- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

Globalstar (GSAT): Evaluating Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Globalstar (GSAT) shares have caught some attention recently, with investors noticing a steady rise over the past month. The stock is up about 43% during that period, which has sparked renewed discussion about its growth prospects.

See our latest analysis for Globalstar.

The excitement around Globalstar isn’t just about this month’s rally. The company has been on a roll with a year-to-date share price return of over 91%. Add that to a five-year total shareholder return of more than 1,100%, and it’s clear that momentum has been building, fueled by renewed optimism about future growth and some headline-grabbing partnership updates along the way.

If Globalstar’s performance has you curious about what else could be on the rise, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

The real question for investors now is whether Globalstar’s impressive gains leave more room to run, or if the market has already factored in all the upside. Is this the start of another rally, or has growth been fully priced in?

Most Popular Narrative: 9.8% Undervalued

At $60.89 per share, Globalstar’s current price is below the most widely followed narrative fair value of $67.50. This suggests narrative followers see further upside, but strong assumptions about the company’s transformation are key to justifying that premium.

The global rollout of the RM200 2-way module with over 50 partners in advanced testing signals accelerating adoption across industrial, defense, and commercial IoT markets. As more assets require always-on connectivity, this trend is increasing subscriber numbers and raising ARPU, ultimately benefiting future revenue and margin expansion.

Want to see what’s fueling this optimism? Hidden behind Globalstar’s fair value are aggressive growth assumptions and margin expansion projections that could reshape the company’s profile. Discover the numbers that unlock the narrative’s higher price target.

Result: Fair Value of $67.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, especially if key partnerships stall or if competitive technologies advance faster than Globalstar can adapt. This could potentially mute future returns.

Find out about the key risks to this Globalstar narrative.

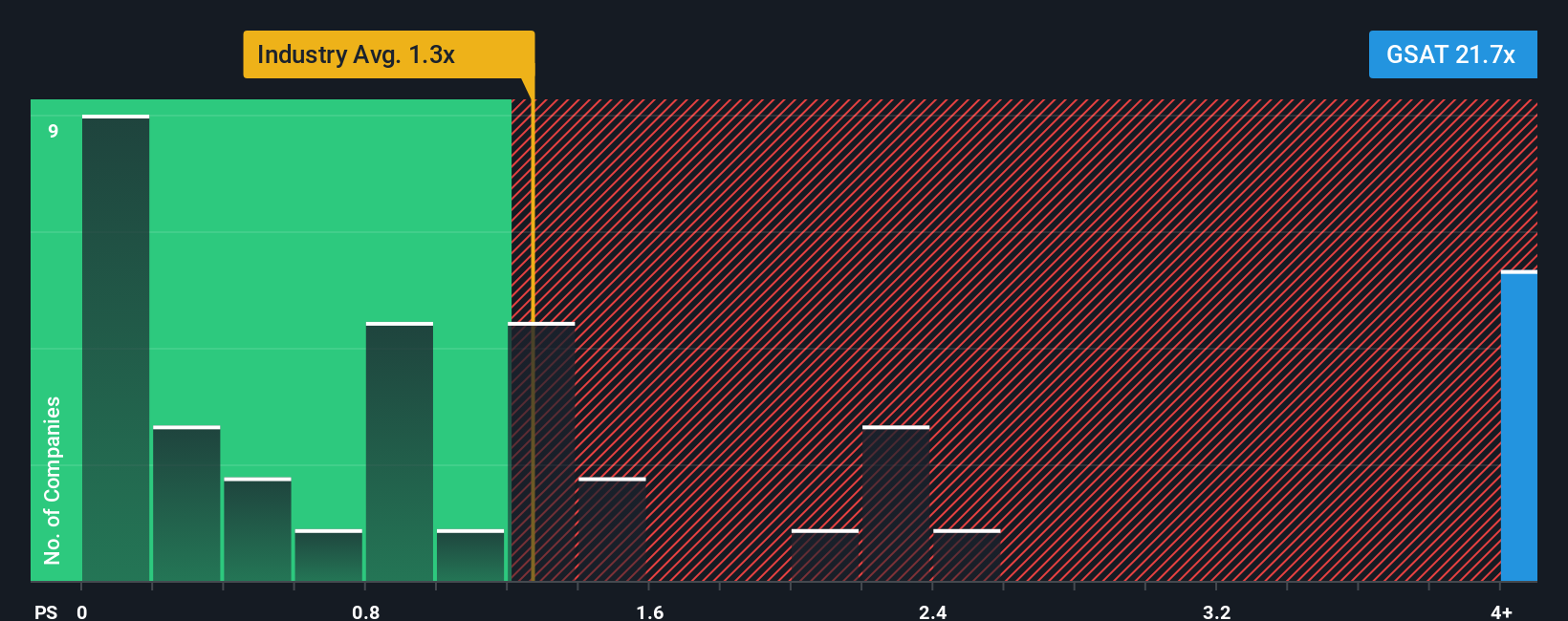

Another View: Multiples Signal Extreme Valuation

While the narrative-based fair value paints Globalstar as undervalued, market ratios tell a different story. The company trades at 29.5 times sales, far above peer and industry averages near 1x, and even its fair ratio of 2.1x. This kind of gap often signals heightened risk. Will investors continue paying up, or is a correction coming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globalstar Narrative

If you have a different perspective or want to dig into the details yourself, you can quickly craft your own view in just a few minutes, Do it your way

A great starting point for your Globalstar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. The market is filled with high-potential stocks waiting for smarter investors like you to spot them by using these powerful screeners.

- Uncover tomorrow’s standouts by reviewing these 3580 penny stocks with strong financials with strong financials that are designed to thrive despite market ups and downs.

- Maximize your returns by checking out these 924 undervalued stocks based on cash flows that are priced attractively based on their future earnings potential.

- Tap into booming innovation and see if these 26 AI penny stocks could give your portfolio a leading edge in the rapidly growing AI sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success