- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

Globalstar (GSAT): Evaluating the Stock’s Valuation After Recent Sharp Share Price Swings

Reviewed by Simply Wall St

Globalstar (GSAT) investors have watched the stock experience sharp swings over the past month, catching many by surprise. It has outperformed the broader market, which has led some to take another look at the company’s fundamentals.

See our latest analysis for Globalstar.

After a huge run-up this spring, Globalstar’s share price has gathered even more momentum, climbing nearly 36% in the last month. This brings its year-to-date share price return to an impressive 86%. The 1-year total shareholder return now stands at 131%, highlighting how quickly sentiment has shifted for the stock as investors warm to its long-term growth story.

If you’re watching Globalstar ride this upswing and wondering where else strong trends might be emerging, it could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But with valuations soaring and expectations high, is Globalstar truly trading below its intrinsic value, or has the recent rally already priced in every bit of the company’s future growth potential? Is there still a buying opportunity here?

Most Popular Narrative: 1.4% Undervalued

Globalstar's current market price is almost in sync with its fair value estimate, prompting investors to consider whether any upside truly remains. The widely followed narrative points to powerful business catalysts that could sustain bullish sentiment, even as questions swirl around future profitability.

The global rollout of the RM200 2-way module with over 50 partners in advanced testing signals accelerating adoption across industrial, defense, and commercial IoT markets. As more assets require always-on connectivity, subscriber numbers are expected to rise along with ARPU, ultimately benefiting future revenue and margin expansion.

Want to know why analysts believe Globalstar could defy gravity? The heart of the narrative lies in extraordinary projections for subscriber gains, margin expansion, and a sky-high future profit multiple. Find out which numbers fuel this bold valuation, then decide if you buy into the story.

Result: Fair Value of $60.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high capital requirements and intensifying competition from new satellite and terrestrial networks could threaten Globalstar’s growth story if these challenges are not carefully managed.

Find out about the key risks to this Globalstar narrative.

Another View: What Do Market Ratios Tell Us?

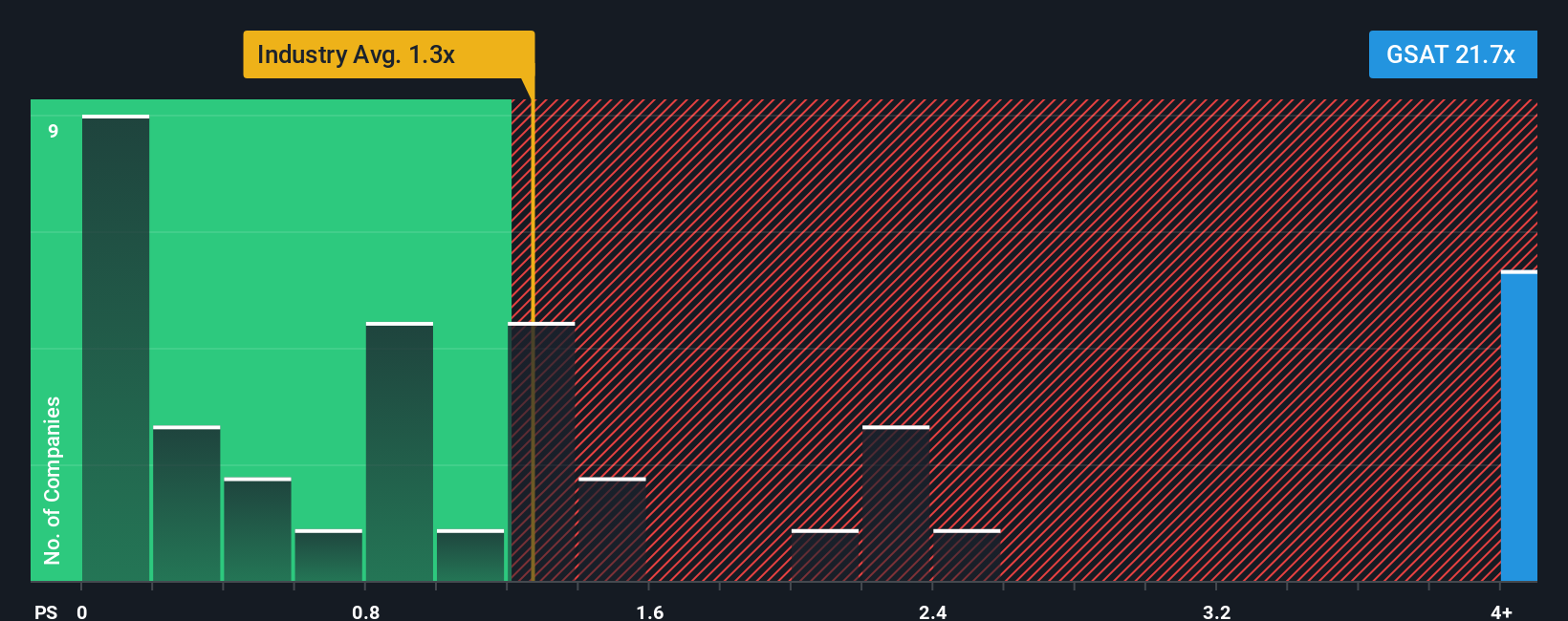

While analysts feel Globalstar is undervalued based on its growth narrative, the company's price-to-sales ratio of 28.6x stands far above both the US telecom industry average of 1.1x and its peers at 0.9x. Even in comparison to the fair ratio of 2.1x, Globalstar appears expensive. This significant premium could reflect confidence in future growth or expose investors to downside risk if expectations are not met. Is the market placing too much emphasis on the potential story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globalstar Narrative

If the current story does not fit your view or you want to dive into the numbers firsthand, you can craft your own narrative for Globalstar in just a few minutes, too. Do it your way

A great starting point for your Globalstar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the best opportunities rarely appear twice. Expand your horizon today with hand-picked stock ideas targeting tomorrow’s biggest trends and returns.

- Build steady income streams by tapping into these 18 dividend stocks with yields > 3%, which showcases reliable yields above 3% and can help strengthen your portfolio’s foundation.

- Access tomorrow’s game-changers and enhance your investments with these 27 AI penny stocks, focused on artificial intelligence breakthroughs and next-level growth stories.

- Explore new opportunities ahead of the crowd by scanning these 894 undervalued stocks based on cash flows, which could highlight stocks trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives