- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

Will Gogo’s (GOGO) $3 Million Sole-Source Government Contract Redefine Its In-Flight Connectivity Role?

Reviewed by Sasha Jovanovic

- SD Government, a division of Gogo, was recently awarded a five-year, sole-source federal contract valued at US$3 million to supply multi-band, multi-orbit airborne satellite communications for a U.S. government agency, consolidating all the agency’s aero communications under a single agreement.

- This contract not only streamlines procurement for the agency, but also marks the first government deal leveraging Gogo’s integrated multi-orbit, multi-band connectivity capabilities, with flexibility to add new technologies and services over its duration.

- We’ll explore how this government contract win further anchors Gogo’s position in critical in-flight connectivity and impacts its future growth outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Gogo Investment Narrative Recap

To be a Gogo shareholder, you have to believe in the ongoing expansion of in-flight broadband connectivity and the company's ability to monetize new technologies across a still largely unconnected global fleet. The recent federal contract adds credibility to Gogo's position in government and defense markets, but its initial US$3 million value is not enough to move the needle on near-term revenue catalysts, nor does it offset core risks like competitive threats or execution on technology rollouts.

Of recent developments, the FAA approval for the Gogo Galileo FDX terminal earlier this month stands out as most relevant. This regulatory progress is closely linked to delivering new service capabilities and increasing revenue from business aviation clients, directly supporting the catalyst of growing addressable market opportunity highlighted by the SD Government contract award.

However, against this progress, investors should remain especially alert to the fact that delays in major product launches or regulatory approvals could...

Read the full narrative on Gogo (it's free!)

Gogo's outlook suggests $1.1 billion in revenue and $160.2 million in earnings by 2028. This assumes annual revenue growth of 17.0% and an increase in earnings of $152.9 million from the current $7.3 million.

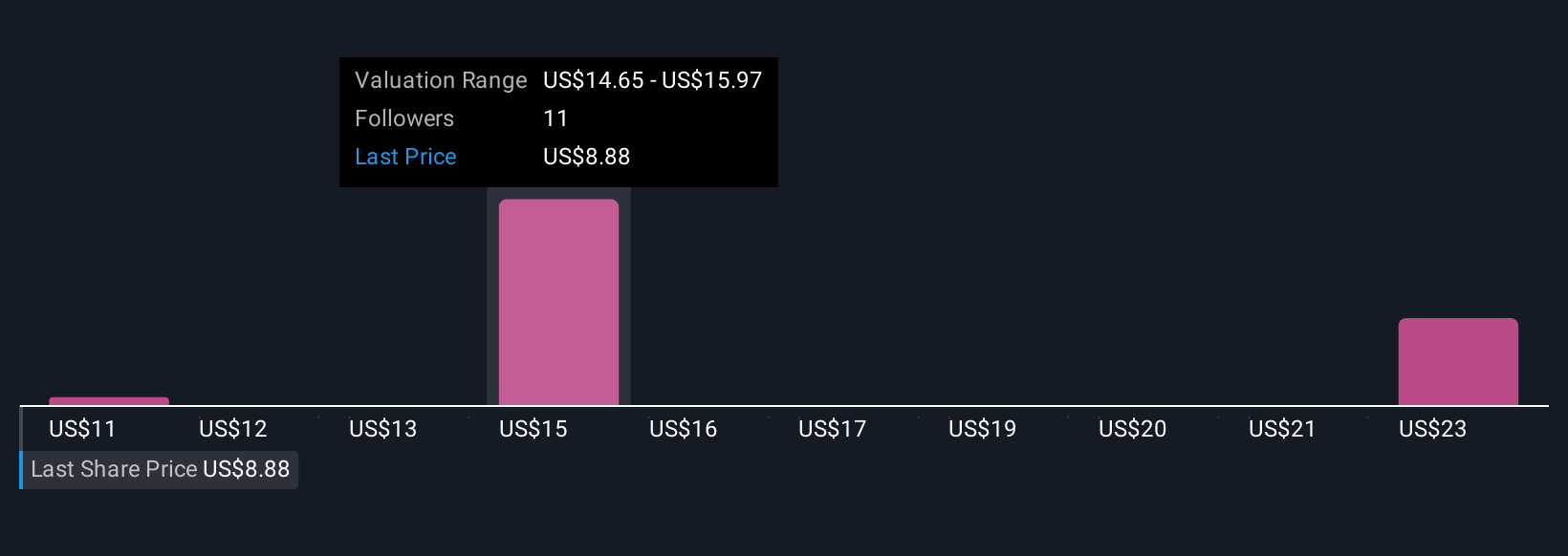

Uncover how Gogo's forecasts yield a $15.50 fair value, a 64% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted three fair value estimates for Gogo shares, ranging from US$10.69 to US$23.88. While these opinions reflect different growth assumptions, they highlight how risks such as regulatory hurdles for next-gen terminals are front of mind for many participants seeking to assess Gogo's growth potential.

Explore 3 other fair value estimates on Gogo - why the stock might be worth over 2x more than the current price!

Build Your Own Gogo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gogo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Gogo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gogo's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives