- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:SHEN

Shenandoah Telecommunications Company's (NASDAQ:SHEN) Shareholders Might Be Looking For Exit

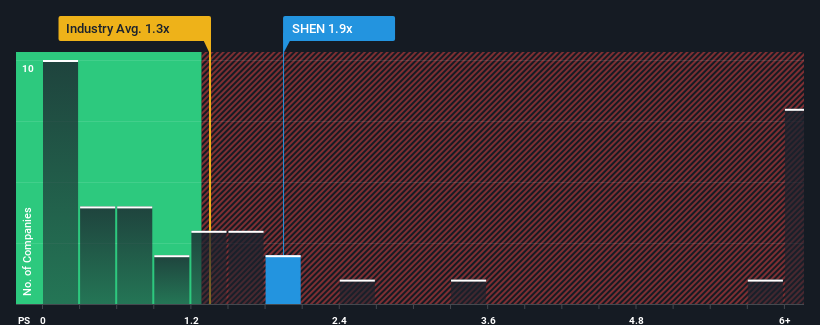

When you see that almost half of the companies in the Telecom industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, Shenandoah Telecommunications Company (NASDAQ:SHEN) looks to be giving off some sell signals with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Shenandoah Telecommunications

What Does Shenandoah Telecommunications' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Shenandoah Telecommunications has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenandoah Telecommunications.Is There Enough Revenue Growth Forecasted For Shenandoah Telecommunications?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shenandoah Telecommunications' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The latest three year period has also seen an excellent 39% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.2% as estimated by the dual analysts watching the company. With the industry predicted to deliver 51% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Shenandoah Telecommunications' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Shenandoah Telecommunications trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shenandoah Telecommunications, and understanding should be part of your investment process.

If you're unsure about the strength of Shenandoah Telecommunications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHEN

Shenandoah Telecommunications

Provides broadband services and video and voice services in the United States.

Very low risk and overvalued.

Similar Companies

Market Insights

Community Narratives