- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:SHEN

Shenandoah Telecommunications (SHEN) Losses Deepen 68.8% Annually, Challenging Bullish Narratives on Growth

Reviewed by Simply Wall St

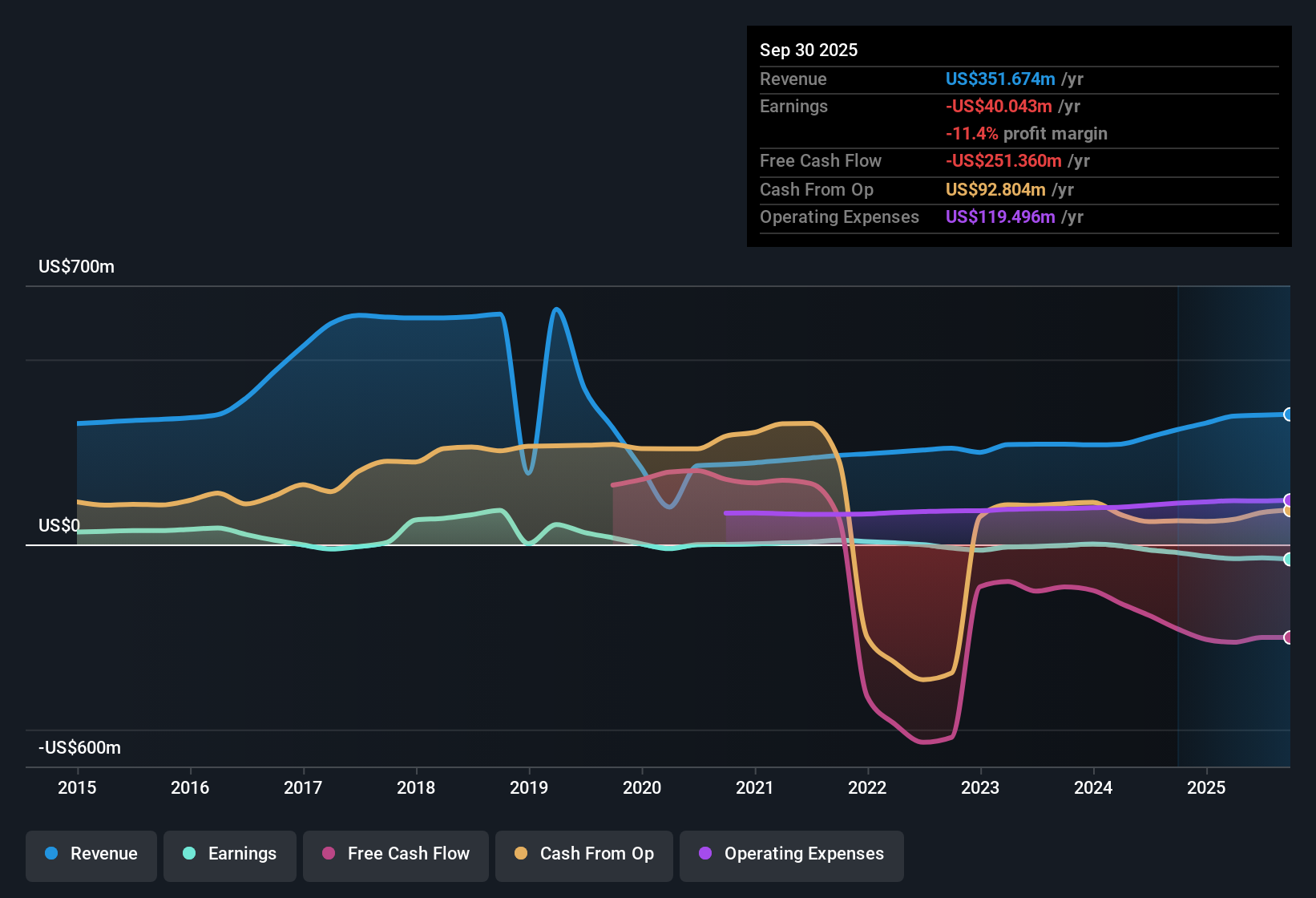

Shenandoah Telecommunications (SHEN) reported ongoing losses, which have accelerated over the past five years at a steep 68.8% annual rate. Revenue is projected to grow at just 5.9% per year, trailing the US market average of 10.3%. With profitability still out of reach for at least the next three years and shares trading above estimated fair value, investors face an earnings story marked by deepening losses and modest and slowing revenue growth.

