- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:SHEN

Is Shenandoah Telecommunications Company's (NASDAQ:SHEN) High P/E Ratio A Problem For Investors?

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We'll show how you can use Shenandoah Telecommunications Company's (NASDAQ:SHEN) P/E ratio to inform your assessment of the investment opportunity. Looking at earnings over the last twelve months, Shenandoah Telecommunications has a P/E ratio of 47.34. That means that at current prices, buyers pay $47.34 for every $1 in trailing yearly profits.

See our latest analysis for Shenandoah Telecommunications

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Shenandoah Telecommunications:

P/E of 47.34 = $44.52 ÷ $0.94 (Based on the year to December 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. When earnings grow, the 'E' increases, over time. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Shenandoah Telecommunications saw earnings per share decrease by 30% last year. But EPS is up 8.8% over the last 5 years.

Does Shenandoah Telecommunications Have A Relatively High Or Low P/E For Its Industry?

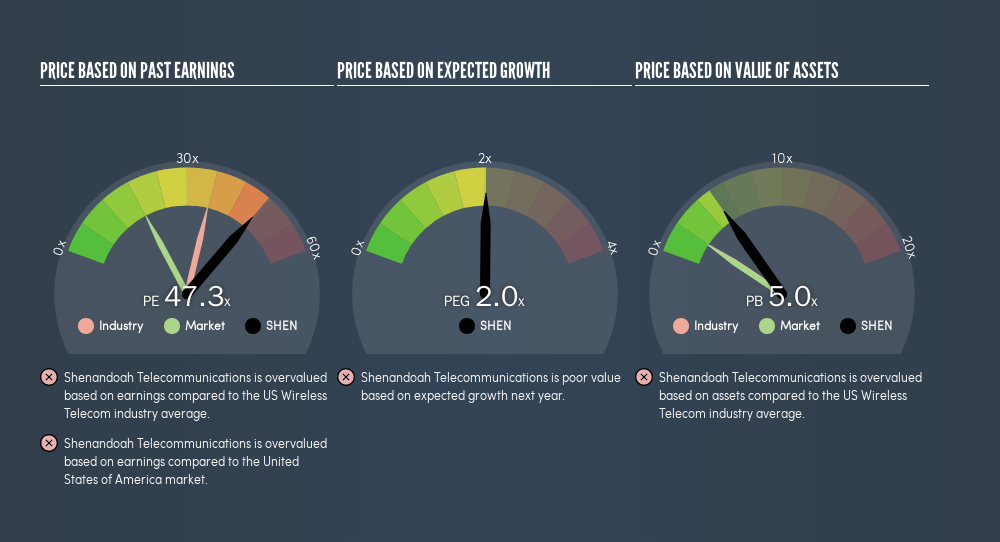

The P/E ratio indicates whether the market has higher or lower expectations of a company. The image below shows that Shenandoah Telecommunications has a higher P/E than the average (35.9) P/E for companies in the wireless telecom industry.

That means that the market expects Shenandoah Telecommunications will outperform other companies in its industry. Shareholders are clearly optimistic, but the future is always uncertain. So investors should delve deeper. I like to check if company insiders have been buying or selling.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Shenandoah Telecommunications's P/E?

Shenandoah Telecommunications has net debt equal to 31% of its market cap. You'd want to be aware of this fact, but it doesn't bother us.

The Bottom Line On Shenandoah Telecommunications's P/E Ratio

Shenandoah Telecommunications trades on a P/E ratio of 47.3, which is above the US market average of 18.1. With some debt but no EPS growth last year, the market has high expectations of future profits.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this freereport on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Shenandoah Telecommunications. If you want a selection of possible winners, check out this freelist of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SHEN

Shenandoah Telecommunications

Provides broadband services and video and voice services in the United States.

Very low risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026