure longer than expected.

Find out about the key risks to this Sify Technologies narrative.

Another Angle On The Valuation

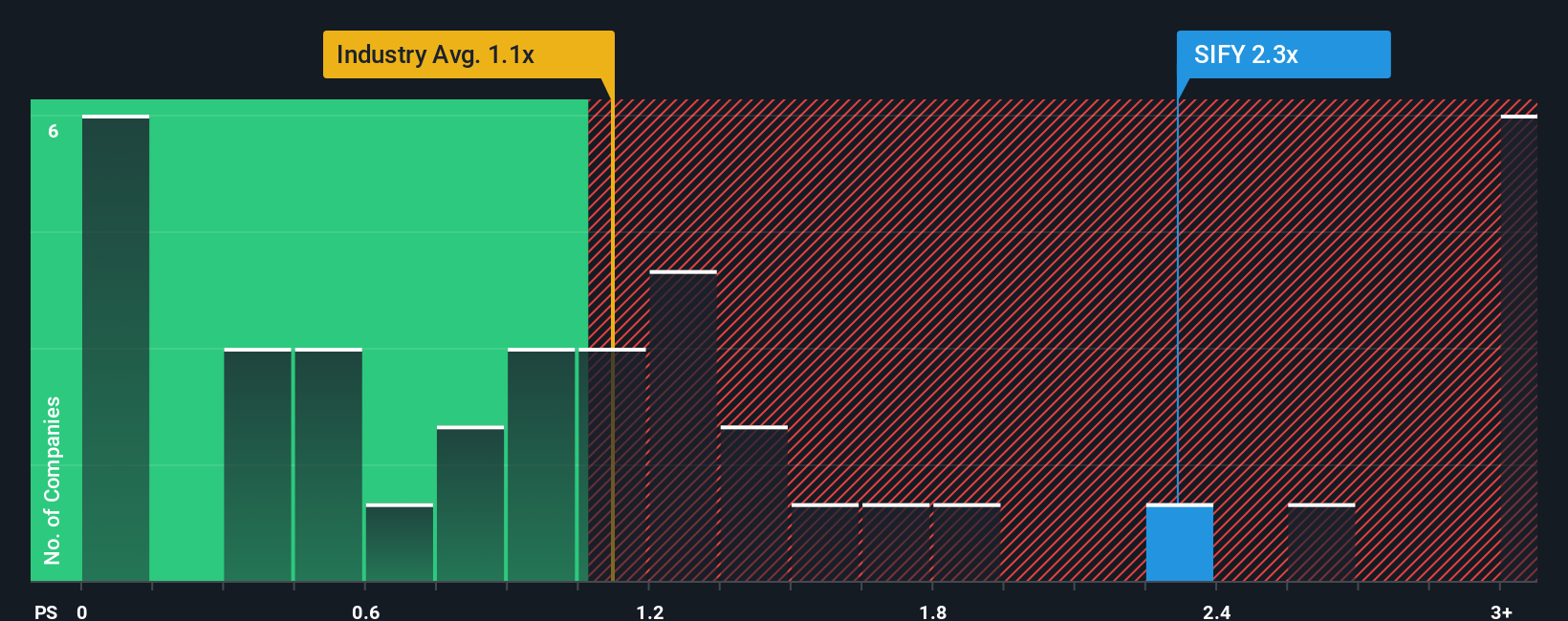

The fair value narrative suggests Sify Technologies looks 31.6% undervalued at $22, but the price tag tells a different story when you look at sales. Sify trades on a P/S of 2.3x, which is richer than both the US Telecom industry at 1.2x and its own fair ratio of 1.8x, so is this really a discount or just optimism priced in early?

See what the numbers say about this price — find out in our valuation breakdown.

Next Steps

With all this in mind, do the story and the numbers line up for you, or not yet? It is worth moving quickly to test the data yourself and see how it stacks up against the mix of concerns and optimism captured in 1 key reward and 1 important warning sign

Looking for more investment ideas?

If this Sify story has sharpened your focus, do not stop here. The next move that fits your portfolio might sit just outside your current watchlist.

- Target resilient income by checking out 13 dividend fortresses, which aim to combine higher yields with balance sheets you can scrutinize in detail.

- Hunt for potential value by scanning screener containing 24 high quality undiscovered gems, which our filters flag for strong fundamentals but limited market attention so far.

- Prioritise capital protection first by reviewing 83 resilient stocks with low risk scores, which score well on stability and downside risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SIFY

Sify Technologies

Offers information and communication technology solutions and services in India and internationally.

High growth potential with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Investment Thesis: Olvi Oyj (OLVAS)

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.