See our full analysis for Shenandoah Telecommunications.Next, we will see how these headline figures square with the community’s prevailing narratives, spotting where the market may have missed something or where the numbers reinforce what everyone is already saying.

See what the community is saying about Shenandoah Telecommunications

Glo Fiber Expansion Locks in Subscriber Growth

- Broadband subscriber numbers jumped 43% year-over-year, benefiting from government-funded Glo Fiber buildouts. This expansion allows SHEN to enter new markets and capture early revenue as more households require faster internet.

- Analysts' consensus view highlights how these aggressive expansion efforts, paired with strong commercial fiber bookings and multi-year wireless carrier agreements, set the stage for steadier revenue and margin growth. These factors could help offset the persistent losses seen elsewhere.

- The company has secured business through long-term wireless carrier deals that run through 2031, giving visibility on revenue for years. Analysts see this as helping to manage volatility as SHEN scales up in new markets.

- Commercial fiber, which posted record bookings, provides additional revenue dependability even if growth moderates in the core consumer broadband market.

To see where the consensus narrative believes this trend could lead, both for growth and resilience, read the full story for Shenandoah Telecommunications here. 📊 Read the full Shenandoah Telecommunications Consensus Narrative.

Rapid Loss Acceleration Remains a Caution Flag

- Losses have worsened at an annual clip of 68.8% over the last five years, a trend that analysts expect will likely continue for the next three years without a return to profitability in sight.

- Analysts' consensus narrative warns of multiple risks that could undercut the expansion story, including rising competition from better-priced cable providers and a heavy dependence on government funding.

- New builds require substantial upfront investment. If subscriber penetration slows, funding pressures and higher debt could compound negative cash flow rather than alleviating it.

- Ongoing declines in SHEN’s legacy broadband and video services reflect a structural challenge that diminishes earnings power and makes the long road to profitability even steeper.

Valuation Sits Above Fair Value and Sector Average

- SHEN trades at a 1.9x Price-to-Sales multiple, higher than the US telecom industry average of 1.2x but still below the 4.5x peer group average. Today's share price is $12.32, while the analyst target sits at $26.00, implying a 111% upside if expectations are realized.

- Analysts' consensus narrative argues that for this valuation to be justified, SHEN must achieve $438.1 million in revenue and $55.9 million in earnings by 2028. This means investors need to believe in both sustained fiber growth and a return to industry-average margins.

- The fact that analysts expect a future PE of 31.2x, more than double the current US telecom sector’s 15.4x, shows just how much optimism is needed for the target to pan out.

- With no clear rewards identified in the data and profitability not expected for at least three years, the valuation story remains high-risk and high-reward for those comfortable with prolonged uncertainty.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Shenandoah Telecommunications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on these results? Jump in and shape your unique perspective by building your own narrative in just a few minutes. Do it your way

A great starting point for your Shenandoah Telecommunications research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

SHEN's prolonged losses, lack of near-term profitability, and a valuation that assumes aggressive growth goals present real risks for investors seeking reliability.

If a more attractive entry point is important to you, use these 830 undervalued stocks based on cash flows to uncover stocks trading at compelling valuations that don’t rely on heroic future assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHEN

Shenandoah Telecommunications

Provides broadband services and video and voice services in the United States.

Very low risk and overvalued.

Similar Companies

Market Insights

Community Narratives