- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Iridium Communications (IRDM): Assessing Valuation After New Vodafone IoT Partnership Expands Direct-to-Device Reach

Reviewed by Simply Wall St

Iridium Communications (IRDM) just announced a new partnership with Vodafone IoT, aiming to bring its NTN Direct service into Vodafone’s global network. This move appears positioned to boost connectivity for Vodafone IoT customers, particularly in remote regions.

See our latest analysis for Iridium Communications.

While this Vodafone IoT partnership marks an ambitious step for Iridium Communications, recent momentum in the share price has been decidedly negative, with a one-year total shareholder return of -41.85% and a year-to-date share price return of -43.25%. Despite the strategic scope of recent initiatives, the stock’s longer-term performance still appears stalled as the company works to regain investor confidence.

If you’re curious about opportunities beyond satellites and connectivity, consider taking the next step and discover fast growing stocks with high insider ownership.

With the shares trading well below analyst targets and the company showing steady growth in revenue and net income, investors may be wondering whether Iridium Communications represents an undervalued opportunity or if the market is already factoring in its future growth.

Most Popular Narrative: 45.9% Undervalued

With a narrative fair value estimate of $31.00, which is nearly double the last close of $16.78, Iridium Communications is portrayed as a deep value play by the most closely watched storyline, despite recent sluggish share performance. The gap highlights how differently narrative followers and the wider market are viewing future expectations for the company.

Strategic partnerships with major MNOs (mobile network operators), Syniverse, and tech ecosystem players are enabling Iridium to integrate into terrestrial networks and unlock new addressable markets. Especially as hybrid and direct-to-device communication solutions gain importance, this supports subscriber and revenue growth.

Want to know the bold assumptions fueling this target? Analyst expectations for growth, margin expansion, and buybacks could completely reframe your view of Iridium. Curious which financial levers support such a high fair value? The full narrative reveals the surprising drivers in detail.

Result: Fair Value of $31.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer migration to lower-value plans and intensifying competition from new direct-to-device satellite offerings could present challenges to Iridium’s growth story in the future.

Find out about the key risks to this Iridium Communications narrative.

Another View: What Do Earnings Ratios Say?

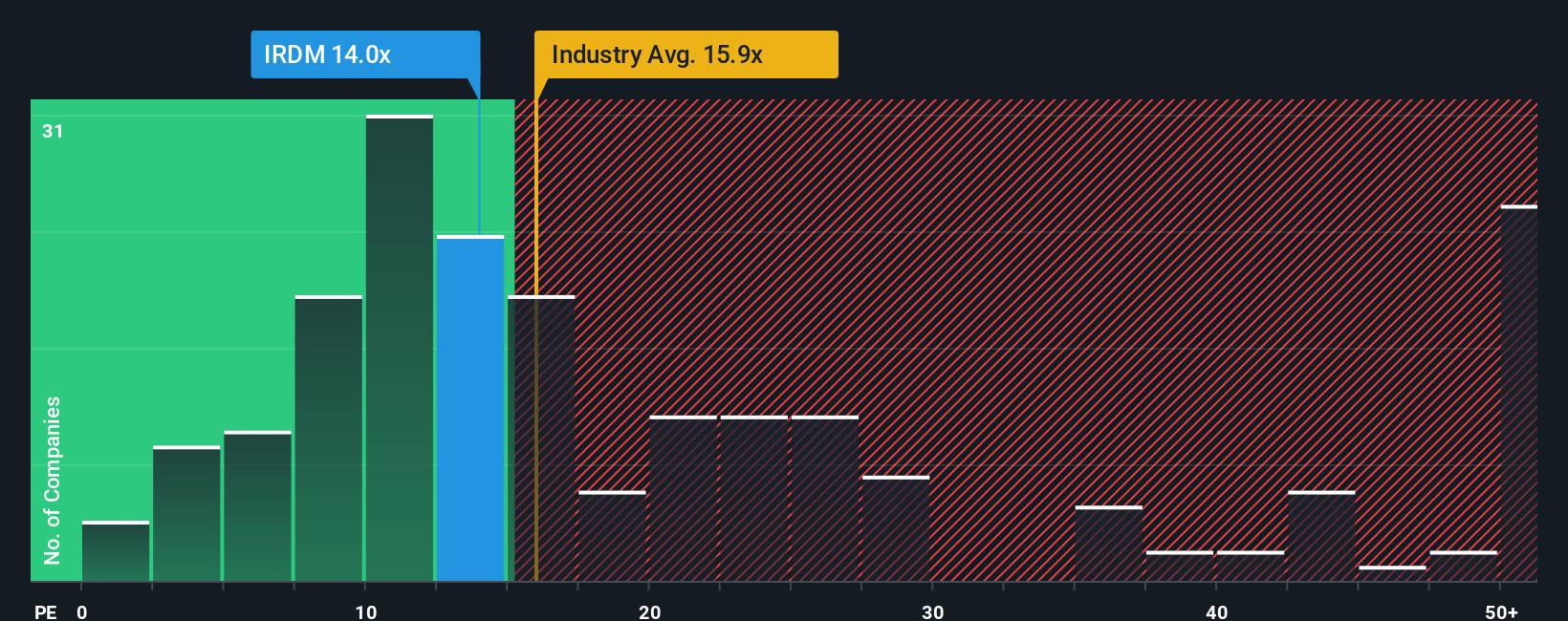

While the narrative fair value presents Iridium Communications as deeply undervalued, its price-to-earnings ratio offers a more cautious perspective. Currently, the ratio stands at 14x, which is higher than its peer average of 12.3x but lower than the industry average of 16x. Interestingly, this figure is also below the fair ratio of 16.9x, suggesting the market could adjust closer to this level over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Iridium Communications Narrative

If you see the story differently, or would rather draw your own conclusions, try building your own Iridium Communications view in just a few minutes. Do it your way.

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their horizons. Level up your research and catch tomorrow’s winners by tapping into hand-picked opportunities across high-potential themes. Your next great move might be just a click away.

- Boost your potential returns and tap into these 876 undervalued stocks based on cash flows where strong cash flows could signal hidden bargains before the crowd catches on.

- Position yourself at the forefront of innovation by selecting these 25 AI penny stocks poised to shape the future of artificial intelligence and automation.

- Maximize income while limiting risk. Target steady performers among these 16 dividend stocks with yields > 3% delivering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives